- Crypto Saving Expert's Newsletter

- Posts

- Crypto Saving Expert Newsletter - Issue 148

Crypto Saving Expert Newsletter - Issue 148

Good afternoon! Bitcoin is eyeing a breakout past $112K, but with macro uncertainty looming and long-term holders under pressure, is this the next leg up or just another false dawn? Let’s break down bitcoin, the S&P 500, and the key levels to keep an eye on this week. 👇

Table of Contents

Sponsored by: BloFin

Why BloFin?

Fair Trading: No internal or sister company market makers; BloFin doesn’t trade against its users.

Independent Liquidity: BloFin’s order books and liquidity is not shared with any large exchanges.

Transparent Leadership: The founder is fully doxxed—check out their Twitter here.

Impressive Volumes & Liquidity: Considering BloFin’s launch in 2023, its performance outshines many competitors like BingX.

Extensive Trading Options: Access 397+ futures pairs and 130+ spot pairs.

Secure Custody: User assets are held with Fireblocks, eliminating risks like hot wallet breaches.

Verified Proof of Reserves: Independently verified on Nansen for maximum security.

Chainalysis Integration: Ensures BloFin doesn’t accept illicit funds.

Instant Trade Execution: One of only four exchanges globally to achieve in-memory trade execution.

User-Friendly Policies: No KYC required, worldwide access via a VPN, and a mobile app for trading on the go.

Outstanding Customer Support and exciting user campaigns to enhance your experience.

Start trading with confidence and take advantage of BloFin’s innovative platform. Sign up now through our exclusive link:

Bitcoin Eyes New Highs

Just days after dropping down towards $100,000, bitcoin has rallied to position itself ever-closer to making new highs and entering price discovery.

Bitcoin

Bitcoin has pushed past $110,000 again, after putting together a strong rally from the lows of last week.

Stonksy has been green on BTC since $105,000, capturing the bulk of the move.

From here, bitcoin is within touching distance of recording a fresh all-time high and potentially rallying towards $120,000.

Get 20% off your first month of Stonksy with code BOT20. Sign up here: https://www.stonksy.io/signup

Bitcoin Weekly

The weekly chart remains green on bitcoin. This shows just how well Stonksy reads the market.

Despite the corrections and pullbacks along the way, Stonksy has highlighted that the high time frame trend is still bullish as bitcoin re-approaches its highs.

However, something to note is where the upper of the inner and our channels reside, which could provide valuable insight should bitcoin rally further.

S&P 500

The S&P 500 is testing a vital inflexion point on the chart. The grey box represents the key S/R zone for the price, alongside the psychological number of $6,000.

This is the spot the price must reclaim if it is to continue its trajectory and make a break for new highs.

However, it has yet to close above this level.

CoreWeave

CoreWeave has taken Wall Street by storm, rallying from $33 to over $160 in a matter of weeks.

The momentum came from some significant deals the firm sealed, generating huge interest in the CRWV stock.

Stonksy turned green on the 1H around the $40 mark and remains green thus far, offering a 4x return from the point of entry.

