- Crypto Saving Expert's Newsletter

- Posts

- Crypto Saving Expert Newsletter - Issue 154

Crypto Saving Expert Newsletter - Issue 154

Good morning! Bitcoin is stuck in a sideways range, showing signs of deep consolidation, while Ethereum continues to push toward $4,000 with strength. Is a breakout coming, or are we in for more chop? Let’s break down BTC, ETH and the key levels to watch this week 👇

Table of Contents

Sponsored by: BloFin

Why BloFin?

Fair Trading: No internal or sister company market makers; BloFin doesn’t trade against its users.

Independent Liquidity: BloFin’s order books and liquidity is not shared with any large exchanges.

Transparent Leadership: The founder is fully doxxed—check out their Twitter here.

Impressive Volumes & Liquidity: Considering BloFin’s launch in 2023, its performance outshines many competitors like BingX.

Extensive Trading Options: Access 397+ futures pairs and 130+ spot pairs.

Secure Custody: User assets are held with Fireblocks, eliminating risks like hot wallet breaches.

Verified Proof of Reserves: Independently verified on Nansen for maximum security.

Chainalysis Integration: Ensures BloFin doesn’t accept illicit funds.

Instant Trade Execution: One of only four exchanges globally to achieve in-memory trade execution.

User-Friendly Policies: No KYC required, worldwide access via a VPN, and a mobile app for trading on the go.

Outstanding Customer Support and exciting user campaigns to enhance your experience.

Start trading with confidence and take advantage of BloFin’s innovative platform. Sign up now through our exclusive link:

Bitcoin’s Cycle Pattern Begins Again

This cycle is one of consolidation for bitcoin as it has entered a multi-week-long sideways range again.

Bitcoin

Bitcoin is wedged inside its local range, with clear resistance and support.

While the pierce has broken this on three occasions over the last two weeks, these breaches have been nothing more than liquidity grabs and traps.

For bitcoin to witness volatility injection, it must break either side of this range.

Cycle Outlook

As the image above shows, this cycle belongs to consolidation. The pattern is typified by extended periods of bitcoin's price ranging before breaking out, which leads to short and aggressive burst of expansion.

If bitcoin does not break out of the local range soon, this could become another phase of sideways price action.

Ethereum

Ethereum has been the standout performer of late, with the price finally showing strength in the market.

Stonksy has been green on the daily since the start of June, capturing the whole run up and remains green as ETH edged closer to interacting with the big resistance wall at $4,000-$4,100.

You can get 25% off the annual Stonksy plan with code TMG25, taking the price down to just £749.25 for an entire year of full access. Join here: https://www.stonksy.io/signup

Important Dates:

Wednesday 30 Jul, 12:30 UTC - Gross Domestic Product (GDP)

The GDP demonstrates the monetary value of all US goods, services, and structures. The GDP is a critical measurement of the economy's strength as it demonstrates economic growth or slowdown.

The GDP is forecasted at 2.4%, and is the first release of the Q2 data.

Wednesday 30 July, 18:00 UTC - Fed Interest Rate Decision

The Federal Open Markets Committee meeting occurs eight times a year. The Fed meets to discuss recent economic data and the strength of the US economy before deciding whether it should increase, decrease, or leave rates unchanged.

The Federal Reserve is composed of a Board of Governors that assists its Chair, Jerome Powell, in making interest rate decisions and steering the US economy.

At 18:00 UTC, the Fed will announce its interest rate decision. Afterwards, a press conference will begin at 18:30, where Powell will conduct a 30-minute speech before taking questions from the press.

Thursday 31 July, 12:30 UTC - Core Personal Consumption Expenditures (PCE)

The US Bureau of Economic Analysis releases the core PCE data, which measures the average amount of money consumers spend monthly in the economy.

PCE is released in two formats: month-over-month and year-on-year. The data also removes volatile products, such as energy and food.

The year-on-year data is forecast to come in at 2.7%, with the previous data the same.

