- Crypto Saving Expert's Newsletter

- Posts

- Crypto Saving Expert Newsletter - Issue 142

Crypto Saving Expert Newsletter - Issue 142

Good afternoon! Bitcoin is in a holding pattern after last week’s major surge. As it consolidates, momentum is quietly building, setting the stage for either a breakout higher or a potential move lower.

Let’s take a deep dive into bitcoin, macro markets, and key levels to watch this week. 👇

This week's issue will feature technical analysis of bitcoin, Solana and SUI as well as important dates and key news stories.

Table of Contents

Sponsored by: BloFin

Why BloFin?

Fair Trading: No internal or sister company market makers; BloFin doesn’t trade against its users.

Independent Liquidity: BloFin’s order books and liquidity is not shared with any large exchanges.

Transparent Leadership: The founder is fully doxxed—check out their Twitter here.

Impressive Volumes & Liquidity: Considering BloFin’s launch in 2023, its performance outshines many competitors like BingX.

Extensive Trading Options: Access 397+ futures pairs and 130+ spot pairs.

Secure Custody: User assets are held with Fireblocks, eliminating risks like hot wallet breaches.

Verified Proof of Reserves: Independently verified on Nansen for maximum security.

Chainalysis Integration: Ensures BloFin doesn’t accept illicit funds.

Instant Trade Execution: One of only four exchanges globally to achieve in-memory trade execution.

User-Friendly Policies: No KYC required, worldwide access via a VPN, and a mobile app for trading on the go.

Outstanding Customer Support and exciting user campaigns to enhance your experience.

Start trading with confidence and take advantage of BloFin’s innovative platform. Sign up now through our exclusive link:

Bitcoin Awaits Its Next Moment

Bitcoin underwent a huge pump last week and has since been consolidating. However, its next move may be brewing, with reasons to look for a drop or pump higher.

Bitcoin

Bitcoin is grinding higher in a channel, currently bouncing from rising support to resistance.

This period of consolidation came after the surge in the price last week, which saw minimal downside and mostly upside continuation.

However, the price is at a vital point on the higher time frame.

Daily Chart

Bitcoin is on the cusp of re-entering its previous consolidation zone, where the price held for roughly three weeks.

Bitcoin has thus far failed to overcome resistance, with many failed attempts over recent days. Still, the price could trade towards $98,000 should it break above.

There also remains the possibility of bitcoin forming a higher low on the daily chart.

Solana

Solana is struggling at supply. The price cannot break above $155 despite pressing hard.

If SOL can rise above, it could quickly trade towards $180, offering a clear route higher.

Still, there is a retest zone for the price should it or the overall market fall.

SUI

SUI has been one of the strongest coins over the past week.

The price has almost doubled, with a seriously strong upside rally. However, it has approached an enormous obstacle, and the daily candles show that with the long upper wicks.

Fear & Greed Index

The Fear and Greed Index has shifted into Greed and scores 60.

This comes about from bitcoin’s sizable move over the past week, brushing off the cobwebs of fear and providing a much more positive sentiment for investors.

Important Dates

Wednesday 30 April, 12:15 UTC - ADP Employment Change

Automatic Data Processing Inc. (ADP) releases employment change for the US. A higher figure is bullish for the markets due to increased employment, which suggests economic strength.

The consensus is set at 108,000, with the previous data coming in at 155,000.

Wednesday 30 April, 12:30 UTC - Core Personal Consumption Expenditures (PCE)

The US Bureau of Economic Analysis releases the core PCE data, which measures the average amount of money consumers spend monthly in the economy.

PCE is released in two formats: month-over-month and year-on-year. The data also removes volatile products, such as energy and food.

The year-on-year data is forecast to come in at 2.6%, with the previous data at 2.8%.

Friday 2 May, 12:30 UTC - Nonfarm Payrolls (NFP)

The US Bureau of Labour Statistics releases the NFP. This form of data represents the number of new jobs created in the previous month, which will be December and is another signal of economic health.

The consensus is set at 135,000, with the previous data at 228,000.

Gainers

Losers

The State of Solana’s Memecoin Trenches: A Revival in Motion

Solana’s memecoin ecosystem is showing renewed strength, with over $100m daily volume and 150k active wallets. As PumpSwap rises and new tokens dominate, the trenches are alive, and evolving.

