- Crypto Saving Expert's Newsletter

- Posts

- Crypto Saving Expert Newsletter - Issue 165

Crypto Saving Expert Newsletter - Issue 165

Gm! Bitcoin enters the new week under heavy pressure, sliding toward the $100,000 mark as sellers keep control.

After months of strength, momentum has flipped - rallies are being sold, and fear is starting to creep back in.

With the CME gap below still open and sentiment at extreme fear, the question now is whether the market finds its footing - or if the next leg down is about to begin 👇

Table of Contents

Sponsored by: BloFin

Why BloFin?

Fair Trading: No internal or sister company market makers; BloFin doesn’t trade against its users.

Independent Liquidity: BloFin’s order books and liquidity is not shared with any large exchanges.

Transparent Leadership: The founder is fully doxxed—check out their Twitter here.

Impressive Volumes & Liquidity: Considering BloFin’s launch in 2023, its performance outshines many competitors like BingX.

Extensive Trading Options: Access 397+ futures pairs and 130+ spot pairs.

Secure Custody: User assets are held with Fireblocks, eliminating risks like hot wallet breaches.

Verified Proof of Reserves: Independently verified on Nansen for maximum security.

Chainalysis Integration: Ensures BloFin doesn’t accept illicit funds.

Instant Trade Execution: One of only four exchanges globally to achieve in-memory trade execution.

User-Friendly Policies: No KYC required, worldwide access via a VPN, and a mobile app for trading on the go.

Outstanding Customer Support and exciting user campaigns to enhance your experience.

Start trading with confidence and take advantage of BloFin’s innovative platform. Sign up now through our exclusive link:

Bitcoin Takes A Tumble

Bitcoin is dropping towards $100,000 as the bearish momentum continues in the market and rallies are met by selling pressure.

Bitcoin

Bitcoin is looking like it will confirm a loss of its major support zone, shifting it back to being resistance.

From here, bitcoin must either reclaim the region, or a drop towards $100,000 is on the cards.

Furthermore, sustained weakness may take it into testing just above $90,000, which lines up with another factor.

CME Gap

Bitcoin has an open CME Gap at $91,500-$92,500.

This was left behind during the string run-up throughout April and May. This CME Gap is small, but remains open and is a possibility for the price.

Dropping into this region, perhaps an overshoot to the downside, may provide the bottom zone.

Ethereum

Ethereum is also approaching lower targets, with a test of the wick coming up from the 10th October crash.

This is also where the price found demand back in August. However, like bitcoin, a further downside region remains a possibility, which is $3,000.

Solana

Solana, like most altcoins, are carbon copy charts of what we’re seeing in bitcoin and ETH.

It is testing S/R now, but has zones below in which the price may subside the selling pressure within.

Of course, the upside is also open for bounces or even a bottom should bitcoin put one in.

Fear & Greed Index

The Fear and Greed Index has been slammed into Extreme Fear and scores 21 following bitcoin’s decline.

The closer bitcoin gets towards $100,000, the more fearful the market is becoming as the price rolls over.

Important Dates

Wednesday 5 November, 13:15 UTC - ADP Employment Change

Automatic Data Processing Inc. (ADP) releases employment change for the US. A higher figure is bullish for the markets due Solana’s increased employment, which suggests economic strength.

The consensus is set at 24,000, with the previous data coming in at -32,000. Therefore, the ADP expects a slight rise in employment.

Wednesday 5 November, 15:00 UTC - ISM Services PMI

The Institute for Supply Management (ISM) releases this data, with it providing a measure of the US non-manufacturing sector. It is considered positive if the figure is above the 50 mark.

The consensus is set at 50.7, with the previous data at 50.

Friday 7 November, 13:30 UTC - Nonfarm Payrolls (NFP)

The US Bureau of Labour Statistics releases the NFP. This form of data represents the number of new jobs created in the previous month, which will be December and is another signal of economic health.

The consensus is set at 50,000, with the previous data at 22,000.

Gainers

Losers

Whale Who Made $200m Shorting Bitcoin Now Bets $55m on Crypto Rebound

The “Hyperunit whale,” who made $200m shorting Bitcoin during the US–China tariff crash, has gone long with $55m in new BTC and ETH positions. Analysts say market pain may be ending as long-term holders reduce exchange supply.