Friday 1 August, 12:30 UTC - Nonfarm Payrolls (NFP)

The US Bureau of Labour Statistics releases the NFP. This form of data represents the number of new jobs created in the previous month, which will be December and is another signal of economic health.

The consensus is set at 110,000, with the previous data at 147,000.

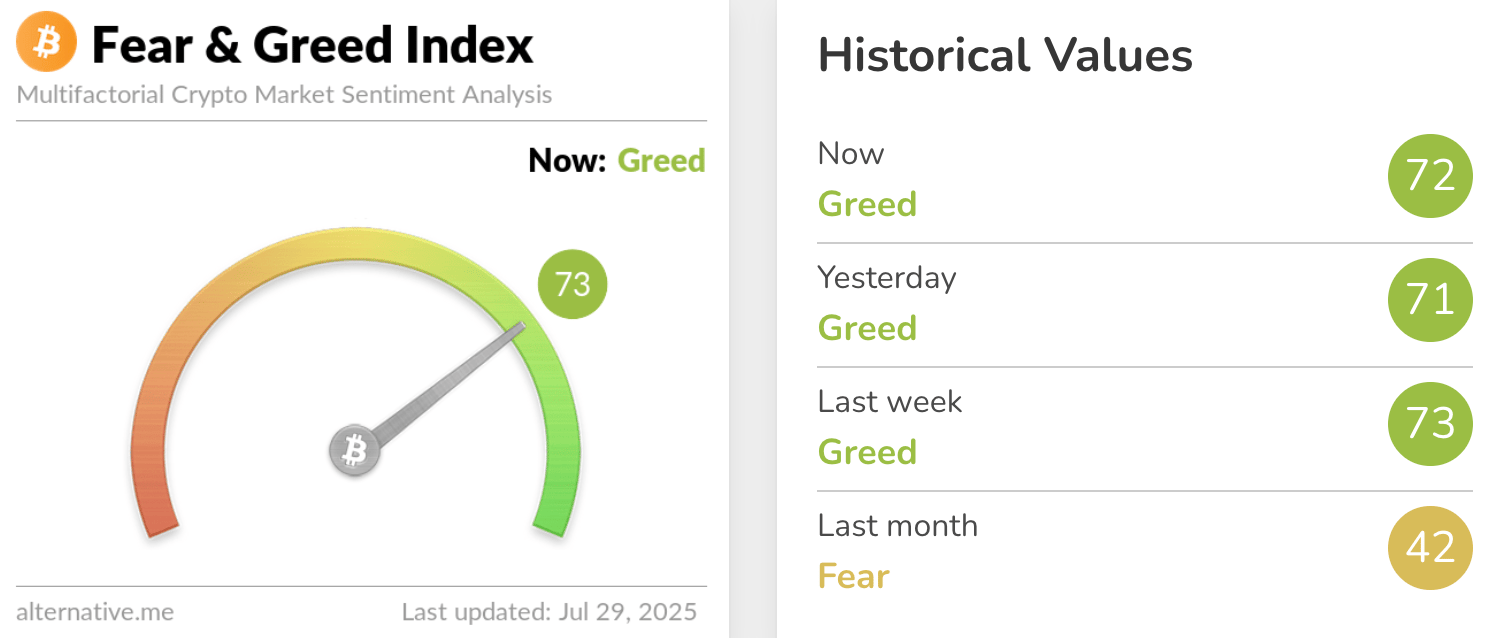

Fear & Greed Index

The Fear and Greed Index remains unchanged for another week, with it cemented in Greed and scores 73.

While bitcoin is flat, there is likely to be no change to sentiment until it can at least break one side of the local range.

Gainers

Losers

Bank of England Reconsiders Digital Pound Amid Growing Doubts on CBDC Necessity

The Bank of England may reconsider its plans for a digital pound as scepticism over central bank digital currencies grows. Here's what CBDCs are, what the BoE does, and why the UK might back out.

TL;DR

🇬🇧 Bank of England may scrap digital pound over lack of clear benefits.

📉 BoE governor says he needs “a lot of convincing” that the UK needs a CBDC.

🏦 Officials are now urging banks to improve payment systems instead.