Despite ongoing claims of their decline, Solana’s memecoin trenches remain far from dormant. While trading volumes and user enthusiasm dipped earlier in 2025, recent on-chain activity suggests that the ecosystem, though leaner, is far from lifeless.

📉 A Retreat From the Peak

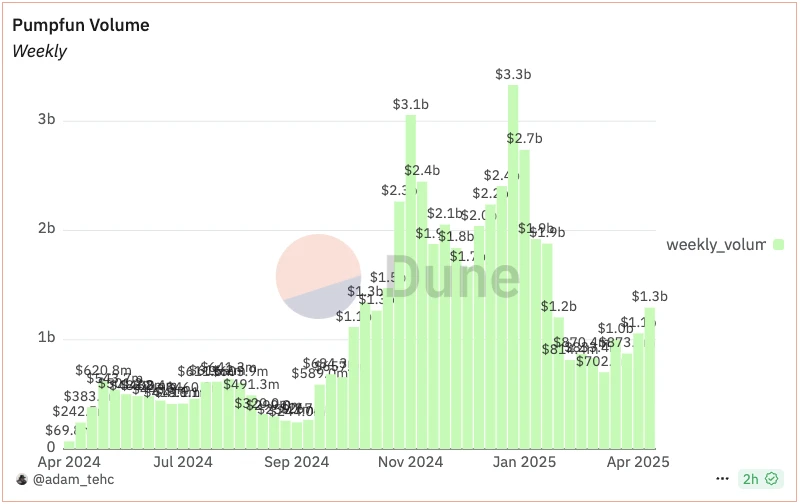

The peak of Solana’s memecoin frenzy occurred between December 2024 and February 2025. It was a period defined by explosive trading volumes, headline-grabbing launches such as the $TRUMP coin, and soaring prices, Solana reached $290, and bitcoin surpassed $100,000.

However, as the market cooled, Solana dropped to as low as $95, and Bitcoin retraced to $74,000. Trading volumes fell, sentiment soured, and some market commentators declared the memecoin ecosystem all but dead.

📊 April Data Reveals Resilience

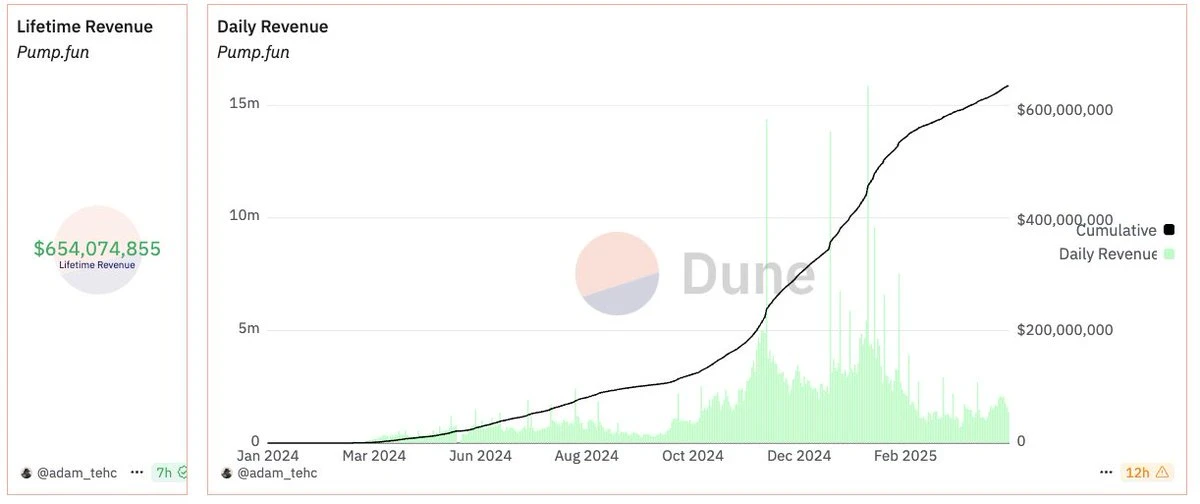

Yet data from Dune Analytics, curated by Adam_Tehc, indicates renewed strength. This has come alongside a market rebound, which has seen Solana recover to $145 and Bitcoin reclaim $92,000. Let’s take a look at the memecoin infrastructure, which is once again heating up:

💰 Pump.fun continues to generate $1m to $2.7m in daily volume in April.