TLDR:

💰 The “Hyperunit whale,” who earned $200m during last month’s US–China tariff crash, has gone long on Bitcoin and Ether.

📈 New open positions total $55m, split between $37m BTC and $18m ETH longs on Hyperliquid.

🕰️ The veteran trader previously accumulated $850m in BTC during the 2018 bear market, now worth around $10bn.

😨 Market sentiment remains cautious, the Crypto Fear & Greed Index sits at 42 (Fear).

📊 Analysts at Santiment say most of the sell pressure may already be exhausted.

“Hyperunit Whale” Flips Long After $200m Profit

The crypto trader known as the “Hyperunit whale”, famed for perfectly timing the October 10 US–China tariff crash, has now flipped bullish, opening $55m in long positions on Bitcoin and Ethereum.

On-chain analytics platform Arkham Intelligence flagged the trades on Monday, revealing:

📈 $37m long position in Bitcoin (BTC)

📈 $18m long position in Ether (ETH) on decentralised derivatives exchange Hyperliquid.

“After making $200m shorting the market in October, the Hyperunit whale has gone long. Will they get it right for the fourth time in a row?” Arkham wrote on X.

The whale became a sensation after correctly predicting the market crash triggered by escalating US–China trade tariffs, profiting massively from leveraged short positions.

Since then, they’ve executed two additional successful shorts, with Arkham calling them “one of the most accurate macro crypto traders in recent memory.”

Veteran Trader With a Decade of Patience

The Hyperunit whale isn’t new to crypto. According to Arkham, the trader has been active for at least seven years, first buying roughly $850m in Bitcoin during the 2018 bear market, holdings that later surged to over $10bn in value.

Now, with Bitcoin trading around $106,598 and Ether at $3,602, the whale appears to be betting that the correction phase is ending and the market is nearing a bottom.

Bitcoin OGs Are Taking Profits, But Not Exiting

The new bullish positioning comes amid broader profit-taking among long-term Bitcoin holders.

According to Bitwise CEO Hunter Horsley, many early investors have been selling portions of their holdings after 100x–1000x gains, citing the emotional toll of large swings in net worth.

“They’ve got life to live,” Horsley said. “It can be emotionally taxing to see $100m or one-third of your wealth vanish in a bear market — even if temporary. But most OGs still plan to hold the majority.”

CryptoQuant data shows that from Oct. 2 to Nov. 2, long-term holders offloaded roughly 405,000 BTC, contributing to the recent market correction.

“The Bottom Could Be Near,” Says Santiment

Despite recent drawdowns, on-chain analytics platform Santiment believes most of the sell pressure has already been absorbed.

“Bitcoin’s market value has dropped 14% since the October 6 peak, but an encouraging sign is that BTC continues to move off exchanges,” Santiment wrote.

The firm’s data shows 208,980 fewer BTC on exchanges compared to six months ago, a bullish signal suggesting investors are choosing to hold rather than sell.

“When supply isn’t moving to exchanges, the risk of further sell-offs is limited,” Santiment added.

Fear Still Dominates, But Smart Money Is Stirring

The Crypto Fear & Greed Index currently reads 42/100, indicating a “Fear” environment, a level that historically precedes market reversals.

Bitcoin remains 15.5% below its all-time high, while Ether sits 27.3% down, suggesting the market still has room to recover before retesting previous peaks.

As the Hyperunit whale takes an aggressive long stance, traders are watching closely to see if this marks the beginning of a new accumulation phase, or just another bull trap in disguise.