⚠️ Public backlash includes privacy concerns, potential bank run fears.

🌍 Only 3 countries have launched CBDCs, UK is falling behind global peers.

🏛 What Is the Bank of England?

The Bank of England (BoE) is the central bank of the United Kingdom, established in 1694. It is responsible for:

✅Setting interest rates to control inflation

✅Issuing banknotes (like the £5, £10, £20, and £50)

✅Regulating the financial system

✅Acting as lender of last resort for UK banks during crises

The BoE plays a critical role in ensuring the stability of the UK’s economy and financial system.

💻 What Are CBDCs?

Central Bank Digital Currencies (CBDCs) are digital versions of a country’s official currency, issued and controlled by the central bank. In this case, the BoE’s proposed CBDC would be a digital pound — sometimes nicknamed "Britcoin."

CBDCs aim to:

💰Offer a government-backed alternative to private cryptocurrencies and stablecoins

⚡️Modernise the payment system and make money transfers faster

💸 Provide a cash-like digital asset for everyday use

💥 Allow greater financial inclusion

However, CBDCs have raised concerns about privacy, government overreach, and the risk of bank runs if consumers flock to digital pounds during financial crises.

🇬🇧 UK May Back Away from Digital Pound Plans

The BoE is now seriously reconsidering its plans for a retail-focused CBDC. According toa new report from Bloomberg, internal discussions at the BoE show growing scepticism. Governor Andrew Bailey told Parliament this week:

“If [commercial innovation] is a success, I question why we need to introduce a new form of money.”

Instead of pushing ahead with a CBDC, BoE officials are encouraging banks to modernise their own payment rails. If they succeed, Bailey said, a digital pound may be unnecessary.

This is a reversal from last year, when the BoE and HM Treasury said a digital pound was “likely needed.”

😬 Why the Pushback?

CBDC plans in the UK have faced:

🤔 Over 50,000 public comments, most of them critical

😱Conspiracy theories and misinformation

📸 Concerns about privacy, state surveillance, and financial control

🏃 Worries that a digital pound could trigger bank runs in times of panic

👀 Fear of competition from foreign stablecoins or Big Tech–issued digital currencies

🇺🇸 US Moves to Block CBDCs

Across the Atlantic, the US House passed the Anti-CBDC Surveillance State Act, which bans the Federal Reserve from launching a CBDC without congressional approval. Some politicians, including Marjorie Taylor Greene, claim CBDCs could give governments too much control over personal finances.

🌍 Global CBDC Progress

✅ Launched: Bahamas, Jamaica, Nigeria

🧪 Pilot: 49 countries

🔧 Development: 20 countries

🧠 Research: 36 countries

Despite its early interest, the UK is now lagging behind global peers in the CBDC race.

🧠 Final Thought

The UK’s retreat from the digital pound could be a sign of a global cooling toward CBDCs. Between technical hurdles, public resistance, and alternative innovations, even central banks are beginning to ask:Do we really need this?

And in Britain’s case, the answer might just be "no.".

Stablecoins Go Parabolic: Why the World Is Suddenly Obsessed With Digital Dollars

Google searches for stablecoins hit an all-time high in 2025 as regulation, adoption, and institutional involvement send demand soaring. But is this the beginning of a stablecoin revolution — or just the calm before a new storm?

TL;DR

📈 Google search interest in “stablecoins” hit record highs in July 2025.

🏛️ The US passed the GENIUS Act, sparking institutional excitement.

🪙 Stablecoin market cap hit an all-time high of $272bn — 98% of it in USD-pegged tokens.

🏦 Big institutions are building their own fiat-backed stablecoins.

🧭 Stablecoins are increasingly seen as the gateway to mass crypto adoption.

Stablecoins Are Back in the Spotlight

Forget hype coins and volatile tokens — 2025 is shaping up to be the year of the stablecoin.

According to Google Trends, global search interest in stablecoins just hit its highest level ever, surpassing even the chaos of Terra’s collapse in May 2022. The surge began in mid-June and hit full speed after the GENIUS Act — a sweeping US stablecoin framework — was signed into law on July 18.

