- Crypto Saving Expert's Newsletter

- Posts

- Crypto Saving Expert Newsletter - Issue 161

Crypto Saving Expert Newsletter - Issue 161

Good morning! Bitcoin has kicked off Q4 with fireworks, printing new all-time highs on consecutive days and setting the tone for what could be a historic month. After breaking through resistance last week, BTC is now testing a crucial support and resistance (S/R) level around the highs, a move that could confirm this zone as a fresh bid area and lay the foundation for the next leg up.

Ethereum and Solana are following closely, while traders eye the next catalysts: this week’s FOMC Minutes and Jerome Powell’s upcoming remarks. With greed creeping back into the market, volatility is almost guaranteed 👇

Table of Contents

Sponsored by: BloFin

Why BloFin?

Fair Trading: No internal or sister company market makers; BloFin doesn’t trade against its users.

Independent Liquidity: BloFin’s order books and liquidity is not shared with any large exchanges.

Transparent Leadership: The founder is fully doxxed—check out their Twitter here.

Impressive Volumes & Liquidity: Considering BloFin’s launch in 2023, its performance outshines many competitors like BingX.

Extensive Trading Options: Access 397+ futures pairs and 130+ spot pairs.

Secure Custody: User assets are held with Fireblocks, eliminating risks like hot wallet breaches.

Verified Proof of Reserves: Independently verified on Nansen for maximum security.

Chainalysis Integration: Ensures BloFin doesn’t accept illicit funds.

Instant Trade Execution: One of only four exchanges globally to achieve in-memory trade execution.

User-Friendly Policies: No KYC required, worldwide access via a VPN, and a mobile app for trading on the go.

Outstanding Customer Support and exciting user campaigns to enhance your experience.

Start trading with confidence and take advantage of BloFin’s innovative platform. Sign up now through our exclusive link:

Bitcoin Readies For Exploration

Bitcoin reached a new all-time high on consecutive days from Sunday to Monday, marking the first explosive week of Q4.