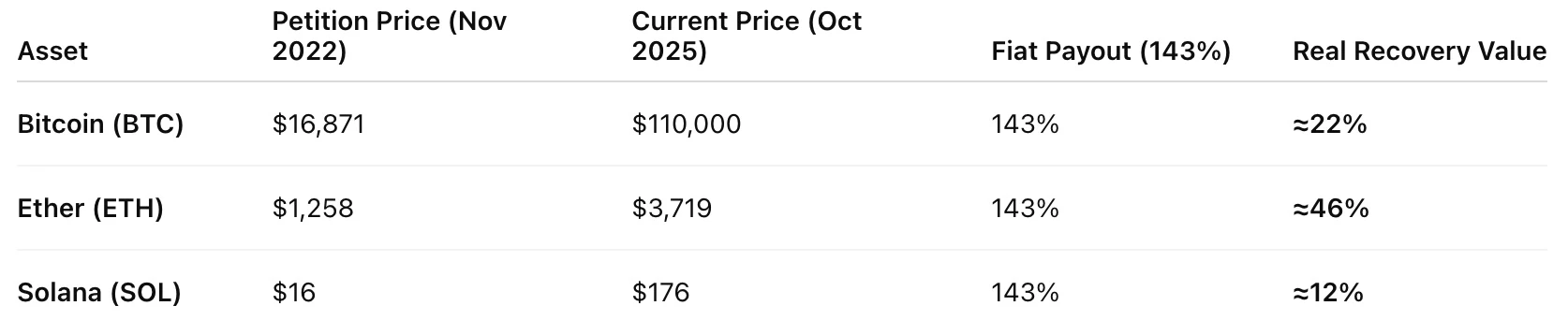

FTX Creditors’ Real Crypto Recovery Could Be as Low as 9%, Analyst Warns

FTX’s promised 143% fiat repayment masks the reality that creditors are only recovering between 9% and 46% of their original crypto value, as Bitcoin, Ether, and Solana have increased in value since 2022. Airdrops may offer partial relief, but losses remain steep.

TLDR:

💰 Despite FTX’s planned 143% fiat repayment, actual crypto recovery may be as low as 9–46%, once adjusted for current prices.

📉 Rising prices for Bitcoin, Ether, and Solana have sharply diluted the real value of creditor payouts.

🪂 Some recovery could come through airdrops from external projects targeting FTX creditors.

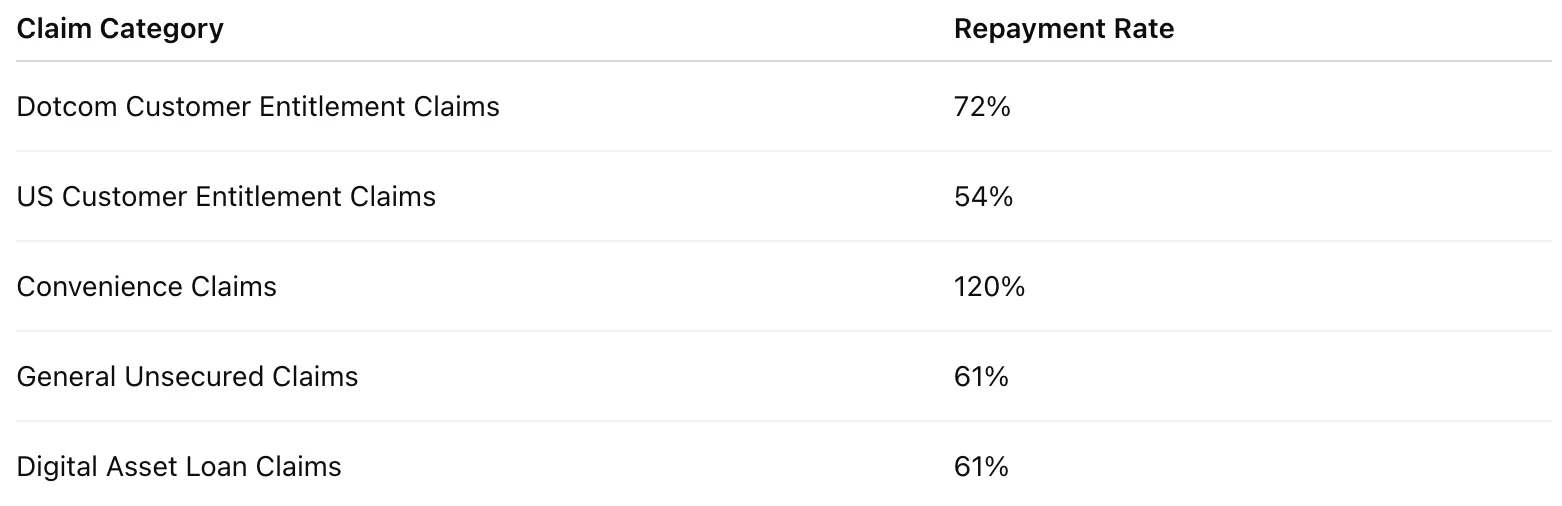

⚖️ FTX’s second payout phase distributed $5bn in May, with more categories due this year.