📊 Nearly 10m tokens have been created to date, with 20,000–40,000 new tokens launching daily.

🫗 Roughly 0.4% to 0.8% of tokens “graduate” to reach key liquidity thresholds.

Revenue generated in Pump.Fun. Source: Dune Analytics, adam_tehc

Although the graduation rate has declined in parallel with user numbers, the low figures reflect a shift toward peer-versus-peer trading strategies. Small groups dominate early liquidity and frequently pull the plug when liquidity bonding stalls.

Pump.Fun's weekly volume. Source: Dune Analytics, adam_tehc

Daily active wallets hover at approximately 150,000, significantly down from early 2025’s peak of 400,000. However, many users employ multiple wallets, creating a high churn that belies apparent stagnation.

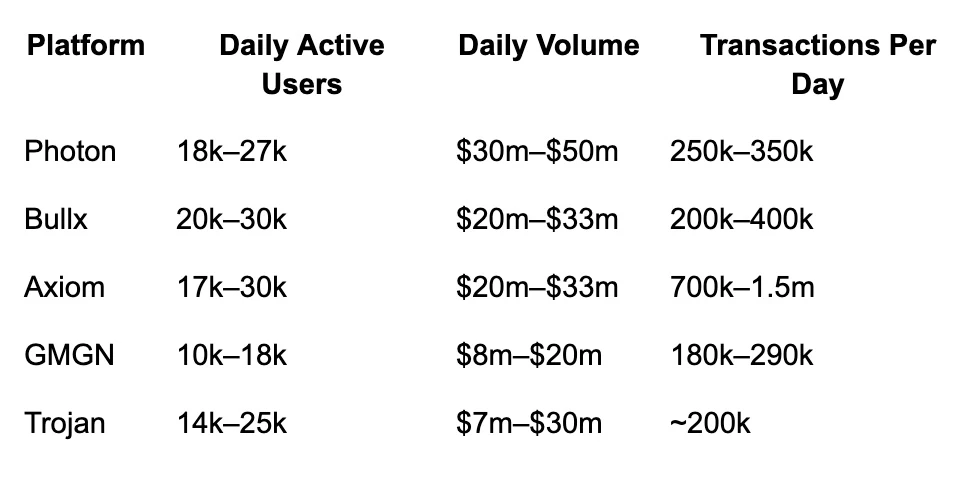

🤖 Trading Terminals Power the Trenches

Activity across top Solana-based memecoin terminals reinforces the ecosystem’s underlying health:

Combined, these platforms generate more than $100m in daily volume from over 100,000 unique users.

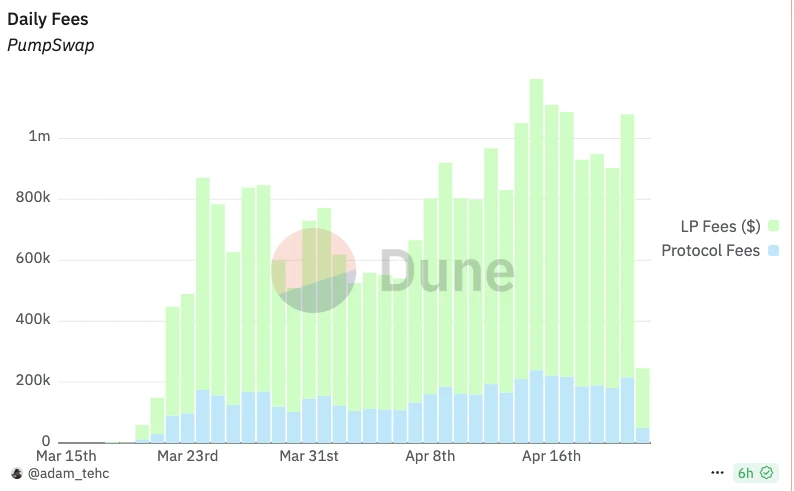

💰 PumpSwap’s Rapid Rise

Pump.fun’s dedicated DEX, PumpSwap, has been a game-changer. With daily trading volumes between $300m and $480m, it now represents 9%–19% of total Solana DEX activity. The fee structure is lucrative:

💹 0.25% total fee per trade

💹 0.02% to liquidity providers

💹 0.05% to the protocol

Since launch, PumpSwap has generated approximately $25m in fees, $20m of which went to LPs. With all new memecoins launching on PumpSwap by default, its market share and influence are only expected to grow.