Bitcoin

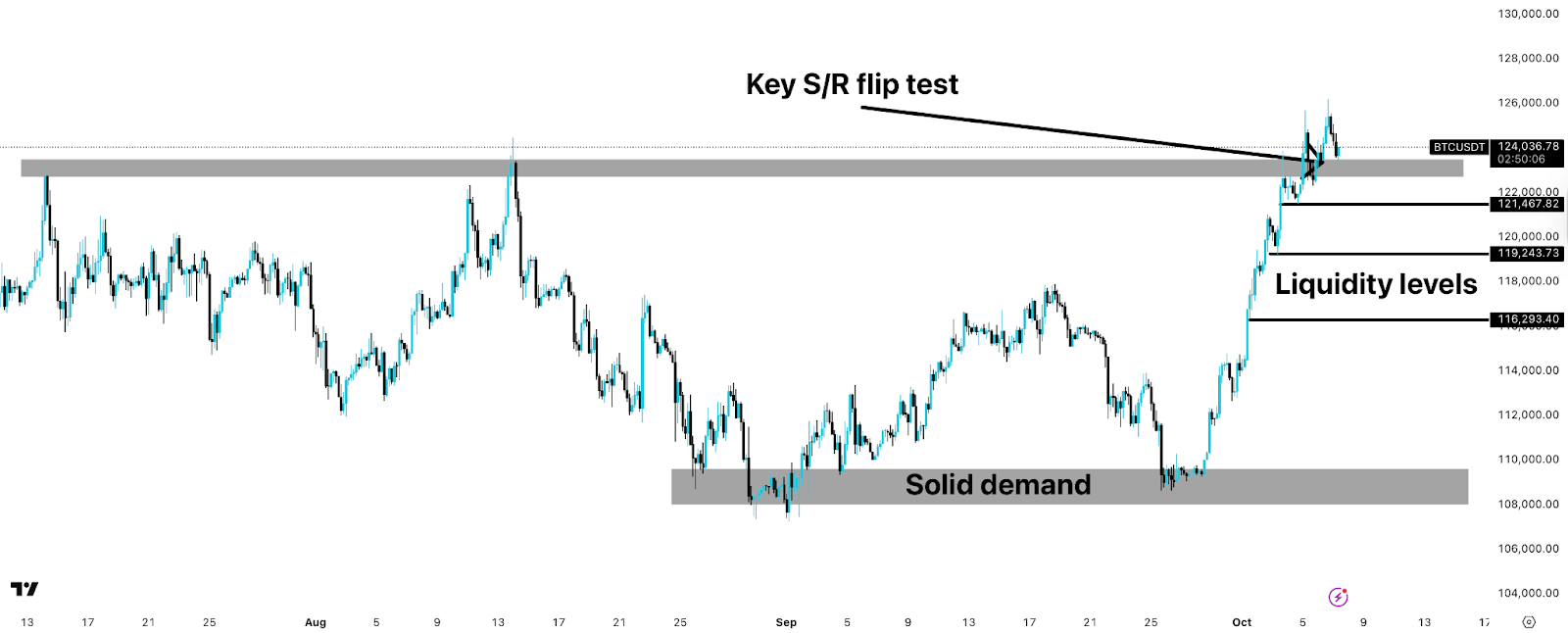

Bitcoin is attempting to confirm a flip of S/R around the highs, something which could be massively significant.

This could set a solid foundation for further expansion higher, if it becomes a bid zone.

To the downside, there are levels to watch should the market give an aggressive flush of longs, which may be shallow or could go deeper down.