👨⚖️ Former CEO Sam Bankman-Fried’s appeal hearing is set for Nov. 4 in New York.

FTX Creditors’ “143%” Repayments Mask Huge Crypto Shortfall

FTX creditors are unlikely to be made whole once repayments are adjusted for current crypto market prices, according to Sunil, a well-known FTX creditor representative.

In a post to X (formerly Twitter) on Sunday, Sunil estimated that real crypto recovery rates for FTX creditors lie between 9% and 46%, depending on the token, far below the 143% headline repayment being touted by the bankrupt exchange’s estate.

“FTX creditors are not whole,” Sunil wrote. “A 143% fiat recovery is not the same as a 143% crypto recovery.”

The discrepancy arises because crypto assets have skyrocketed since FTX collapsed in November 2022.

In real terms, creditors are receiving a fraction of their original holdings’ crypto value, because the repayment plan converts claims into US dollar equivalents based on the bankruptcy petition prices, not on the current market rates.

Airdrops Could Offer Additional “Recovery” Routes

Sunil noted that some projects have begun offering airdrops or incentive programs specifically for verified FTX creditors, calling them “the most valuable asset class in crypto right now.”

He pointed to Paradex, a decentralized trading protocol, which rewarded FTX creditors in an effort to grow its user base.

“FTX creditors are the most attractive audience for recovery-focused projects,” Sunil added.

While these airdrops won’t replace the lost crypto value, they could offer supplemental returns to those still facing major shortfalls.

Breakdown of FTX’s Creditor Repayments So Far

FTX’s first payout, completed in February 2025, distributed $1.2bn to claimants with balances under $50,000.

The second payout round, launched in May, totalled $5bn and included several major claim categories:

Funds are being distributed through Kraken and BitGo, typically reaching recipients within one to two business days after approval.

Legal Shadow: SBF’s Appeal Hearing Looms

The repayment developments come as former FTX CEO Sam Bankman-Fried prepares for his Nov. 4 appeal hearing before the US Court of Appeals for the Second Circuit.

Bankman-Fried, who is serving a 25-year prison sentence for fraud and conspiracy, is attempting to overturn his 2023 conviction, arguing that he was “never presumed innocent” and that prosecutors mischaracterised FTX’s internal fund flows.

The appeal is being closely watched by the crypto industry, as it could influence ongoing litigation involving other exchange executives and restructuring trustees.

Reality Check: “FTX Creditors Are Not Whole”

Despite months of positive headlines around full repayment in fiat terms, Sunil’s analysis underscores a more sobering reality:

FTX creditors will never fully recover the crypto value they lost in 2022, especially given Bitcoin’s sevenfold rise, Ether’s tripling, and Solana’s near tenfold increase since then.

“The numbers look good on paper,” one creditor wrote in response to Sunil’s post, “but in crypto terms, it’s like getting your coins back at 2019 prices.”

As the FTX bankruptcy nears its final phase, creditors are now left balancing nominal recovery optimism with the reality of massive opportunity costs in one of crypto’s most dramatic collapses.

