- Crypto Saving Expert's Newsletter

- Posts

- Crypto Saving Expert Newsletter - Issue 155

Crypto Saving Expert Newsletter - Issue 155

Good morning! Bitcoin is locked in a tight sideways range around $114K‑$115K, showing signs of deep consolidation. Ethereum, meanwhile, is on the move - trading near $3,650–$3,660, and pushing toward the $4,000 resistance level with notable strength.

Is a breakout coming - or is more chop ahead? Here’s a closer look at BTC, Solana, Circle and what to watch this week 👇

Table of Contents

Sponsored by: Foxify

Prop Trading Is About to Be Turned on Its Head with FUNDED V2 by FOXIFY.TRADE

Foxify.trade is rewriting the rules of prop trading with FUNDED v2 — a fully on-chain prop trading system built for traders, not against them. Say goodbye to shady evaluation phases, delayed payouts, and hidden restrictions. With FUNDED v2, you get funded instantly, trade freely, and receive automated payouts via smart contracts — no delays, no gatekeeping.

✅ What Is FUNDED v2?

FUNDED v2 gives traders instant access to up to $10,000 in trading capital — no evaluation, no guesswork. Everything runs on-chain, which means payouts are trustless, instant, and fully automated.

And it doesn’t stop there. With Flash Funding, you can choose your funding amount — even up to $1 million with 100x — and start trading immediately.

Funded is integrated with leading platforms to give a world class trading experience, first up is Orderly Network, while FOXIFY boasts more exciting partnerships with the likes of Binance, ApeX, Vertex, Sonic, Pyth, Certik and Halborn.

🚀 How Is It Different?

No evaluations — Get started right away

No hidden rules or restrictions — Trade how you want

Smart contract payouts — Instant, secure, and transparent

Flash Funding & Instant Funding options

Activity-based progression — Earn points, unlock more capital

🔥 Why It Matters Now

Legacy prop firms are falling behind. Delayed payouts, vague rules, and trader-unfriendly models are driving frustration. FUNDED v2 flips the script, offering a model where traders win — with speed, clarity, and on-chain efficiency.

🎁 Massive Bonus Opportunity

Get on the waitlist now and unlock up to $5,000 in bonus rewards when you request a payout with your $10K FUNDED account — that’s potentially $10K in total payouts. Early access users and OG Discord members can unlock even more.

⚡ BETA launch is coming fast.