Bitcoin Weekly

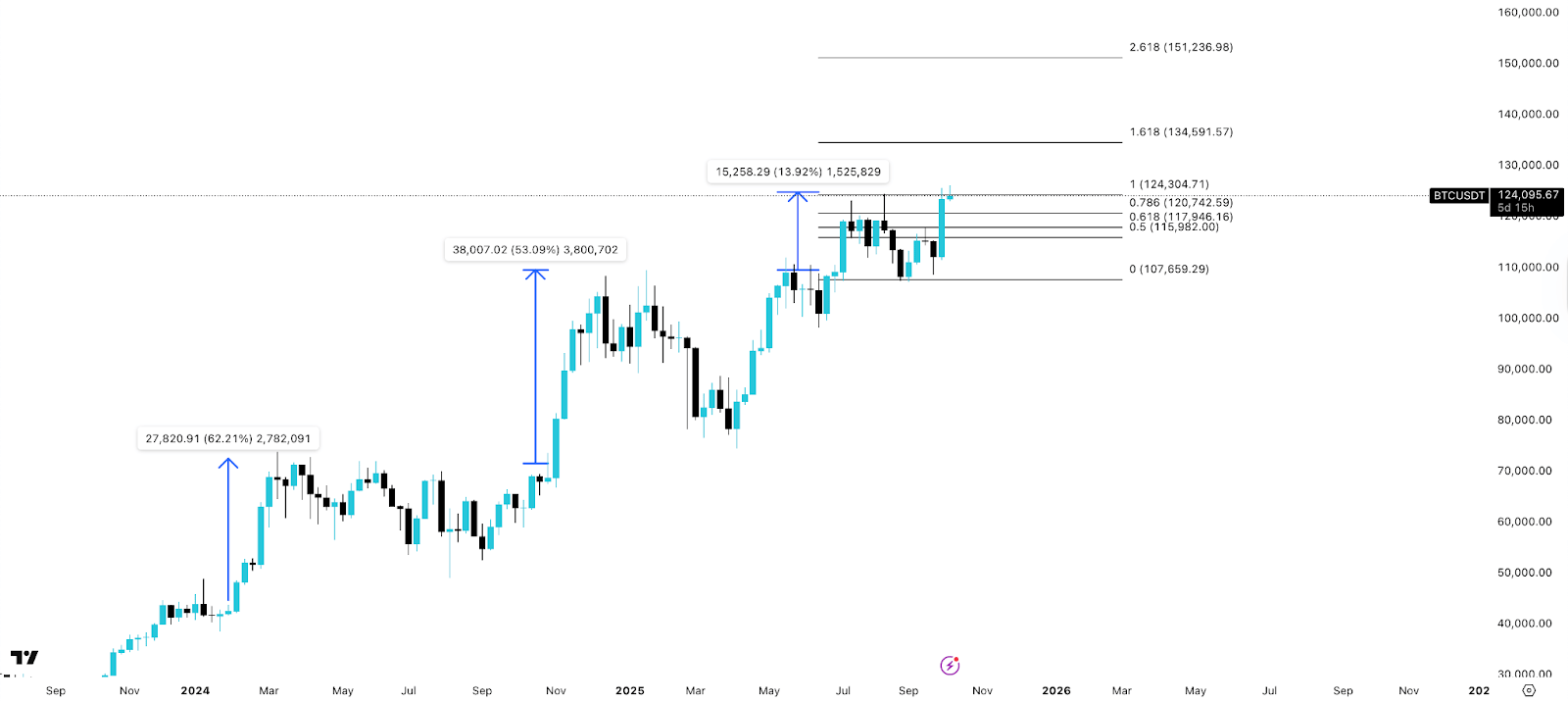

Bitcoin is now entering a phase of price exploration after closing its highest-ever weekly candle.

The Fibonacci levels suggest a rally towards $135,000 or potentially $151,000. Typically, the upside price action lasts a few weeks once bitcoin moves into expansion following consolidation.

This can be seen in the previous two ranges.