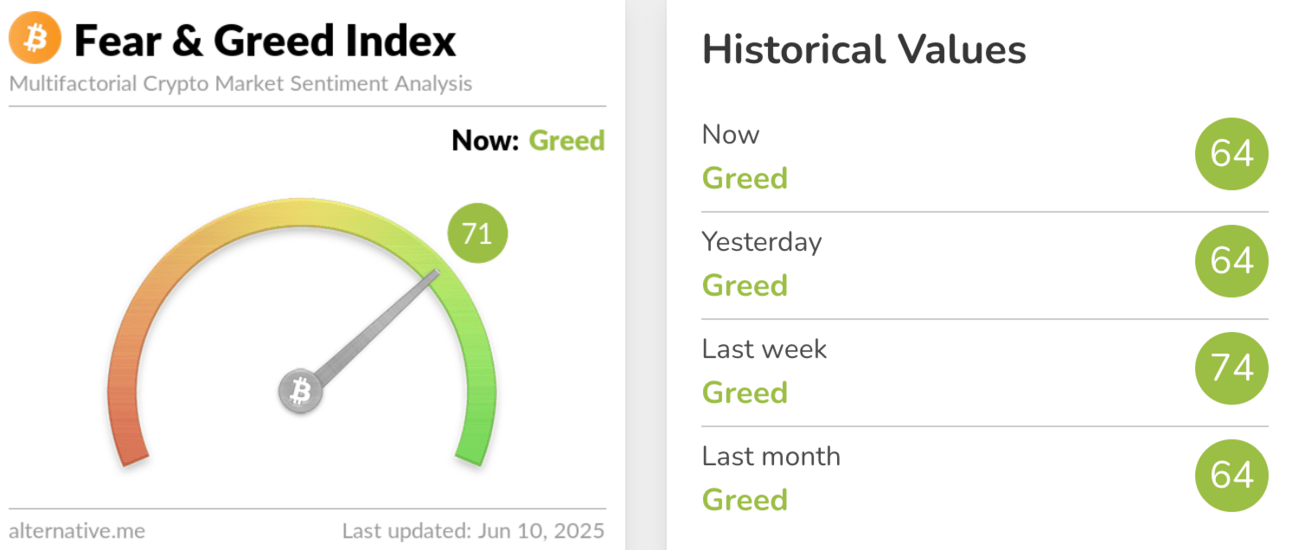

Fear & Greed Index

The Fear and Greed Index remains within Greed and scores 71.

The Index has barely moved in recent weeks as bitcoin consolidates close to new highs. Should the price push into new territory, Extreme Greed may enter the market as excitement grows.

Important Dates

Wednesday 11 June, 12:30 UTC - US Consumer Price Index (CPI)

CPI measures inflation and is a vital economic measurement in all countries. The data is released by the Bureau of Labor Statistics and calculated using a shopping basket of goods and services.

The data is forecast at 2.5%, with the previous data lower at 2.3%.

Thursday 12 June, 12:30 UTC - Producer Price Index (PPI)

The Bureau of Labour Statistics is also responsible for PPI, which measures the average change in commodity prices. Similar to core inflation, PPI removes volatile goods from its findings. The forecast is set at 3%, with the previous data at 3.1%.

Friday 13 June, 14:00 UTC - Michigan Consumer Sentiment Index

The University of Michigan releases the index, which is a survey depicting consumer confidence in the economy. The survey provides insight into consumers’ confidence to spend money within the US economy.

The Index’s score is set to come in at 53.5, with the previous data coming in at 52.2.

Gainers

Losers

Trump vs. Musk: Billionaire Feud Rattles Bitcoin Bulls

Bitcoin dips near $100k amid a public fallout between Donald Trump and Elon Musk, triggering mass long liquidations and wider crypto market losses.

TL;DR:

📉 Bitcoin dropped nearly 3%, nearing the $100,000 level amid rising tension between Trump and Musk.

🫗 $308m in bitcoin long positions were liquidated as traders were caught off guard.

🤔 Elon Musk warned Trump's tariff policies could trigger a recession in H2 2025.

✂️ Trump vowed to cut SpaceX’s government contracts, escalating the feud.

😰 Long-term BTC holders are selling off following May's all-time high of $111,970.

📉 Market Drops as Political Drama Heats Up

Bitcoin investors took a hit on 5 June as the cryptocurrency plunged from $105,915 to $100,500 in just hours. The price has since recovered slightly to $102,180, but the pullback has erased over $308m in long positions, according to CoinGlass.

The drop wasn’t just technical — it coincided with the escalating political spat between former allies Donald Trump and Elon Musk, whose feud is now spilling over into financial markets.

💬 Musk: Trump Tariffs = Recession Incoming

The drama hit centre stage when Musk took to X and slammed Trump’s plan to impose global tariffs, warning it would “cause a recession in the second half of this year.”