Revenue generated by PumpSwap. Source: Dune Analytics, adam_tehc

🔁 New Over Old: The Rotation Meta

Traders continue to gravitate toward newly launched tokens rather than established ones. This reflects a structural trait of the memecoin market: it thrives on novelty and rapid liquidity cycling. As new tokens launch, they attract sidelined traders and speculative capital faster than traditional DeFi plays.

🧠 A Sharpened Ecosystem

Today’s trenches are leaner, more experienced, and more competitive. The casual participants have largely exited. What remains is a core of highly active wallets, many operated by veterans who have weathered multiple market cycles. Volume may be lower, but execution is tighter, and PvP mechanics are more refined.

Estimates suggest that over $200m in liquid SOL is circulating within the memecoin sector, excluding LP pools and longer-term token holdings.

📈 Memecoin Future: Speculation, Simplicity, Scale

Memecoins continue to serve as one of crypto’s most potent speculative vehicles. Their simplicity, narrative appeal, and asymmetric upside provide fertile ground for retail participation and rapid viral growth.

As market conditions improve and memecoins become more integrated with native Solana infrastructure like PumpSwap, the groundwork is being laid for another explosive phase.

Despite scepticism, data reveals an evolving but persistent market. The memecoin trenches aren’t dead; they’re consolidating, recalibrating, and preparing for what could be the next major leg up.

SEC Set to Review Over 70 Crypto ETFs in 2025 — Could a Tidal Wave of Approvals Be Coming?

The SEC is reviewing over 70 new crypto ETF filings in 2025, from Bitcoin and Ethereum to memecoins and altcoin options. Could this be the year ETFs take crypto fully mainstream?

The United States could be on the verge of a massive wave of crypto ETF approvals as the Securities and Exchange Commission (SEC) prepares to review over 70 digital asset ETFs throughout 2025, ranging from bitcoin and Ethereum funds to ETFs tied to altcoins, memecoins, and complex derivatives.

Bloomberg senior ETF analyst Eric Balchunas said the review list is the most diverse and expansive in crypto ETF history.

🗣️ “Everything from XRP, Litecoin, and Solana to Penguins, Doge and 2x Melania and everything in between,” Balchunas wrote on 21 April. “Gonna be a wild year.”

While not all filings are expected to be approved, the scale and variety of applications suggest that the SEC is preparing to broaden access to more crypto-linked investment vehicles, opening the door to altcoin ETFs and even meme-inspired products.

📘 What Is an ETF? An Exchange-Traded Fund (ETF) is an investment vehicle that tracks the price of an underlying asset, such as stocks, commodities, or cryptocurrencies, and is traded on traditional stock exchanges, just like company shares.

For crypto, this means investors can gain exposure to digital assets without buying or storing the tokens directly. Instead, they can purchase shares of an ETF that tracks Bitcoin, Ethereum, or another token.

Some ETFs hold the actual asset (like spot Bitcoin ETFs), while others replicate price exposure using futures contracts, options, or structured derivatives.

ETFs are popular with both institutional and retail investors because they offer:

✅ Simplicity and accessibility

🧑⚖️ Regulatory protections

🔐 Custody and security services

⚡️ Integration with traditional brokerage platforms

🏛️ Institutional Appetite Is Growing A March 2025 report by Coinbase and EY-Parthenon found that over 80% of institutional investors plan to increase their crypto allocations this year, a significant jump in sentiment compared to 2023.

The report suggests that regulated products like ETFs are playing a major role in bridging the gap between traditional finance and crypto.

However, Balchunas cautioned that approval alone does not guarantee demand.