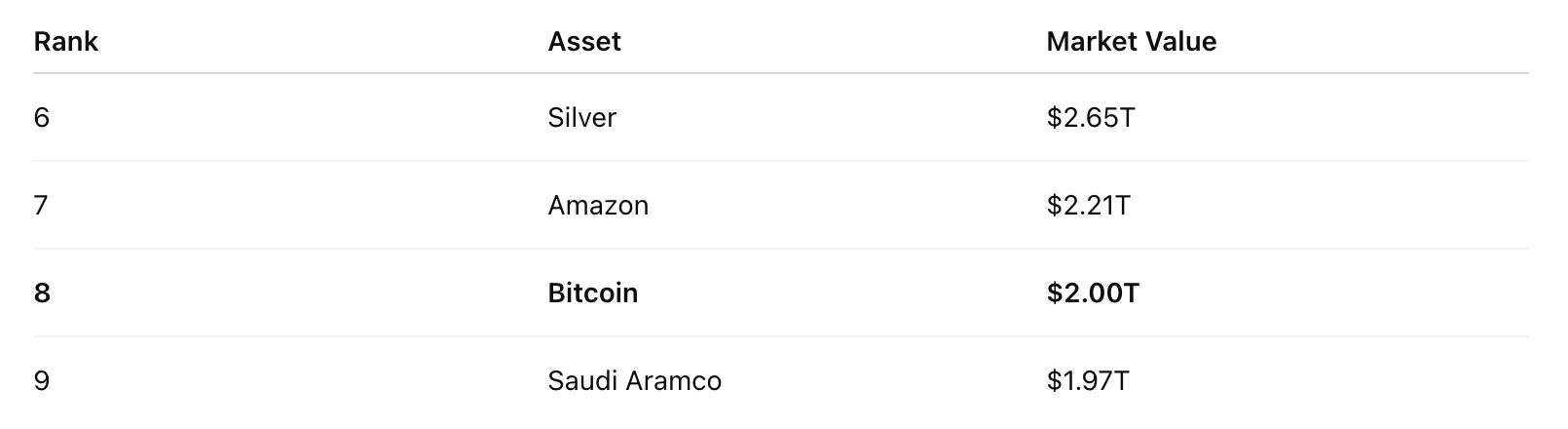

Bitcoin Turns 17: From a Cypherpunk Manifesto to a $2tn Global Asset

Seventeen years after Satoshi Nakamoto published the Bitcoin white paper, BTC has grown from a cypherpunk idea to a $2tn global asset. Despite its milestone, Bitcoin faces its first “red October” in seven years amid controlled market deleveraging.

TLDR:

📜 Bitcoin’s white paper was published 17 years ago on Oct. 31, 2008, by Satoshi Nakamoto.

🧠 The document introduced a peer-to-peer electronic cash system powered by proof-of-work.

💰 Bitcoin has grown into a $2tn asset, ranking 8th globally by market capitalisation.

📉 Despite the milestone, BTC is on track for its first “red October” since 2018, down 3.5% this month.

⚙️ Analysts see the recent drawdown as a healthy deleveraging ahead of Bitcoin’s next leg up.

From White Paper to World-Changing Protocol

Seventeen years ago, on Oct. 31, 2008, a pseudonymous cryptographer named Satoshi Nakamoto shared a nine-page document that would transform global finance forever: “Bitcoin: A Peer-to-Peer Electronic Cash System.”

Released amid the 2008 global financial crisis, the white paper proposed a decentralised, borderless monetary network, one where users could transact without banks, intermediaries, or central authorities.

At its core was proof-of-work (PoW), a consensus mechanism designed to secure the network and prevent double-spending through distributed verification.

Just three months later, on Jan. 3, 2009, Nakamoto mined the genesis block, embedding a now-famous message in its code:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

It marked the birth of Bitcoin (BTC), a self-sovereign currency born out of distrust in centralised finance.

From Cypherpunk Dream to Trillion-Dollar Reality

Fast forward 17 years, and Bitcoin has evolved from a niche digital experiment into a $2 trillion global asset held by governments, institutions, and public companies.

According to CompaniesMarketCap, Bitcoin now ranks as the eighth-most-valuable asset in the world, sitting just behind silver and Amazon.

Bitcoin’s influence now stretches beyond finance, serving as a reserve asset, payment rail, and inflation hedge in economies from El Salvador to Argentina.

“Seventeen years in, Bitcoin has proven not just its resilience, but its inevitability,” said Oliver Cameron, a digital asset strategist at Glassnode. “It’s no longer an experiment — it’s infrastructure.”

Bitcoin Faces Its First “Red October” in Seven Years

Despite the anniversary celebrations, Bitcoin’s price action has been notably subdued.