The statement echoed broader market fears that Trump’s policies could delay monetary easing, as highlighted by Swyftx analyst Pav Hundal. He warned that without "hard data," the Fed might stall rate cuts, risking a growth slowdown at a time when crypto markets are hungry for bullish macro conditions.

🔥 Trump: I’ll Cut Musk’s Contracts

Trump didn’t take Musk’s comments lightly.

Posting on his Truth Social platform, Trump announced he would terminate Musk’s government subsidies and federal contracts, claiming it would save the US “billions and billions of dollars.”

Musk fired back dramatically:

“In light of the President’s statement… SpaceX will begin decommissioning its Dragon spacecraft immediately.”

The billionaire later walked back the comment, but the damage was done — investor sentiment in both equities and crypto took a hit.

🪙 Bitcoin Holders Cashing Out

Compounding the political chaos, long-term BTC holders are taking profits after Bitcoin's all-time high of $111,970 on 22 May. According to Glassnode:

“With long-term holders gradually applying sell pressure, the probability of a short-term correction continues to build…”

The lack of a new bullish catalyst has left Bitcoin “on very shaky ground,” as author Saifedean Ammous noted earlier this week.

🧊 Not Just Bitcoin: ETH, XRP, SOL Slide Too

The crypto sell-off wasn’t limited to Bitcoin. Across the board, major altcoins saw steep drops:

📉 Ether (ETH): Down 7.25%

📉 XRP: Down 4.35%

📉 Solana (SOL): Down 5.20%

Total crypto liquidations reached $982.55m, with $891.63m coming from long positions alone.

🎯 Key Takeaway

As Musk and Trump part ways politically, the crypto market appears to be the unexpected casualty. With investor confidence shaken, long-term holders selling, and macro fears resurfacing, Bitcoin's battle to stay above six figures may just be beginning.

James Wynn Loses $25m in BTC Liquidation — Sparks Market Manipulation Debate

High-leverage trading star James Wynn gets wiped out again as volatility rocks crypto markets. Analysts say it’s a harsh reminder of why risk management matters.

Millionaire crypto trader James Wynn lost $25m in a high-leverage Bitcoin trade. The incident underscores the risks of 40x leverage and poor risk management in volatile crypto markets.

📌 TL;DR:

☠️ James Wynn was liquidated for 240 BTC ($25m) on a 40x leveraged long.

💥 He still holds 770 BTC at a liquidation threshold of $104,035.

🤔 Wynn claims the market is being manipulated and is asking for donations.

💰 His total losses now exceed $100m in a single week.

🧑💻 Analysts say the case highlights the need for strong risk management.

🎢 Wynn Liquidated Again After $1.25bn Long Bet

Millionaire trader James Wynn has suffered another brutal loss after betting big that Bitcoin would rally—and getting liquidated for 240 BTC, or roughly $25m. Lookonchain confirmed the liquidation on 4 June, also noting that Wynn had manually trimmed the position to delay his liquidation point.

Despite the blow, Wynn still holds 770 BTC (~$80.5m), with a liquidation price looming at $104,035, just a few hundred dollars away at press time.

According to Hypurrscan, he also has an unrealised loss of nearly $1m from his current 40x BTC long position.

💬 Market Manipulation Claims

Following his loss, Wynn took to X, accusing “market manipulation” for his liquidation and requesting donations to fund a campaign to expose it.

Wynn gained crypto fame after placing a $1.25bn 40x long on Bitcoin through Hyperliquid, one day after losing $29m. His volatile trading history includes a $110m short position, a $100m reentry into a long, and total weekly losses now estimated at $100m+.

🛡️ Why Risk Management Matters

Wynn’s rapid-fire leverage bets serve as a stark warning for traders, particularly in crypto markets where volatility can swing prices thousands of dollars in hours.

Key Risk Management Takeaways:

👉 Use lower leverage: 40x is extremely risky — even 2–5% price moves can wipe out capital.

👉 Diversify exposure: Avoid going all-in on a single trade.

👉 Set stop-losses: Protect your capital automatically.

👉 Don’t revenge trade: Reentering with higher stakes after a loss is a common pitfall.