👉 Join the waitlist now: https://foxify.trade/

Bitcoin’s Moment To Shine

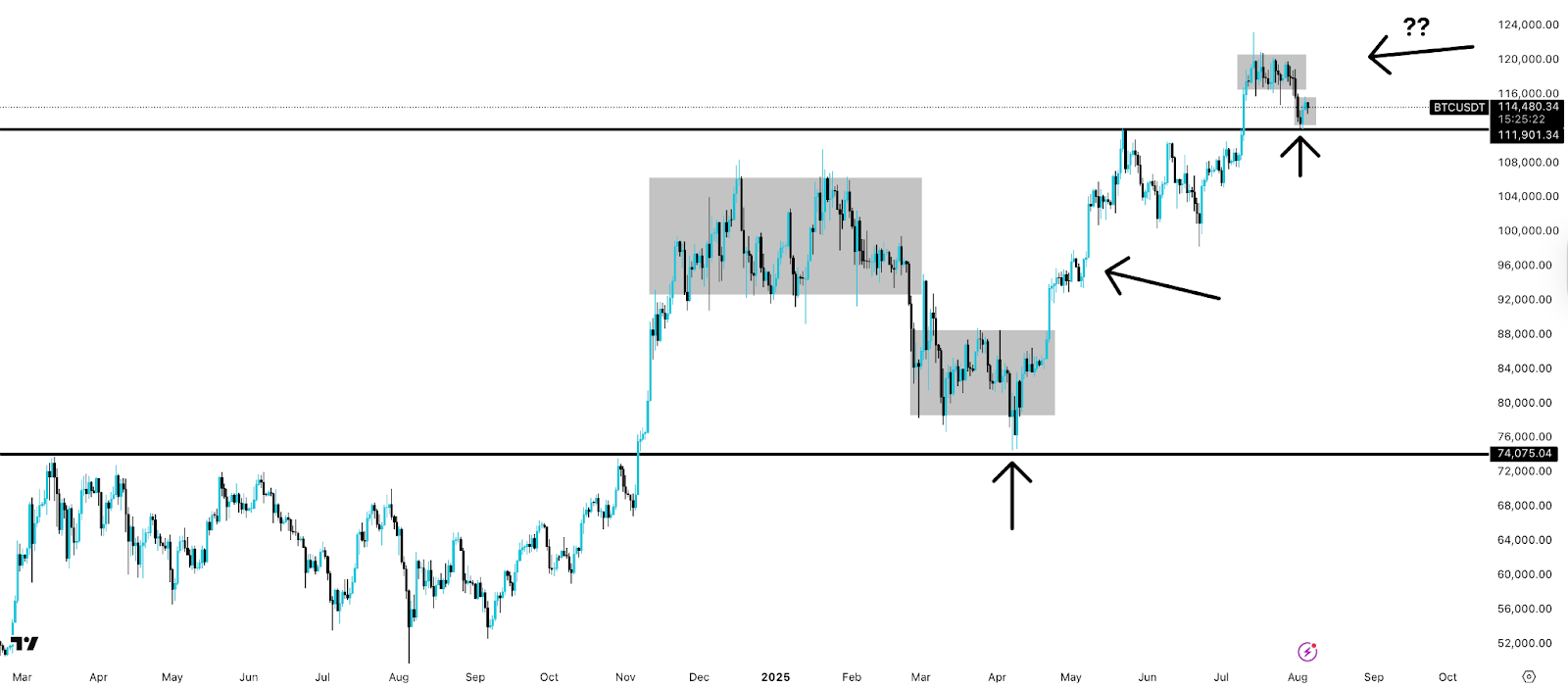

Bitcoin dropped to the downside last week, leaving the consolidation range, retesting a key area. From here, it could stay strong and garner the momentum to launch a rally.

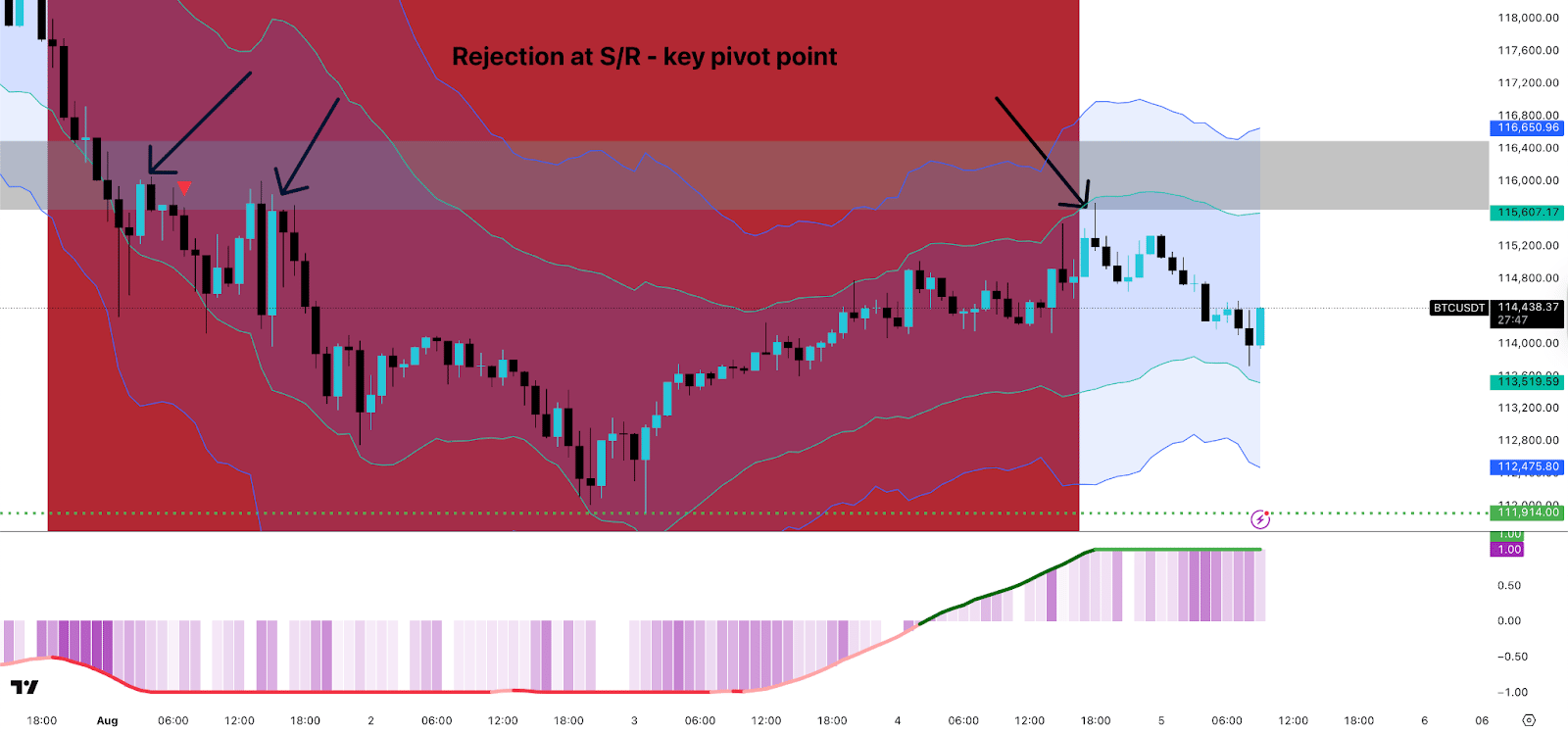

Bitcoin

Bitcoin is facing a huge task at $116,000 after dropping out of the previous range and has now turned support into resistance.

This now marks the key pivot point for longs back towards $120,000 as a significant period of time spent below these key levels can lead to the price dropping further.

Bitcoin Weekly

Bitcoin may be putting in a similar pattern as to what occurred earlier this year.

As seen, bitcoin dropped out of consolidation, reached a key retest point, then held and later bounced.

