- Crypto Saving Expert's Newsletter

- Posts

- Crypto Saving Expert Newsletter - Issue 166

Crypto Saving Expert Newsletter - Issue 166

Gm! Bitcoin starts the week caught between the bull and the bear, testing key support as the market battles for direction.

Momentum has cooled, traders are split, and every move feels like it could tip the scale either way. Bulls see a healthy reset; bears see the start of a deeper unwind.

Fear lingers, but so does hope and whichever side wins next might define the rest of November’s trend. 👇

Table of Contents

Sponsored by: BloFin

Why BloFin?

Fair Trading: No internal or sister company market makers; BloFin doesn’t trade against its users.

Independent Liquidity: BloFin’s order books and liquidity is not shared with any large exchanges.

Transparent Leadership: The founder is fully doxxed—check out their Twitter here.

Impressive Volumes & Liquidity: Considering BloFin’s launch in 2023, its performance outshines many competitors like BingX.

Extensive Trading Options: Access 397+ futures pairs and 130+ spot pairs.

Secure Custody: User assets are held with Fireblocks, eliminating risks like hot wallet breaches.

Verified Proof of Reserves: Independently verified on Nansen for maximum security.

Chainalysis Integration: Ensures BloFin doesn’t accept illicit funds.

Instant Trade Execution: One of only four exchanges globally to achieve in-memory trade execution.

User-Friendly Policies: No KYC required, worldwide access via a VPN, and a mobile app for trading on the go.

Outstanding Customer Support and exciting user campaigns to enhance your experience.

Start trading with confidence and take advantage of BloFin’s innovative platform. Sign up now through our exclusive link:

Bitcoin Toys With The Bull & Bear

Bitcoin has a bull on one shoulder and a bear on the other as the next directional flow for the price appears uncertain.

Bitcoin

Bitcoin attempted to recapture the key S/R zone on Monday and early Tuesday morning, but has thus far met rejection.

From here, bitcoin has two areas of interest to the downside, above $102,000 and towards $100,000.

These areas must hold or bitcoin will likely head towards the CME gap down towards $90,000.

However, if bitcoin can flip $108,000, a run into $110,000-$111,000 looks likely and where the price will meet supply.

50WMA

Bitcoin held the 50-weekly moving average last week after testing it again.

This has been a pivotal place for the price since the uptrend began and where the price has held after testing.

This could show bitcoin is ready for more upside and a stronger bounce, but losing it for the weekly close would suggest bigger weakness and a break in this trend.

ZEC

ZEC has formed a local high, and what may become a macro high.

The price has rallied over 14x since mid-September and is now undergoing a corrective phase.

To the downside, the $320 and $220 regions look reasonable for ZEC to bounce. Upon any relief rally, an eye on a lower high will be key, unless it goes onto new highs.

XMR

Monero finally got a pump over the weekend after lagging behind other privacy coins.

XMR has a clear trading range, which the price may end up testing the upper bound for an S/R flip.

This may be the region the price bounces to rally towards the upside resistance. Although a drop back below $340 would throw Monero back into the range

Fear & Greed Index

The Fear and Greed Index scores 26 and remains within Fear as sentiment fails to move up while bitcoin’s next direction looks uncertain.

Sentiment is likely not to move massively until bitcoin either puts in a confirmed reclaim of support or drops into a huge fearful level.