Wynn’s case underscores what happens when ego and ambition overpower discipline — a cautionary tale that even massive bankrolls are no match for poor execution.

🧠 CZ Suggests Dark Pool DEX to Combat Liquidation Manipulation

Wynn’s latest loss has sparked a broader conversation on market transparency and manipulation. Binance co-founder Changpeng Zhao proposed the creation of a dark pool perpetual swap DEX, arguing that current systems expose whales to real-time front-running and slippage.

“The transparency of current DEXs enables front-running and forced liquidations. A dark pool DEX could help fix that,” said CZ.

Dark pools — common in traditional finance — allow large traders to execute orders privately without broadcasting them to the market. While they can reduce manipulation, critics say they also limit transparency and fairness for retail users.

🔍 Final Thoughts

James Wynn’s $25m wipeout is just the latest chapter in an aggressive, high-risk trading saga. Whether you see him as a bold market genius or an overleveraged gambler, one fact remains:

“Risk management isn’t optional. It’s survival.”

As the crypto market matures, Wynn’s story may become the case study traders cite when discussing the dangers of excessive leverage, poor planning, and unchecked ego.

Bitcoin Nears All-Time High — Rally or Reversal?

Bitcoin eyes a breakout past $112K, but with macro uncertainty looming and long-term holders under pressure, is this the next leg up or just another head fake?

TL;DR:

💥 Bitcoin is less than 2% from its all-time high of $111,970.

📈 Crypto stocks responded, with Circle, Core Scientific, and Coinbase leading gains.

📊 Analysts warn of a short-term correction amid weakening upside catalysts.

🩳 If BTC breaks ATH, $1bn in shorts may be liquidated, potentially triggering a squeeze.

🚨 The 18 June Fed rate decision looms large, with macro policy and Trump’s tariffs key wild cards.

📈 Bitcoin Inches Toward $112K — But Traders Remain Wary

Bitcoin broke above $110,000 in Monday’s Asia session, rising 4% in 24 hours and fueling speculation it could retest or surpass its 22 May peak of $111,970. BTC sits around $109,519 at the time of writing, just 2.2% below its ATH.

Crypto stocks surged in tandem. Standouts include:

🔵 Circle (CRCL): +7% (+2.2% after-hours)

🧑🔬 Core Scientific (CORZ): +4.27%

💥 CleanSpark (CLSK) & MARA Holdings (MARA): +3%+

🚨 Riot Platforms (RIOT): +2.74%

🧑🏫 MicroStrategy (MSTR): +4.71%

🪙 Coinbase (COIN): +2%

Meanwhile, BitMine Immersion Technologies (BMNR) bought 100 BTC for the first time, joining firms like KULR Technology Group in adding Bitcoin to their treasuries.

🧠 Sentiment Split: Is the Market Running on Fumes?

Despite the optimism, several analysts are waving caution flags. In a recent note, Bitfinex analysts said:

“The risk of a short-term correction continues to build — especially in the absence of a strong catalyst to push Bitcoin decisively above the current all-time high.”

The concern isn’t new. After past ATHs, Bitcoin has often consolidated for weeks or months, as it did in March 2024 after hitting $73,679.

Adding to the caution:

👉 Long-term holders are beginning to distribute coins.

👉 Funding rates are neutral, suggesting neither bulls nor bears are dominant.

👉 If prices slide before breaking ATH, $1.08B in short positions may remain intact, according to CoinGlass.

💣 Macro Watch: All Eyes on the Fed and Tariffs

Bitcoin’s trajectory this week may hinge on two macro flashpoints:

📆 18 June – Fed Interest Rate Decision

The Federal Reserve is expected to hold rates steady, but hinting at a future rate cut could ignite risk-on appetite, boosting BTC. A hawkish tone, however, might sap momentum.

🇺🇸 Trump’s Tariff Threats

President Trump’s evolving stance on China tariffs continues to inject volatility into global markets. Analysts like Pav Hundal (Swyftx) caution:

“The biggest threat to bulls right now is that nothing changes over the next two months, and we stay trapped in this cycle of endless tariff ultimatums.”