While smaller this time around, the pattern is very similar and could see bitcoin rally to new highs should the same outcome occur.

Solana

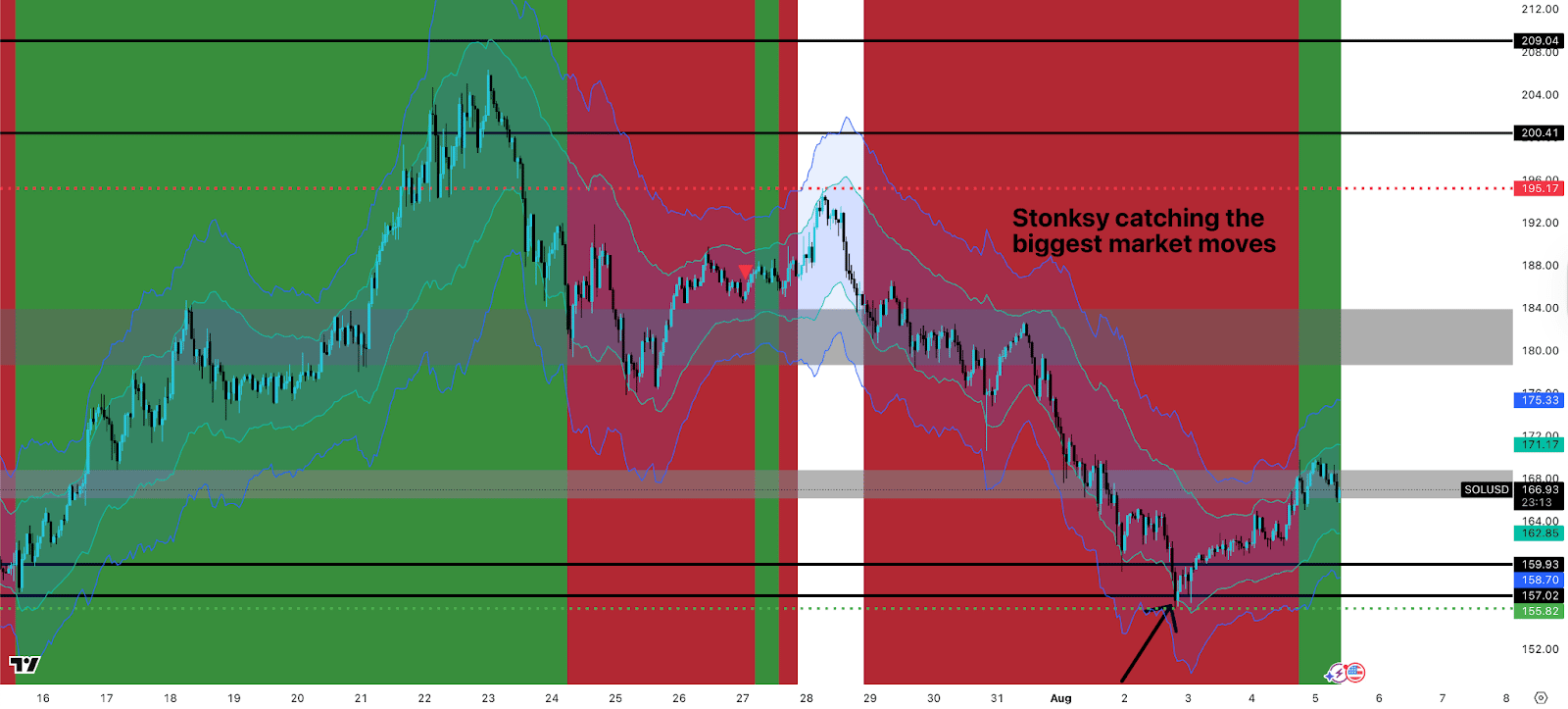

What is also key to note is the levels mapped out on the chart, catching the key areas of interest for reversals. Stonksy has since exited the red background for a massive gain and entered green.

From here, the $158 area needs to hold or SOL could plummet below $150. To the upside, the $180 area will be the obstacle should it hold above $168.