Gainers

Losers

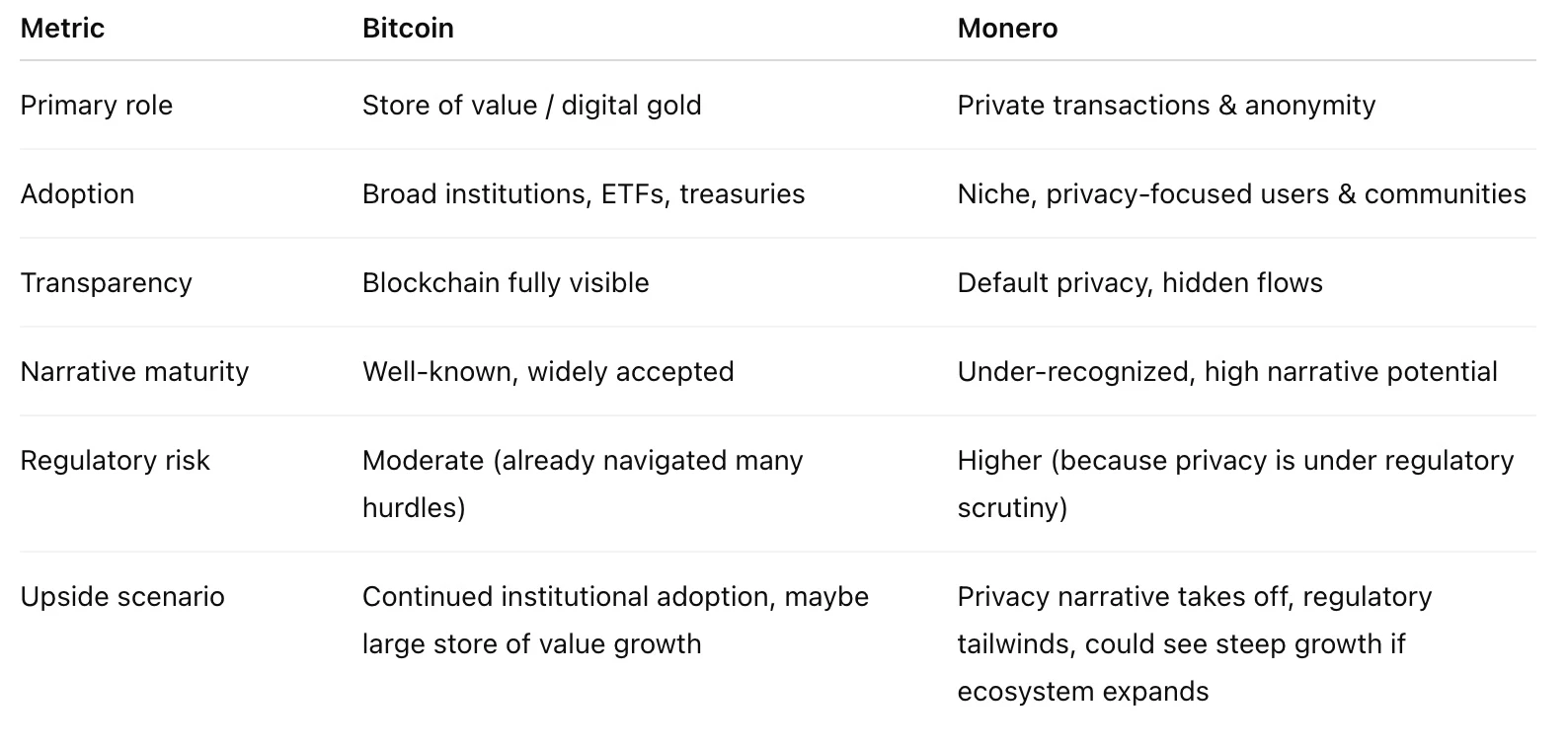

Bitcoin vs Monero: Why Monero Could Be the “Next Zcash” in the Privacy Narrative

Bitcoin dominates as digital gold, but Monero offers privacy unmatched by most cryptos. With regulatory pressure mounting and narratives shifting, Monero could emerge as the next Zcash-style narrative. Here’s why and how it compares to Bitcoin.

TL;DR

🏅 Bitcoin is widely adopted and seen as digital gold, but its transparency is both a strength and a weakness.

🤫 Monero remains the gold standard for privacy coins, offering untraceable transactions and full anonymity.

🤔 With global regulation tightening, privacy coins like Monero may gain narrative momentum, potentially similar to what Zcash saw.

💥 Monero faces liquidity, exchange-listing, and regulatory hurdles, but if the privacy narrative wins this cycle, it could punch above its weight.

📊 Investors should view Monero not as a replacement for Bitcoin, but as a complementary asset with a distinct role and risk profile.

Bitcoin: The Digital Store of Value

Bitcoin has achieved what few cryptocurrencies ever did: broad institutional acceptance, large-scale adoption, and a multi-trillion-dollar asset-class status.

Strengths:

✅ Capped supply (21m coins) and decentralised issuance.

✅ High institutional flows, spot ETFs, treasury adoption.

✅ Transparent blockchain makes audits, custody, and regulation easier.

Weaknesses (relative to privacy narrative):

❌ Every transaction is visible, traceable, which means regulatory authorities can monitor flows.

❌ Its dominant narrative (store of value) may limit upside compared to narrative-driven altcoins.

Thus, while Bitcoin remains the baseline “digital gold,” it may not offer the narrative growth potential tied to privacy or transaction anonymity that alternative coins can.

Monero: The Privacy Coin That Markets Tend to Forget

Monero (XMR) is often overlooked by mainstream investors, but among privacy-coin communities, it holds a gold standard reputation.

Key features:

🕵️♀️ Fully private by default: sender, receiver, and amount are hidden.

🕵️♀️ Strong anonymity set due to ring signatures, stealth addresses, and confidential transactions.

🕵️♀️ Focused narrative: if you care about true digital privacy, Monero is the go-to.

Why it could be the next Zcash-style narrative:

1️⃣ Regulatory pressure is rising globally, as nations clamp down on privacy-enhancing tools. Monero stands to gain attention as an alternative.

2️⃣ Privacy coins are experiencing renewed interest; Zcash, DASH and others have seen strong recent performance, and the spotlight is shifting to the privacy sector.

3️⃣ Narrative runway exists, while Bitcoin's story is mature, Monero’s is less saturated. A fresh privacy narrative could spark outsized returns if adopted broadly.