🎵 “Having your coin get ETF-ized is like being in a band and getting your songs added to all the music streaming services,” he said. “Doesn’t guarantee listens, but it puts your music where the vast majority of the listeners are.”

📉 Altcoin ETFs May Struggle to Gain Traction While Bitcoin ETFs drew in over $100bn in assets following their launch in 2024, analysts are more cautious about ETFs holding lesser-known altcoins.

Katalin Tischhauser, head of research at Sygnum Bank, stated that she expects altcoin ETFs to draw between $300m and $1bn in cumulative inflows, a fraction of Bitcoin’s numbers.

A big concern is market maturity and liquidity, particularly for tokens with low trading volumes or high volatility, which may deter institutional investors from large allocations.

📊 Structured ETFs Using Options Could Be a Game-Changer While altcoin funds may face headwinds, ETFs that use options and derivatives to gain exposure to cryptocurrencies could attract significantly more institutional interest, analysts say.

💬 “Options unlock portfolio strategies that aren’t available with spot holdings,” said Jeff Park, head of alpha strategies at Bitwise Invest. “They could be the catalyst for explosive upside.”

These strategies include:

🦔 Hedging downside risk

📞 Leveraging upside through calls

🚀 Generating yield via covered options

🧪 The Solana Experiment On 21 April, ARK Invest announced it had added exposure to staked Solana (SOL) in two of its tech-focused ETFs, marking the first time US investors can access spot Solana through an ETF wrapper.

This move could set a precedent for more layer-1 and DeFi ecosystem tokens to enter ETF territory, and it may be a sign of things to come if the SEC loosens the regulatory reins in the coming months.

🔮 What Comes Next? With over 70 crypto ETFs now on the SEC’s docket and institutional appetite surging, analysts say 2025 could become the year when crypto ETFs go mainstream, beyond Bitcoin and Ethereum.

If the SEC gives the green light to even a fraction of these applications, a new era of crypto investing may be just around the corner, one where even the wildest memecoins might soon be available in your brokerage account.

Ljubljana Crowned World’s Most Crypto-Friendly City in 2025 Report

Ljubljana, Slovenia, has been named the world’s most crypto-friendly city for 2025, topping global leaders like Hong Kong and Zürich. Learn how this historic European capital became a blockchain hub.

Ljubljana, the picturesque capital of Slovenia, has officially been named the world’s most crypto-friendly city, according to the 2025 Crypto-Friendly Cities Index published by migration advisory firm Multipolitan.

Outperforming prominent hubs like Hong Kong and Zürich, Ljubljana topped the index based on a combination of regulatory clarity, tax policies, digital infrastructure, and crypto adoption rates, solidifying its status as a rising powerhouse in the global blockchain economy.

🧠 What Makes a City Crypto-Friendly?

Multipolitan’s index ranked 20 cities across the globe using factors such as:

🧑⚖️ Regulatory environment and licensing frameworks

📊 Capital gains tax rates

⚡️ Internet speed and digital infrastructure

🏧 Crypto ATM density and retail acceptance

💰 GDP per capita and housing affordability

“High concentrations of crypto ATMs and strong retail adoption rates signalled a deeply embedded crypto culture,” Multipolitan wrote.

The top 5 cities in the 2025 Crypto-Friendly Cities Index were:

1 - Ljubljana, Slovenia

2 - Hong Kong (tie)

3 - Zürich, Switzerland (tie)

4 - Singapore

5 - Abu Dhabi, UAE

Notably, Sydney ranked 10th, home to the most crypto ATMs in the index, while Madison, Wisconsin, was the only city in the Americas to appear, tied for 11th place with Riga, Doha, and Riyadh.

🏛️ A Brief History of Ljubljana

Ljubljana has long been a crossroads of cultures and commerce. Nestled between the Alps and the Adriatic Sea, the city has seen influences from Roman, Germanic, and Slavic civilisations. Its roots date back to Roman times, when it was known as Emona, which was a key military and trade outpost.

By the Middle Ages, Ljubljana had become a prominent regional centre under Habsburg rule, eventually emerging as Slovenia’s capital after independence from Yugoslavia in 1991. Today, it is celebrated not only for its medieval architecture and green policies but also as a modern innovation hub driving financial and technological advancement across Europe.