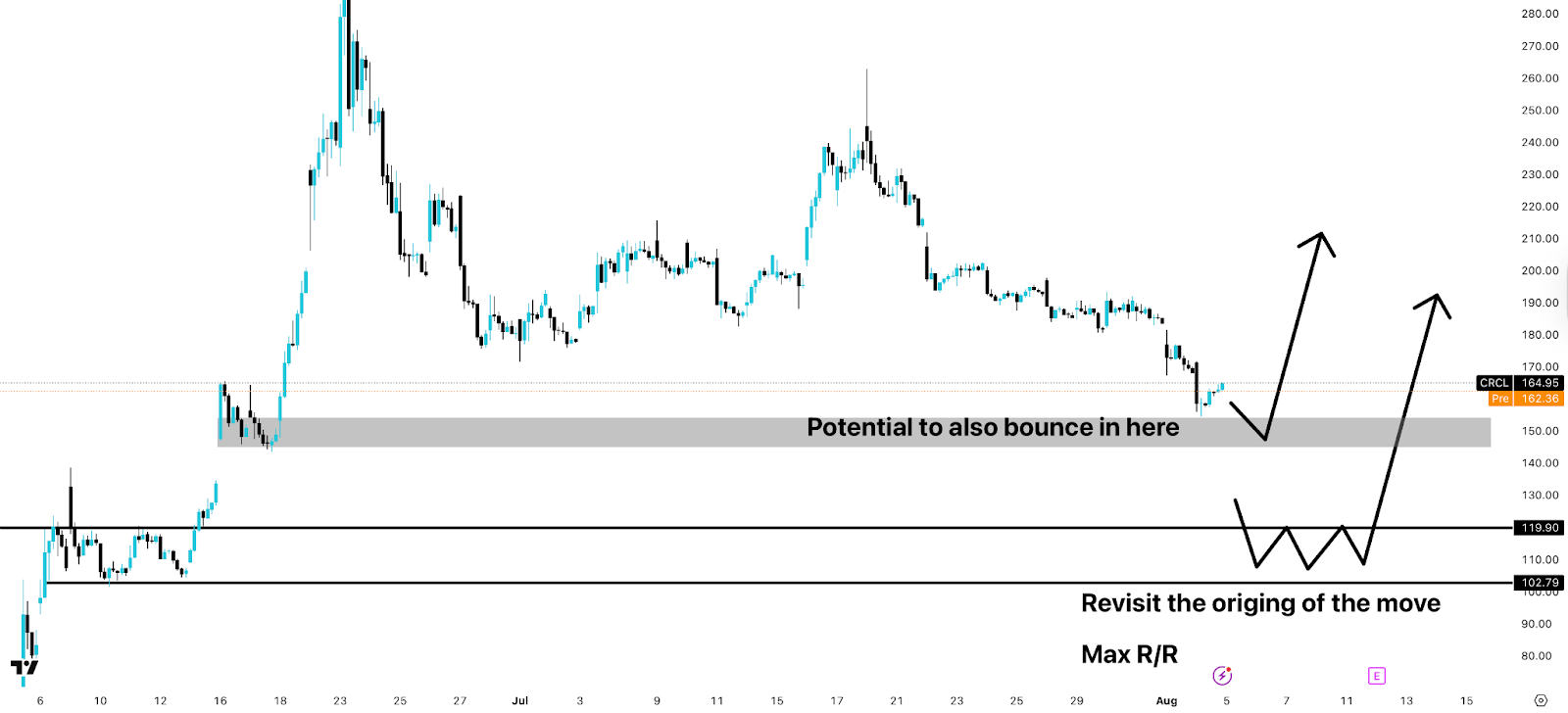

Circle

Circle is one of the largest crypto-related stocks.

After undergoing a massive rally upon IPO listing, Circle is undergoing its retrace back to prior levels.

From here, the $150 region could see demand come in, but max risk/reward would be lower down in the sub-$119 zone, where the origin of the monster rally began.