BTC is set to post its first October loss since 2018, falling more than 3.5% this month, breaking a six-year “Uptober” streak, according to data from CoinGlass.

Historically, October has been Bitcoin’s second-strongest month, with average returns of +19.9%. The last time Bitcoin finished the month in the red was in 2018, when it dropped 3.8%.

The downturn follows a record $19bn crypto market liquidation event on Oct. 17, which saw BTC plunge to a four-month low near $104,000.

Still, analysts argue the pullback reflects “controlled deleveraging”, a flush of excessive leverage and open interest that could pave the way for a more sustainable rally.

“These resets are critical for structural health,” said Ryan Lee, chief analyst at Bitget Exchange. “Bitcoin is consolidating strength for the next major move — not collapsing.”

17 Years Later: Bitcoin’s Legacy and the Road Ahead

From an email to a cryptography mailing list to a globally traded, government-held asset, Bitcoin’s journey is unparalleled in financial history.

Once dismissed as a fringe idea, Bitcoin is now:

🧾 Held on balance sheets by public companies and central banks,

🏦 Integrated into Wall Street ETFs, and embedded in the fabric of digital commerce and macroeconomics.

Seventeen years on, Satoshi’s vision of a decentralised, censorship-resistant monetary network continues to resonate - and its influence shows no signs of fading.

“Bitcoin is 17 today,” wrote one crypto historian on X. “But in economic terms, it’s still a teenager - volatile, rebellious, and full of potential.”

We’re excited to offer you a massive 35% discount!

What You Unlock:

- Strategies from top crypto experts

- Exclusive access to market insights, guides, and top tips

- Tools to maximise your crypto savings and investments

- A supportive community of like-minded crypto enthusiasts

- Access to our community Discord

Use the code 35OFF at checkout to claim your discount and get full access to our community plan for just a fraction of the price.

Secure your spot in the Crypto Saving Expert Community today.

Sponsored by: Stonksy

Stonksy is a momentum identifier that aims to capture expansive market moves before they happen by highlighting the start of potential price shifts. It can be used across all markets, including crypto, stocks, indices, commodities, and currencies.

Stonksy is growing in users week-on-week, proving why it aims to become one of the most-used indicators in the industry.

You can get 25% off the annual Stonksy plan with code TMG25, taking the price down to just £749.25 for an entire year of full access. Sign up today.

Find examples of Stonksy indications posted to the X every day: @stonksyio and learn how to use Stonksy and how it can benefit your trading system on the YouTube channel, with daily livestreams at 12:00 UTC.

Best Price, Every Trade.

Want the best price on every swap? CoW Swap evaluates routes across DEXs in real time and settles the most efficient path. Tighter pricing, higher success rates, fewer reverts. Find your best price.

This Newsletter is strictly for informational purposes only; the content is generic and has not been tailored in any way. Crypto Saving Expert UAB (“CSE”) is not providing, and should not be interpreted as providing, any form of offer of any currency, security, financial instrument or digital asset, or investment advice, recommendations or strategy. The content of this Newsletter is not intended to replace your own research with regard to any assets, products or services, and any action taken on the basis of this material is entirely at your own risk. CSE neither accepts nor assumes any liability or responsibility for any loss or damage arising out of, or in any way connected to, the Newsletter content. Cryptocurrencies and digital assets may be unregulated in your jurisdiction, any profits may be subject to tax and the value of any investment could fall.

If you click on a link within this Newsletter to go through to a provider, we may get paid. This usually only happens if you get a product/use a service from it. This is what helps fund CSE and keeps the majority of our content free to use. Two crucial things you should know about this, however: a) this never impacts our editorial recommendations, if something is included, it is because we independently rate it as the best; and b) you will always get as good a deal, or better, than if you went direct. For full details on how CSE is funded, please click here.

CSE collects, processes and stores certain data. Such data may be shared with CSE’s wholly owned subsidiary company, Crypto Saving Expert Limited. Please note that by submitting information about yourself to CSE you are consenting to such use. For full details on our collection, processing and storage of data, together with your rights in relation thereto, please consult our Privacy Statement here.