Aster

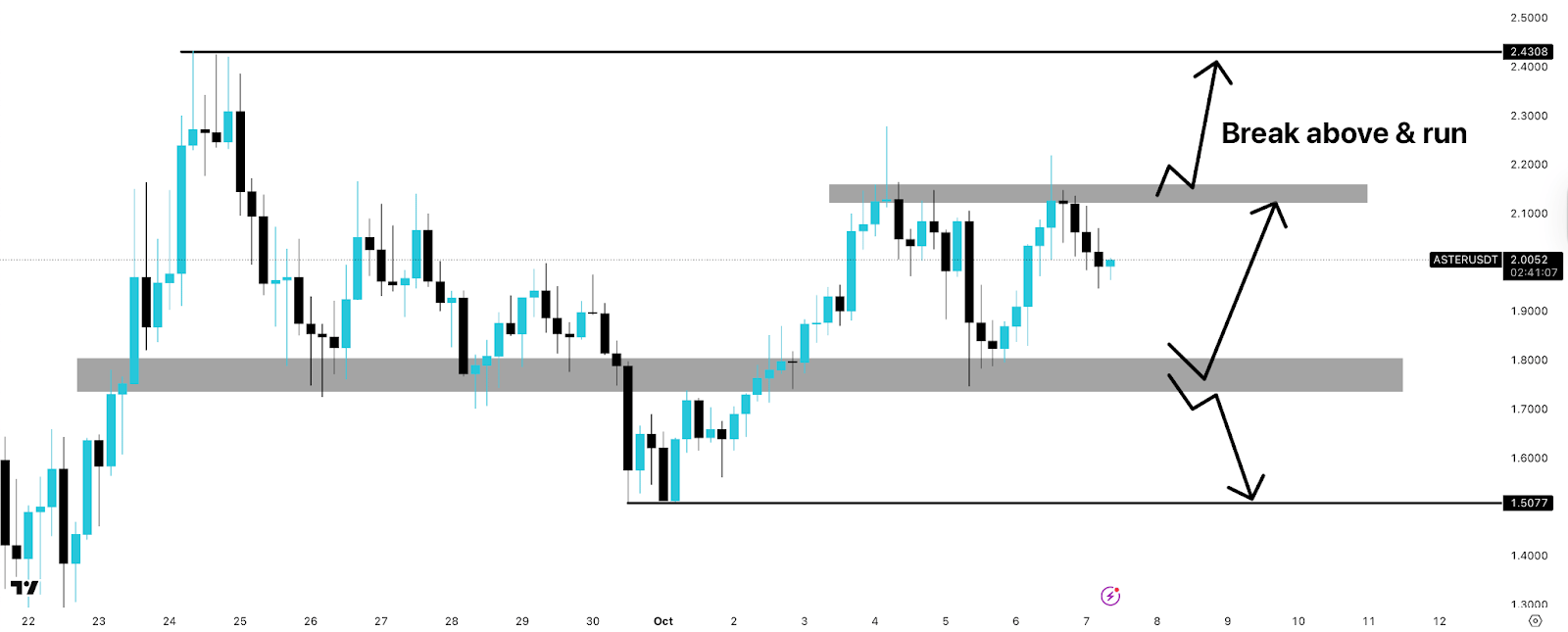

Aster has formed a trading range between $1.80 and $2.15. This means it is consolidating between support and resistance while the next move brews.

However, should the market take a drop, a fall towards $1.50 remains possible, where it recently put in a low.

Still, a rally towards its high, or potentially $3-$4 is on the cards if it breaks above resistance.

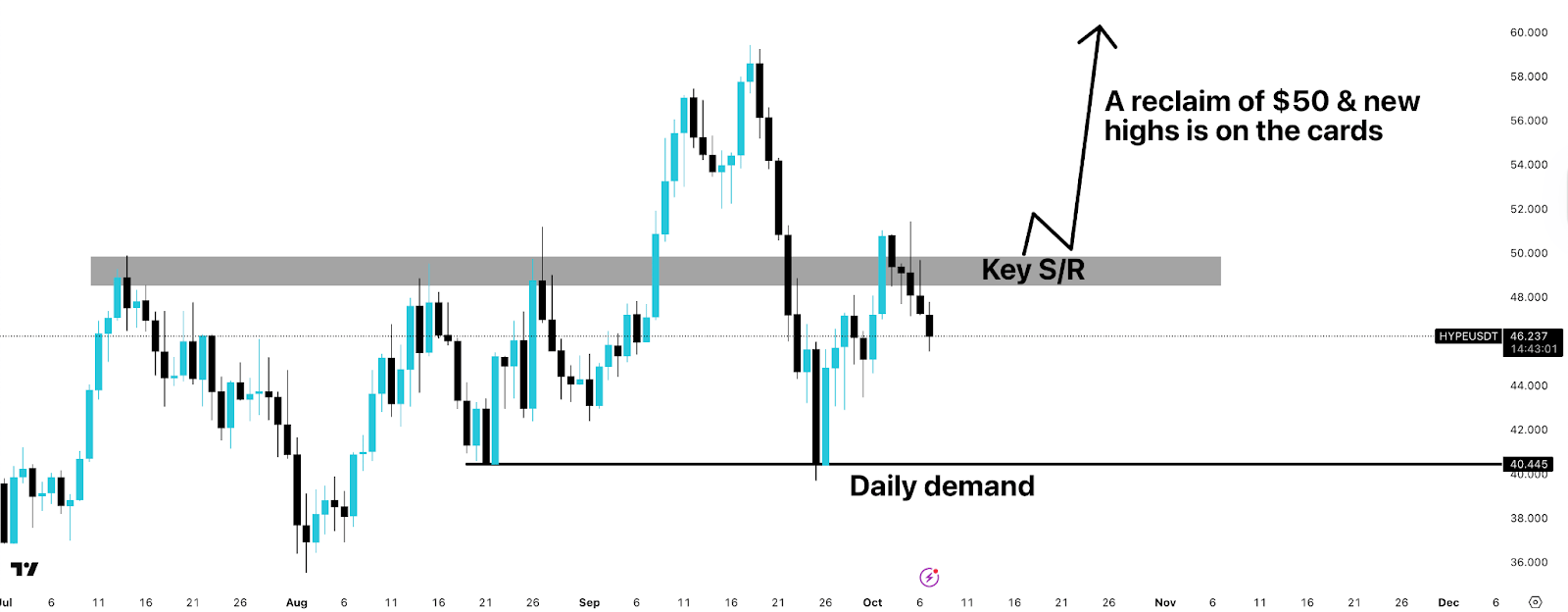

HyperLiquid

Hyperliquid is witnessing similar price action. It is stuck between key S/R and demand, while the fun begins should it get above.