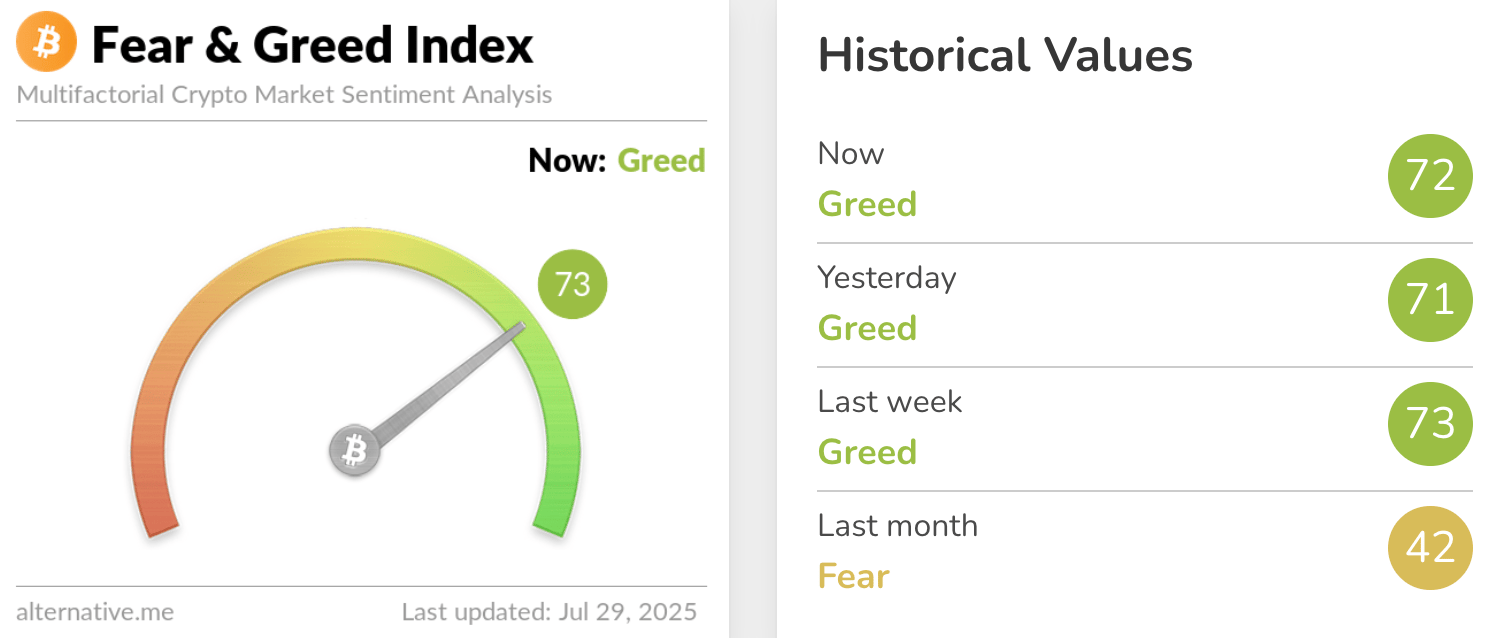

Fear & Greed Index

Despite the drop on bitcoin, the Index remains within Greed, scoring 60.

Following the drop, bitcoin has recovered well, which appears to have put out any fires in investor confidence. Should bitcoin head back towards $120,000, the Index may re-enter Extreme Greed.

However, a drop lower and sentiment may take a big hit as panic enters the market.