🧮 Market Structure: Breakout or Fakeout?

Bitcoin has rallied 39% from its Q1 2025 low of $78,513 — but analysts say we’re entering a decision zone. Long-term holders who held through that drawdown now face a key choice: sell into strength or wait for a higher leg?

“Whatever they decide will help define the next leg of the market structure,” analysts wrote.

If BTC breaks above $112K and holds, it could set the stage for a surge toward $120k—$140k. If not, a return to the $95k—$100k zone is possible, especially if macro conditions remain uncertain.

⚖️ Final Verdict: New Highs Ahead, or Another Trap?

Bitcoin is on the brink. On-chain data, stock correlations, and treasury buys all support upside. But without fresh momentum or macro clarity, a rally above ATH could prove fleeting.

Bullish scenario:

🐂 Breaks $112K → short squeeze → targets $118K+

🐂 Rate cuts or risk-on sentiment from Fed or geopolitical clarity

Bearish scenario:

🧸 Failure to break ATH → long-term holders sell → revisit $100K

🧸 No macro progress or hawkish Fed tone

We’re excited to offer you early access to our exclusive Crypto Saving Expert Monthly Community Plan with a massive 80% discount!

What You Unlock:

- Strategies from top crypto experts

- Exclusive access to market insights, guides, and top tips

- Tools to maximise your crypto savings and investments

- A supportive community of like-minded crypto enthusiasts

- Access to our community Discord

Use the code BTC80 at checkout to claim your discount and get full access to our community plan for just a fraction of the price.

Secure your spot in the Crypto Saving Expert Community today.

Sponsored by: Stonksy

Stonksy is a momentum identifier that aims to capture expansive market moves before they happen by highlighting the start of potential price shifts. It can be used across all markets, including crypto, stocks, indices, commodities, and currencies.

Stonksy is growing in users week-on-week, proving why it aims to become one of the most-used indicators in the industry.

You can use code BOT20 to join Stonksy for 20% off your first month. Sign up today.

Find examples of Stonksy indications posted to the X every day: @stonksyio and learn how to use Stonksy and how it can benefit your trading system on the YouTube channel, with daily livestreams at 12:00 UTC.

Start learning AI in 2025

Everyone talks about AI, but no one has the time to learn it. So, we found the easiest way to learn AI in as little time as possible: The Rundown AI.

It's a free AI newsletter that keeps you up-to-date on the latest AI news, and teaches you how to apply it in just 5 minutes a day.

Plus, complete the quiz after signing up and they’ll recommend the best AI tools, guides, and courses – tailored to your needs.

This Newsletter is strictly for informational purposes only; the content is generic and has not been tailored in any way. Crypto Saving Expert UAB (“CSE”) is not providing, and should not be interpreted as providing, any form of offer of any currency, security, financial instrument or digital asset, or investment advice, recommendations or strategy. The content of this Newsletter is not intended to replace your own research with regard to any assets, products or services, and any action taken on the basis of this material is entirely at your own risk. CSE neither accepts nor assumes any liability or responsibility for any loss or damage arising out of, or in any way connected to, the Newsletter content. Cryptocurrencies and digital assets may be unregulated in your jurisdiction, any profits may be subject to tax and the value of any investment could fall.

If you click on a link within this Newsletter to go through to a provider, we may get paid. This usually only happens if you get a product/use a service from it. This is what helps fund CSE and keeps the majority of our content free to use. Two crucial things you should know about this, however: a) this never impacts our editorial recommendations, if something is included, it is because we independently rate it as the best; and b) you will always get as good a deal, or better, than if you went direct. For full details on how CSE is funded, please click here.

CSE collects, processes and stores certain data. Such data may be shared with CSE’s wholly owned subsidiary company, Crypto Saving Expert Limited. Please note that by submitting information about yourself to CSE you are consenting to such use. For full details on our collection, processing and storage of data, together with your rights in relation thereto, please consult our Privacy Statement here.