“People are waking up to their potential,” said crypto analyst The DeFi Investor on X. “Stablecoins are the product that can onboard the first billion people on-chain.”

🧨 Stablecoin Market Cap Explodes

The numbers back it up:

🪙 $272bn total stablecoin market cap (CoinGecko)

💹 Record-high transaction volume across major blockchains

🔗 Stablecoins now represent ~7% of all crypto market value

🏆 Tether dominates with 60% market share, followed by USDC and a handful of upstarts

Even more striking? About 98% of that capital is tied to USD-pegged stablecoins. Dollar dominance is going digital — and fast.

Bitwise summed it up best on X:

“You can’t spell ‘stablecoins’ without ‘parabolic.’”

🌍 Why Stablecoins Matter — More Than Ever

✅ 1. They’re a Safe Haven

In an era of market volatility, stablecoins offer shelter — a reliable unit of account that doesn’t swing 30% overnight. Traders use them to park funds, while institutions see them as tools for treasury diversification.

🌐 2. Cross-Border Payments

Traditional international banking is slow, expensive, and inefficient. Stablecoins are 24/7, near-instant, and cut out intermediaries.

🏛️ 3. Regulatory Green Light

The GENIUS Act gives legal clarity and institutional backing. Unlike 2022’s Wild West, 2025 is looking more like Wall Street meets Web3.

🏗️ 4. Institutional Build-Out

Companies are either launching their own stablecoins or integrating them into services. Expect big brands, fintechs, and banks to mint branded dollars soon.

“Stablecoins offer a way to connect with crypto while staying conservative,”said CoinW CSO Nassar Al Achkar.

💣 But It’s Still a Dollar Game

One uncomfortable truth? 98% of stablecoins are USD-backed.

Despite EU efforts, yuan-pegged pilots, and gold-backed experiments, the US dollar still rules, just in tokenised form. Tether, USDC, and others keep the dollar’s global reserve status alive on-chain.

But that raises a question:

Can the US stay on top if the world starts tokenising their own fiat?Or will regulation, geopolitics, or innovation finally tilt the scale?

🧠 Final Thoughts: Stablecoins Are Just Getting Started

Stablecoins aren’t just surviving the bear — they’re thriving. With regulators on board, institutions piling in, and users demanding utility over speculation, stablecoins may be the final form of mass crypto adoption.

They're the bridge. They're the buffer.

And if the trends hold, they might just be the future of money.

SharpLink Gaming boosts its Ether holdings by 77,210 ETH, now owning over $1.69B in ETH. The move adds to mounting corporate demand and a looming ETH supply crunch.

🟣 TL;DR 💰 SharpLink Gaming bought 77,210 ETH for $295m

📈 Its total ETH holdings now exceed 438,000 ETH, worth $1.69bn+

😱 ETH acquisition outpaced network issuance over the last 30 days

💸 The majority of ETH is staked for yield

⚡️ Corporations and ETFs now hold 6.73% of all ETH

👀 Supply crunch is forming as institutional ETH demand heats up

👨💼 SharpLink is also scaling leadership, hiring ex-BlackRock & Consensys figures

📊 Company plans to expand stock offering to $6bn — much of it earmarked for ETH

SharpLink Gaming, the second-largest corporate holder of Ether, has just acquired 77,210 ETH, worth approximately $295m, marking another major move in its aggressive crypto treasury strategy.

This single purchase outpaced the entire net ETH issuance from the last 30 days, which stood at 72,795 ETH, according to Ultra Sound Money.

SharpLink has now amassed over 438,000 ETH, valued at more than $1.69bn, according to Lookonchain.

“Banks close on weekends. Ethereum runs 24/7,” — SharpLink on X

💼 Most of the ETH? Staked. SharpLink staked the majority of the newly acquired ETH to start earning staking rewards, which further aligns the company with Ethereum’s proof-of-stake ecosystem and helps reduce the circulating supply.

This vaults the firm even closer to the top of the ETH treasury leaderboard, second only to BitMine Immersion Technologies, which recently crossed $2bn in ETH holdings.