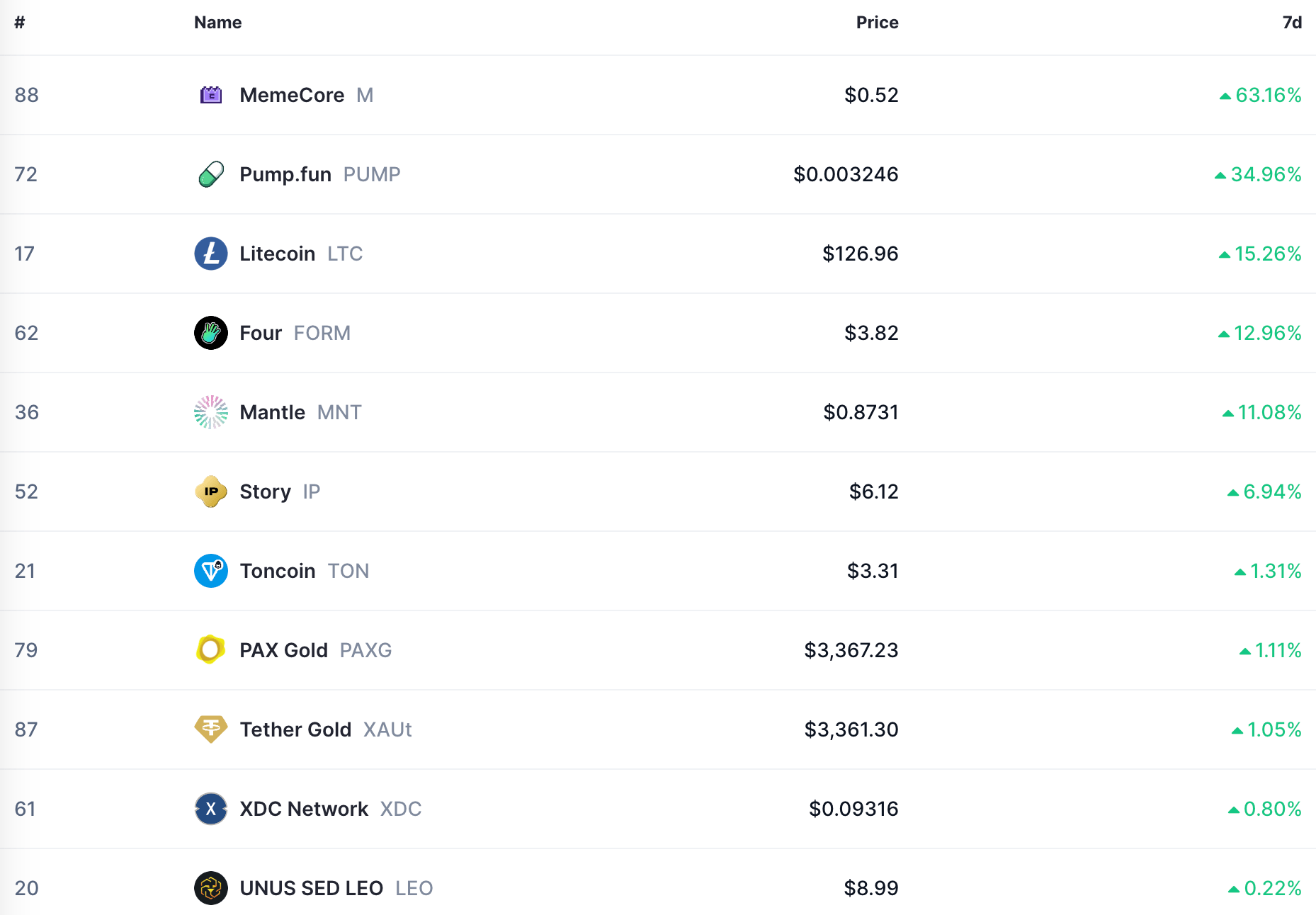

Gainers

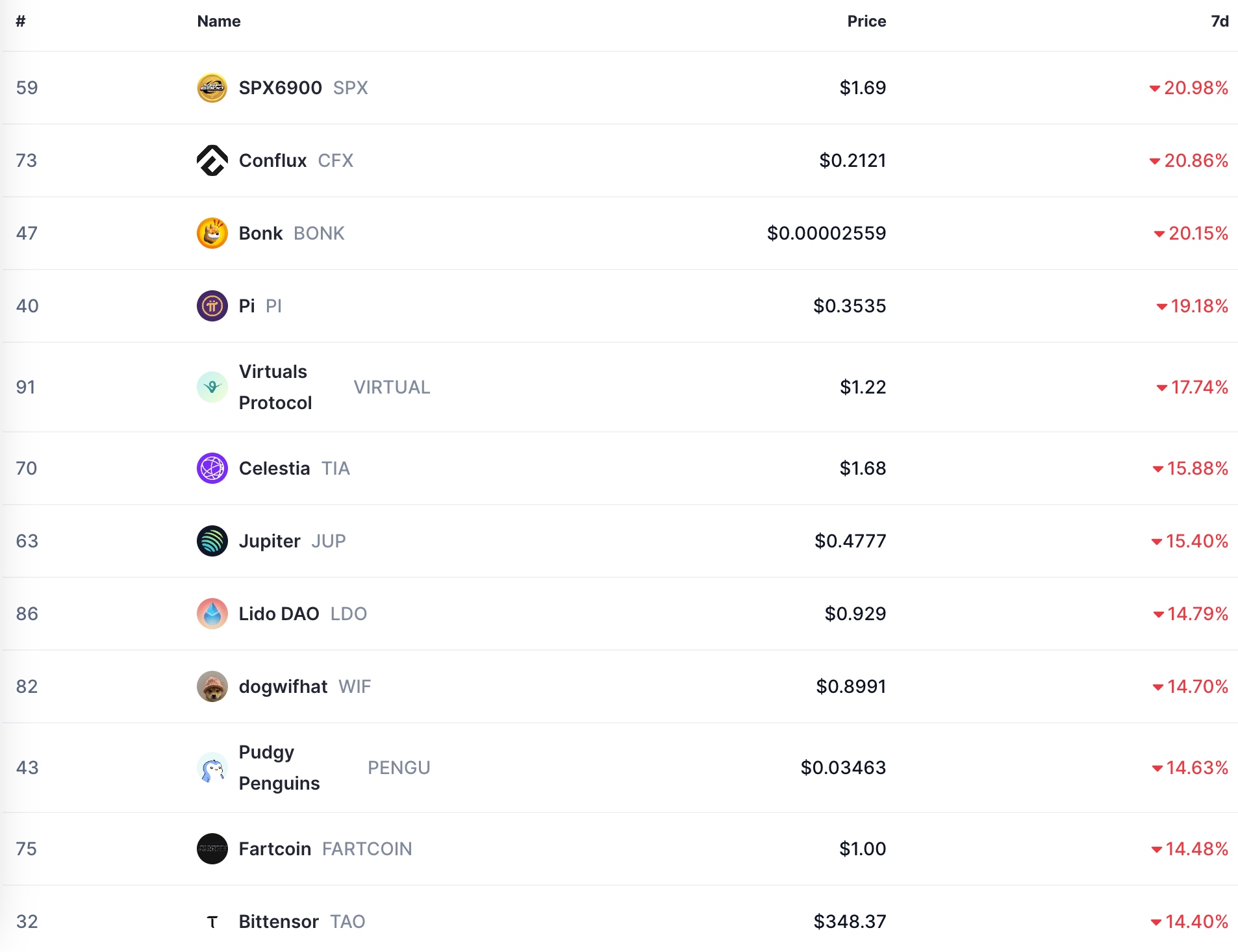

Losers

Five Reasons Why Ethereum Is Headed for $6k

Ethereum is surging — and $6,000 is in sight. From ETF inflows to institutional adoption, here are five key reasons why ETH could be primed for a major breakout.

TL;DR:

📈 Spot ETH ETFs are flooding with billions in inflows.

🏛️ Institutions like BitMine and SharpLink are stacking ETH fast.

🪙 Ethereum’s burn mechanism is keeping supply pressure high.

⚙️ DeFi, staking, and L2s are driving network usage.

📊 ETH is showing technical strength, and $6k is a realistic next stop.

1. 💼 Institutional Demand Is Booming

Ethereum isn’t just for crypto degens anymore. Major players like BitMine Immersion Technologies and SharpLink Gaming have bought billions of dollars in ETH for their treasuries. These are the two largest corporate holders of ETH — and they’re still accumulating.

👉 BitMine holds over 566,000 ETH

👉 SharpLink now owns more than 438,000 ETH

This kind of demand creates massive buy-side pressure — and sends a clear signal that smart money is betting big on ETH.

2. 💰 Spot Ethereum ETFs Are Seeing Billions in Inflows

Spot ETH ETFs have finally landed in the US, and the timing couldn’t be better. Between 21 and 27 July they saw some remarkable traction:

💰 $2.39bn flowed into spot ETH ETFs

🤯 BlackRock’s ETHA alone captured $1.79bn

💥Fidelity’s FETH saw its best inflow day ever at $210m

These ETFs give traditional investors an easy way to gain ETH exposure, and they’re snapping it up fast.