A push and hold above $50 would likely signal a rally towards the highs, but it may also enter price discovery itself.

HYPE & ASTER are two coins with the most attention on them currently.

Fear & Greed Index

The Fear and Greed Index shifted into Greed following bitcoin’s rally and scores 70.

The Index has followed the price movement as the market falls into the most anticipated period of this year, Q4.

Important Dates

Wednesday 8 October, 18:00 UTC - FOMC Minutes

The minutes from the Fed’s FOMC meeting in June will be released. This will provide a deeper insight into what was discussed in the meeting, alongside the tone of the comments.

The market will use the minutes as a marker leading up to the next FOMC meeting.

Thursday 9 October, 13:30 - Jerome Powell Speech

Federal Reserve Bank Chairman Jerome Powell delivers a welcoming remarks via pre-recorded video at the Community Bank Conference in Wahington, D.C, United States.

Friday 10 October, 14:00 UTC - Michigan Consumer Sentiment Index

The University of Michigan releases the index, which is a survey depicting consumer confidence in the economy. The survey provides insight into consumers’ confidence to spend money within the US economy.

The Index’s score is set to come in at 54.6, with the previous data coming in at 55.1.

Gainers

Losers

Kazakhstan Launches State-Backed Crypto Reserve With Binance

Kazakhstan has launched the Alem Crypto Fund, a state-backed digital asset reserve seeded with BNB in partnership with Binance. The move follows the launch of its tenge-backed stablecoin and broader crypto adoption plans.

TLDR:

🏦 Kazakhstan has created the Alem Crypto Fund, which is seeded with BNB as its first asset.

🤝 The fund is run by Qazaqstan Venture Group under the Astana International Financial Centre.

📊 Goal: build long-term digital asset reserves and strengthen national strategy.

🌐 Comes days after Kazakhstan launched a tenge-backed stablecoin (KZTE) on Solana.

🔋 Kazakhstan has a history in crypto, once ranked #2 in global Bitcoin hashrate.

Kazakhstan’s First Crypto Reserve 🚀

Kazakhstan announced the launch of the Alem Crypto Fund, its first state-backed crypto reserve, in partnership with Binance.

The fund’s first holding is BNB, Binance’s utility token. While the government didn’t disclose how much was purchased, officials said the fund’s goal is long-term investment in digital assets and building strategic reserves.

Binance Partnership Runs Deep 🤝

Binance has worked closely with Kazakhstan since 2022, when then-CEO CZ Zhao signed an MoU with the government to support crypto regulations.

This latest move strengthens that relationship and signals that Kazakhstan wants to align itself with major crypto players.

Broader Strategy 🧭

The Alem Fund is part of a bigger national push:

🪙 Last week, Kazakhstan launched KZTE, a tenge-backed stablecoin on Solana, with Mastercard and Eurasian Bank.

🏙️ In 2025, the government announced plans for “CryptoCity,” a pilot zone for crypto payments.

⚡ Historically, Kazakhstan has been a global mining hub, accounting for ~18% of BTC hashrate in 2021.

President Tokayev has recently pushed for a strategic crypto reserve and a “full-fledged ecosystem of digital assets” by 2026.

Global Trend 🌍

Kazakhstan joins a growing list of countries exploring national crypto reserves:

🇸🇻 El Salvador set the precedent with its Bitcoin treasury in 2021.

🇧🇹 Bhutan has quietly been mining and accumulating BTC since 2019.

🇧🇷🇮🇩 Brazil and Indonesia are developing their own reserve frameworks.

While the Alem Fund isn’t a central bank reserve, it shows Kazakhstan is serious about treating crypto as a strategic asset.