💰 Slovenia’s Crypto Rise

Slovenia didn't just top the cities index, it also led Multipolitan’s Crypto Wealth Concentration Index.

📈 The average Slovenian crypto holder owns around $240,500 worth of digital assets, surpassing runner-up Cyprus ($175,000) and Hong Kong ($97,500).

📉 The United States ranked near the bottom of this index, with average holdings of just $23,300.

Slovenia's crypto industry benefits from its inclusion in the EU’s Markets in Crypto-Assets Regulation (MiCA), a sweeping legal framework designed to provide regulatory clarity while encouraging innovation.

Ljubljana is home to several blockchain-focused entities, including:

🇪🇺 Blockchain Alliance Europe, a key advocacy group

🧱 Blocksquare, a real estate tokenisation platform

Notably, a partnership between Blocksquare and Vera Capital to tokenise $1bn in U.S. real estate was announced on 18 April.

🇸🇮 Why Ljubljana Matters for Crypto’s Future

Ljubljana’s recognition as the world’s leading crypto city is more than symbolic — it signals a shift in global crypto adoption. While cities like Singapore and Dubai continue to attract companies with low taxes and custom licenses, Ljubljana stands out for organic adoption from both the public and private sectors.

With strong infrastructure, regulatory alignment with the EU, and a growing number of crypto-native startups and institutions, the city is proving that crypto-friendly doesn’t just mean favourable laws but a culture built around digital asset inclusion.

🗺️ Looking Ahead

As regulatory frameworks like MiCA continue to shape crypto’s future across Europe, cities like Ljubljana will likely play an outsized role. The Slovenian capital’s blend of historical charm, modern governance, and grassroots crypto activity could serve as a blueprint for other cities aiming to lead in the digital economy.

We’re excited to offer you early access to our exclusive Crypto Saving Expert Monthly Community Plan with a massive 80% discount!

What You Unlock:

- Strategies from top crypto experts

- Exclusive access to market insights, guides, and top tips

- Tools to maximise your crypto savings and investments

- A supportive community of like-minded crypto enthusiasts

- Access to our community Discord

Use the code BTC80 at checkout to claim your discount and get full access to our community plan for just a fraction of the price.

Secure your spot in the Crypto Saving Expert Community today.

Sponsored by: Stonksy

Stonksy is a momentum identifier that aims to capture expansive market moves before they happen by highlighting the start of potential price shifts. It can be used across all markets, including crypto, stocks, indices, commodities, and currencies.

Stonksy is growing in users week-on-week, proving why it aims to become one of the most-used indicators in the industry.

You can use code BOT20 to join Stonksy for 20% off your first month. Sign up today.

Find examples of Stonksy indications posted to the X every day: @stonksyio and learn how to use Stonksy and how it can benefit your trading system on the YouTube channel, with daily livestreams at 12:00 UTC.

This Newsletter is strictly for informational purposes only; the content is generic and has not been tailored in any way. Crypto Saving Expert UAB (“CSE”) is not providing, and should not be interpreted as providing, any form of offer of any currency, security, financial instrument or digital asset, or investment advice, recommendations or strategy. The content of this Newsletter is not intended to replace your own research with regard to any assets, products or services, and any action taken on the basis of this material is entirely at your own risk. CSE neither accepts nor assumes any liability or responsibility for any loss or damage arising out of, or in any way connected to, the Newsletter content. Cryptocurrencies and digital assets may be unregulated in your jurisdiction, any profits may be subject to tax and the value of any investment could fall.

If you click on a link within this Newsletter to go through to a provider, we may get paid. This usually only happens if you get a product/use a service from it. This is what helps fund CSE and keeps the majority of our content free to use. Two crucial things you should know about this, however: a) this never impacts our editorial recommendations, if something is included, it is because we independently rate it as the best; and b) you will always get as good a deal, or better, than if you went direct. For full details on how CSE is funded, please click here.

CSE collects, processes and stores certain data. Such data may be shared with CSE’s wholly owned subsidiary company, Crypto Saving Expert Limited. Please note that by submitting information about yourself to CSE you are consenting to such use. For full details on our collection, processing and storage of data, together with your rights in relation thereto, please consult our Privacy Statement here.