3. 🔥 ETH Supply Is Shrinking, Thanks to EIP-1559

Since the implementation of Ethereum’s burn mechanism (EIP-1559), a portion of every transaction fee is permanently removed from circulation. This creates deflationary pressure, especially when network activity spikes.

With DeFi, NFTs, L2s, and ETFs heating up, ETH burn rates are back on the rise. Combine that with staking, and you're looking at a major supply squeeze as demand grows.

4. 🧱 Ethereum Is Still the King of On-Chain Activity

Despite competition from Solana, Avalanche, and others, Ethereum remains the undisputed leader in:

🔗 DeFi (over $60bn in TVL)

🪙 Stablecoins (USDC, USDT)

🏗️ Layer 2 ecosystems (Arbitrum, Optimism, Base)

Developers, protocols, and institutions continue to build on Ethereum. It’s not just a blockchain — it’s the infrastructure of Web3.

5. 📊 Technicals Are Strong — and Momentum Is Building

Ethereum recently reclaimed $3,600 and is showing a strong bullish structure:

📈 Higher highs and higher lows on the daily and weekly chart

📈 ETF inflows acting as a catalyst

📈 Key resistance zones already tested — $4,000 is next, and $6,000 follows

As Galaxy Digital CEO Mike Novogratz recently said:

“ETH is going to $4K minimum. It may just outperform BTC in the next leg.”

🧠 Final Thoughts: ETH to $6k Isn’t a Meme — It’s a Math Problem

With institutions stacking, supply shrinking, and ETF inflows surging, Ethereum isn’t just positioned to go higher — it’s being pulled there by macro forces.

If the bull run continues, $6,000 ETH may be less of a question and more of a timeline.

Why an Alt Season May Never Arrive

The long-awaited "altcoin season" may be a relic of the past. Here's why capital, attention, and real utility are consolidating around just a few major players — and leaving the rest behind.

TL;DR

🪙 Altcoin seasons thrived in early, inefficient markets — those days are mostly gone.

💸 Capital is flowing into BTC and ETH, not speculative small caps.

🏛️ Institutions aren’t touching most altcoins — ETFs and treasuries focus on blue chips.

📉 Many alts still sit 80–90% below all-time highs while BTC and ETH run.

🧠 Utility, liquidity, and regulatory clarity are what matter now, not hype.

1. 🕰️ Alt Season Was a Product of a Younger Market

Altcoin seasons — those wild periods where everything from Dogecoin to obscure DeFi tokens mooned 10x in weeks — made sense in the early days of crypto. Markets were inefficient, liquidity was thin, and retail money could pump projects fast.

But today’s market is more mature, institutionalised, and algorithmically traded. Altcoins can’t pump on vibes anymore — they need substance. And most don’t have it.

2. 💼 Institutions Don’t Care About Your Bags

Let’s be blunt: BlackRock isn’t buying your favourite microcap memecoin. Institutional capital is flowing into Bitcoin and Ethereum through regulated, tradable vehicles like:

✅Spot ETFs

✅Corporate treasuries

✅Staking funds and trust structures

Even Solana — which had a huge year — hasn’t seen the same kind of serious capital inflow that BTC and ETH are enjoying. And the smaller the altcoin, the less likely it get noticed.

3. 📊 Liquidity Is Consolidating — and Alts Are Dying

Here’s the harsh truth: Thousands of altcoins are functionally dead. Their charts are down 90%, devs have left, and their Telegrams are ghost towns.

Meanwhile:

💥 BTC and ETH are nearing all-time highs

💥 SOL, AVAX, and LINK are top 20 survivors, but even they’re down vs ETH

💥 Most alts haven’t even broken 2022 resistance levels

Altcoin seasons depend on rotational capital, but that capital just isn’t rotating like it used to. It’s consolidating into assets with real use cases, volume, and credibility.

4. 📉 Regulatory Pressure Is Killing the Party

The SEC has made it clear: most altcoins are probably securities. That’s scared off exchanges, institutions, and even retail buyers.

👉Delistings are happening quietly

👉New launches face insane scrutiny

👉DeFi tokens are struggling with on-chain liquidity and price suppression

Without clear regulation, altcoin momentum is being throttled — even if the tech is good.

5. 🧠 Use Case > Hype in the New Cycle

This is the era of on-chain metrics, real users, and product-market fit. Ethereum dominates DeFi. Solana runs memecoins. Bitcoin is digital gold. And the rest? They need to fight for relevance.

👀 Does it generate fees?

👀 Does it have users?

👀 Is it integrated into major protocols?

If not, it’s probably just drifting.

🪦 Final Thoughts: Alt Season May Be Dead — And That’s Okay

The days of blind rotation from BTC to small caps may be over. We’re in anew erawhere capital stays concentrated in assets with:

✅ Regulation

✅ Liquidity

✅ Institutional pathways

✅ Real-world adoption

Altcoin season isn’t guaranteed. And maybe it never really was.

Buying Houses with Crypto: Why Dubai Is Leading the Charge

Dubai is quickly becoming the global hub for buying property with crypto. From luxury apartments to beachfront villas, here’s how digital assets are reshaping the UAE real estate market.