Crypto Investment Products Hit Record $5.95bn Inflows as Shutdown Sparks Market Rally

Crypto ETPs hit record $5.95bn inflows as the US government shutdown and rate cuts boost demand, pushing Bitcoin to $125k and total crypto AUM above $250bn.

TLDR:

📈 Crypto ETPs record $5.95bn in inflows, the largest in history.

🏛️ Traders respond to the FOMC rate cut + US government shutdown.

💥 Bitcoin funds lead with $3.6bn inflows, driving BTC to $125K ATH.

🌐 Total crypto AUM crosses $250bn for the first time.

⏸️ SEC shutdown delays ETF approvals, but new staking ETFs launch regardless.

Shutdown and Rate Cuts Fuel Record Demand 🔥

Global crypto exchange-traded products (ETPs) posted their biggest inflow week on record, attracting $5.95bn for the seven days ending Friday, according to CoinShares.

The surge came as investors reacted to a delayed response to the FOMC’s rate cut, weak employment data, and mounting concerns over US fiscal stability after the federal government’s partial shutdown.

“This was due to a delayed response to the rate cut and concerns over US government stability following the shutdown,”said CoinShares’ head of research, James Butterfill.

The momentum helped Bitcoin (BTC) break through $125,000 over the weekend, its highest level ever, extending the October rally across digital assets.

Bitcoin Dominates the Flow 🥇

The record inflows smashed the previous high of $4.4 billion in July by 35%, with the bulk flowing into Bitcoin-linked funds.

💸 Bitcoin ETPs: $3.6bn inflows (new record)

💎 Ether ETPs: $1.48bn inflows

🚀 Solana: $706.5m

🌊 XRP: $219.4m

Butterfill noted that no meaningful short positions were added, a sign of investor confidence despite BTC’s proximity to record highs.

Total AUM Crosses $250bn 🚀

With massive new inflows, total assets under management (AUM) in crypto investment products hit $254.4bn, marking the first time global crypto funds have surpassed the quarter-trillion mark.

Ether funds have now racked up $13.7 bn in year-to-date inflows, nearly triple last year’s pace, underscoring renewed institutional interest in Ethereum-based assets.

SEC Slowdown, But ETF Momentum Continues ⚖️

The US government shutdown forced the Securities and Exchange Commission (SEC) to pause most operations, raising concerns about delayed ETF approvals this month.

While the agency can still act on emergencies, ETF analysts warned that non-critical decisions could face “rain delays.”

Yet, the broader trend hasn’t slowed: Grayscale launched two new staking-enabled crypto ETFs on Monday — the Ethereum Mini Trust (ETH) and Ethereum Trust (ETHE) — giving investors access to staking yields alongside price exposure.

“Despite delays, the pipeline for crypto ETFs keeps expanding,” Bloomberg ETF

The Bottom Line 💡

Even amid political gridlock, crypto markets continue to surge — with record inflows, new products, and BTC at fresh highs. If history is any guide, macro turbulence may once again be fueling Bitcoin’s next leg upward.

Tether Co-Founder: “All Currency Will Be Stablecoins by 2030”

Tether co-founder Reeve Collins predicts all fiat currencies will exist as stablecoins by 2030, as tokenisation and US policy shifts push TradFi into blockchain rails.

TLDR:

🪙 Reeve Collins predicts all fiat will exist as stablecoins within the decade.

📊 Tokenized assets seen as more efficient + transparent, driving adoption.

🇺🇸 Collins says US policy shift has“opened the floodgates”for TradFi entry.

🏦 Every major bank is now exploring stablecoin issuance.

⚠️ Risks remain: smart contract exploits, wallet security, and bridge vulnerabilities.

The 2030 Vision 🔮

Tether co-founder Reeve Collins believes the world is moving toward an on-chain financial system where all currencies operate as stablecoins:

“A stablecoin simply is a dollar, euro, yen, a traditional currency running on a blockchain rail by 2030.”

Collins argues that stablecoins will be the primary method of transferring money within five years, as traditional rails lose ground to faster, programmable, and borderless networks.