📊 Institutional ETH Demand Driving Supply Crunch With corporate ETH purchases and ETFs accumulating fast, Ethereum is facing an emerging supply shock. As of now:

✅ Corporates + ETFs hold 8.12m ETH

😱 That’s 6.73% of the total circulating supply

💰 Worth over $31bn, according to Strategic ETH Reserve

BitMine itself has ambitious plans to eventually control 5% of all ETH supply, or around six million ETH, worth over $23bn at current prices.

🔧 SharpLink’s Ambitions Don’t Stop at ETH On July 18, SharpLink filed to expand its stock sale from $1bn to $6bn, intending to funnel a significant portion of the proceeds into further ETH acquisitions.

They’re not just buying tokens — they’re buying talent:

Joseph Chalom, a 20-year veteran of BlackRock, joined as co-CEO

Joseph Lubin, founder of Consensys, is now Chairman of the Board

This positions SharpLink as not just a large ETH holder, but a crypto-native strategic powerhouse.

📈 With corporate giants stockpiling ETH and staking it, the supply squeeze could be Ethereum’s biggest narrative heading into 2026.

We’re excited to offer you early access to our exclusive Crypto Saving Expert Monthly Community Plan with a massive 80% discount!

What You Unlock:

- Strategies from top crypto experts

- Exclusive access to market insights, guides, and top tips

- Tools to maximise your crypto savings and investments

- A supportive community of like-minded crypto enthusiasts

- Access to our community Discord

Use the code BTC80 at checkout to claim your discount and get full access to our community plan for just a fraction of the price.

Secure your spot in the Crypto Saving Expert Community today.

Sponsored by: Stonksy

Stonksy is a momentum identifier that aims to capture expansive market moves before they happen by highlighting the start of potential price shifts. It can be used across all markets, including crypto, stocks, indices, commodities, and currencies.

Stonksy is growing in users week-on-week, proving why it aims to become one of the most-used indicators in the industry.

You can get 25% off the annual Stonksy plan with code TMG25, taking the price down to just £749.25 for an entire year of full access. Sign up today.

Find examples of Stonksy indications posted to the X every day: @stonksyio and learn how to use Stonksy and how it can benefit your trading system on the YouTube channel, with daily livestreams at 12:00 UTC.

Wall Street has Bloomberg. You have Stocks & Income.

Why spend $25K on a Bloomberg Terminal when 5 minutes reading Stocks & Income gives you institutional-quality insights?

We deliver breaking market news, key data, AI-driven stock picks, and actionable trends—for free.

Subscribe for free and take the first step towards growing your passive income streams and your net worth today.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

This Newsletter is strictly for informational purposes only; the content is generic and has not been tailored in any way. Crypto Saving Expert UAB (“CSE”) is not providing, and should not be interpreted as providing, any form of offer of any currency, security, financial instrument or digital asset, or investment advice, recommendations or strategy. The content of this Newsletter is not intended to replace your own research with regard to any assets, products or services, and any action taken on the basis of this material is entirely at your own risk. CSE neither accepts nor assumes any liability or responsibility for any loss or damage arising out of, or in any way connected to, the Newsletter content. Cryptocurrencies and digital assets may be unregulated in your jurisdiction, any profits may be subject to tax and the value of any investment could fall.

If you click on a link within this Newsletter to go through to a provider, we may get paid. This usually only happens if you get a product/use a service from it. This is what helps fund CSE and keeps the majority of our content free to use. Two crucial things you should know about this, however: a) this never impacts our editorial recommendations, if something is included, it is because we independently rate it as the best; and b) you will always get as good a deal, or better, than if you went direct. For full details on how CSE is funded, please click here.

CSE collects, processes and stores certain data. Such data may be shared with CSE’s wholly owned subsidiary company, Crypto Saving Expert Limited. Please note that by submitting information about yourself to CSE you are consenting to such use. For full details on our collection, processing and storage of data, together with your rights in relation thereto, please consult our Privacy Statement here.