TL;DR

🇦🇪 Dubai is emerging as the top global destination for crypto-based real estate purchases.

🏗️ Property developers and brokers are now accepting Bitcoin, Ether, and stablecoins for home purchases.

🤝 Partnerships between crypto exchanges and real estate firms are making deals smoother than ever.

💵 UAE’s crypto-friendly regulation and zero income tax attract both investors and crypto millionaires.

🌍 With increasing global demand, Dubai is positioning itself as the crypto capital of real estate.

Dubai Is Turning Crypto Into Concrete

Forget wire transfers and banks — in Dubai, homebuyers are using Bitcoin and Ethereum to secure everything from penthouses to villas. The city’s open stance on digital assets has transformed it into the epicentre of crypto property transactions.

Luxury real estate agencies like Binayah Properties and developers such as DAMAC now accept cryptocurrencies, often through third-party platforms that convert coins into fiat instantly. That means no price volatility risk for sellers, and fast, seamless deals for buyers.

How It Works 🏗️

1️⃣ Choose a property: Buyers browse listings priced in AED, but sellers accept crypto.

2️⃣ Select a payment method: Bitcoin, Ethereum, or USDT are the most common choices.

3️⃣ Execute the deal: A crypto payment processor facilitates the transaction and converts it to AED if needed.

4️⃣ Transfer ownership: After payment confirmation, standard title transfer and registration occur, just like any cash deal.

Major crypto exchanges like Binance and OKX are also entering the space by launching real estate marketplaces in the UAE.

Why Dubai? 🌴

Several key factors explain why Dubai is ahead of the curve:

👉 Zero income and capital gains tax on crypto earnings

👉 Progressive regulation under VARA (Dubai’s crypto regulator)

👉 Luxury real estate boom and massive foreign investor interest

👉 Favourable residency options for high-net-worth crypto holders

👉 Cultural openness to tech, innovation, and alternative finance

In short, Dubai’s crypto ecosystem is designed for global wealth, and property is becoming its most attractive asset class.

Who's Buying With Crypto?

👉 Crypto millionaires looking to diversify into real estate

👉 Digital nomads seeking long-term residency

👉 Institutional investors are placing capital in regulated markets

👉 NFT and Web3 entrepreneurs relocating to crypto-friendly jurisdictions

Several buyers have already made headlines for multi-million-dollar real estate acquisitions using nothing but their digital wallets.

Final Thoughts 💬

Dubai is proving that crypto and real estate can coexist — legally, efficiently, and lucratively. While most cities are still debating crypto regulation, Dubai is already selling homes on the blockchain.

If you’re holding serious crypto and thinking of converting it into something tangible, a beachfront view in Dubai might be closer than you think.

We’re excited to offer you early access to our exclusive Crypto Saving Expert Monthly Community Plan with a massive 80% discount!

What You Unlock:

- Strategies from top crypto experts

- Exclusive access to market insights, guides, and top tips

- Tools to maximise your crypto savings and investments

- A supportive community of like-minded crypto enthusiasts

- Access to our community Discord

Use the code BTC80 at checkout to claim your discount and get full access to our community plan for just a fraction of the price.

Secure your spot in the Crypto Saving Expert Community today.

Sponsored by: Stonksy

Stonksy is a momentum identifier that aims to capture expansive market moves before they happen by highlighting the start of potential price shifts. It can be used across all markets, including crypto, stocks, indices, commodities, and currencies.

Stonksy is growing in users week-on-week, proving why it aims to become one of the most-used indicators in the industry.

You can get 25% off the annual Stonksy plan with code TMG25, taking the price down to just £749.25 for an entire year of full access. Sign up today.

Find examples of Stonksy indications posted to the X every day: @stonksyio and learn how to use Stonksy and how it can benefit your trading system on the YouTube channel, with daily livestreams at 12:00 UTC.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

This Newsletter is strictly for informational purposes only; the content is generic and has not been tailored in any way. Crypto Saving Expert UAB (“CSE”) is not providing, and should not be interpreted as providing, any form of offer of any currency, security, financial instrument or digital asset, or investment advice, recommendations or strategy. The content of this Newsletter is not intended to replace your own research with regard to any assets, products or services, and any action taken on the basis of this material is entirely at your own risk. CSE neither accepts nor assumes any liability or responsibility for any loss or damage arising out of, or in any way connected to, the Newsletter content. Cryptocurrencies and digital assets may be unregulated in your jurisdiction, any profits may be subject to tax and the value of any investment could fall.

If you click on a link within this Newsletter to go through to a provider, we may get paid. This usually only happens if you get a product/use a service from it. This is what helps fund CSE and keeps the majority of our content free to use. Two crucial things you should know about this, however: a) this never impacts our editorial recommendations, if something is included, it is because we independently rate it as the best; and b) you will always get as good a deal, or better, than if you went direct. For full details on how CSE is funded, please click here.

CSE collects, processes and stores certain data. Such data may be shared with CSE’s wholly owned subsidiary company, Crypto Saving Expert Limited. Please note that by submitting information about yourself to CSE you are consenting to such use. For full details on our collection, processing and storage of data, together with your rights in relation thereto, please consult our Privacy Statement here.