The US Shift Changed Everything 🇺🇸

Collins credited Washington’s regulatory pivot in 2025 as the turning point:

📉 TradFi firms were previously paralysed by regulatory fear.

✅ A friendlier stance has unlocked institutional appetite.

🏦 “Every large institution, every bank, everyone wants to create their own stablecoin.”

He added that the lines between CeFi and DeFi will blur, replaced by apps offering lending, investing, and payments, all powered by blockchain rails.

Why Tokenisation Matters 📈

The tokenisation narrative remains central:

👉 On-chain assets = instant settlement + global mobility.

👉 Removing intermediaries boosts efficiency and transparency.

👉 “The same asset on-chain carries greater utility and higher potential returns,” Collins noted.

This logic has pushed ETFs, treasuries, and banks into tokenisation pilots — laying the groundwork for full-scale adoption.

Risks on the Road to 2030 ⚠️

Despite optimism, Collins admitted risks:

🪲 Smart contract bugs + bridge hacks remain systemic threats.

🔐 Wallet security + social engineering continue to plague retail users.

The trade-off between self-custody (complex) and custodial services (trust) won’t disappear, but infrastructure is improving.

“There are always risks in technology. But the services will get more robust, and people will have more options moving forward.”

Big Picture 🌍

If Collins’ forecast holds, by 2030, the distinction between fiat and stablecoin may vanish. With governments, banks, and DeFi protocols converging on blockchain rails, stablecoins could evolve from crypto-native assets to the backbone of global finance.

We’re excited to offer you a massive 50% discount!

What You Unlock:

- Strategies from top crypto experts

- Exclusive access to market insights, guides, and top tips

- Tools to maximise your crypto savings and investments

- A supportive community of like-minded crypto enthusiasts

- Access to our community Discord

Use the code 50OFF at checkout to claim your discount and get full access to our community plan for just a fraction of the price.

Secure your spot in the Crypto Saving Expert Community today.

Sponsored by: Stonksy

Stonksy is a momentum identifier that aims to capture expansive market moves before they happen by highlighting the start of potential price shifts. It can be used across all markets, including crypto, stocks, indices, commodities, and currencies.

Stonksy is growing in users week-on-week, proving why it aims to become one of the most-used indicators in the industry.

You can get 25% off the annual Stonksy plan with code TMG25, taking the price down to just £749.25 for an entire year of full access. Sign up today.

Find examples of Stonksy indications posted to the X every day: @stonksyio and learn how to use Stonksy and how it can benefit your trading system on the YouTube channel, with daily livestreams at 12:00 UTC.

Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

This Newsletter is strictly for informational purposes only; the content is generic and has not been tailored in any way. Crypto Saving Expert UAB (“CSE”) is not providing, and should not be interpreted as providing, any form of offer of any currency, security, financial instrument or digital asset, or investment advice, recommendations or strategy. The content of this Newsletter is not intended to replace your own research with regard to any assets, products or services, and any action taken on the basis of this material is entirely at your own risk. CSE neither accepts nor assumes any liability or responsibility for any loss or damage arising out of, or in any way connected to, the Newsletter content. Cryptocurrencies and digital assets may be unregulated in your jurisdiction, any profits may be subject to tax and the value of any investment could fall.

If you click on a link within this Newsletter to go through to a provider, we may get paid. This usually only happens if you get a product/use a service from it. This is what helps fund CSE and keeps the majority of our content free to use. Two crucial things you should know about this, however: a) this never impacts our editorial recommendations, if something is included, it is because we independently rate it as the best; and b) you will always get as good a deal, or better, than if you went direct. For full details on how CSE is funded, please click here.

CSE collects, processes and stores certain data. Such data may be shared with CSE’s wholly owned subsidiary company, Crypto Saving Expert Limited. Please note that by submitting information about yourself to CSE you are consenting to such use. For full details on our collection, processing and storage of data, together with your rights in relation thereto, please consult our Privacy Statement here.