4️⃣ Comparable to Zcash’s early narrative cycle, Zcash enjoyed a period of dominant narrative momentum (‘privacy coin for the future’). Monero may be positioned for a similar story, though with its own unique architecture and community.

Comparing Bitcoin & Monero: Role, Adoption, Narrative

The Case for Monero as the “Next Zcash”

✅ Narrative arbitrage: The market has internalised Bitcoin’s story. A privacy narrative is still under-priced.

✅ Regulation trends: Privacy tools are increasingly in the scope of regulators. If the narrative shifts from “crypto needs compliance” to “crypto needs privacy”, Monero stands to benefit.

✅ Emerging tailwinds: Privacy coin rallies have correlated with halving events, regulatory commentary, and ecosystem upgrades.

✅ Valuation gap: Monero remains far smaller in market cap and institutional attention compared to Bitcoin or even Zcash at its peak. That creates potential for outsized gains if the narrative develops.

Risks & Why Bitcoin Still Dominates

❌ Monero faces listing risks: Some exchanges delist privacy coins due to regulatory concerns.

❌ Liquidity and institutional involvement are currently much smaller compared to Bitcoin.

❌ If regulation tightens sharply, privacy coins may incur higher compliance costs, delisting risk, or even bans in certain jurisdictions.

❌ Bitcoin’s dominant network effects, liquidity, institutional backing and brand are hard to disrupt. Monero is not a replacement; it’s a complementary play.

Final Thoughts

Bitcoin remains the bedrock of crypto, but its story is largely written. Monero offers a distinct, high-narrative opportunity: the privacy angle.

If the market begins to value transaction anonymity, financial sovereignty, and data protection, Monero could well ride the next major wave — just as Zcash did earlier in the year.

For investors, the question is: Do you already own the trusted store of value? Or do you allocate a slice to the privacy narrative before it becomes mainstream?

Trump Promises $2,000 “Tariff Dividend” to Most Americans

President Trump says most Americans will receive a $2,000 “dividend” from tariff revenues. Markets see an immediate bullish impact for Bitcoin and stocks, but analysts warn of inflation, debt expansion, and legal uncertainty as the Supreme Court reviews the policy.

TLDR

💸 Trump says most Americans will receive a $2,000 dividend funded by tariff revenue.

🤔 Supreme Court may block the policy, prediction markets give only 21–23% odds of approval.

📊 Analysts expect short-term stimulus pumps for Bitcoin and stocks, but warn of long-term inflation and rising national debt.

👨 Compared to COVID-era checks, analysts estimate ~85% of adults would qualify.

Trump Announces $2,000 “Tariff Dividend”, Legal Fight Begins

United States President Donald Trump declared on Sunday that most Americans will receive a $2,000 “dividend” sourced from his sweeping tariff program, a policy that has triggered both market excitement and immediate legal challenges.

“A dividend of at least $2000 a person… will be paid to everyone,”Trump posted on Truth Social, excluding high-income earners from eligibility.

The announcement lands as the US Supreme Court reviews the legality of Trump’s tariff authority. And prediction markets overwhelmingly expect the Court to strike it down:

👉23% odds of approval on Kalshi

👉21% odds on Polymarket

Trump criticised the legal pushback, questioning why a president may halt all trade, a far more severe action, yet potentially cannot impose tariffs for national security purposes.

Markets View It as Stimulus, Analysts See Inflation Ahead

Crypto traders and market analysts immediately framed the proposal as fresh stimulus, a catalyst that has historically been bullish for risk assets.

“Stocks and Bitcoin only know to go higher in response to stimulus,”said investor Anthony Pompliano.

Historical data backs that view. According to The Kobeissi Letter, roughly 85% of U.S. adults would qualify — similar to COVID-era stimulus distributions. Even a fraction flowing into markets would lift crypto liquidity at a time when risk appetite has been shaky.

But analysts also underscored the consequences.

Kobeissi warned that any such mass payout will:

👉 Increase the national debt

👉 Fuel fiat currency inflation

👉 Reduce long-term purchasing power

Bitcoin advocate Simon Dixon summarised it bluntly:

“If you don’t put the $2,000 in assets, it’s going to be inflated away.”

Crypto’s Reaction: Short-Term Pump, Long-Term Divergence

While markets reacted positively to the prospect of new liquidity, the longer-term outlook is complex:

Bullish near-term:

🐂 More disposable cash → more inflows into Bitcoin, ETFs, memecoins, and equities.

🐂 Crypto historically rallies ahead of major fiscal stimulus events.

Bearish long-term:

🧸 Inflation pressures increase the likelihood of future monetary tightening.

🧸 Higher debt could hurt broader macro stability.

🧸 A Supreme Court rejection could unwind some of the bullish sentiment.

Bitcoin, trading near $106,000, remains sensitive to both tariff-related volatility and macro uncertainty.

The Bottom Line

Trump’s proposed“tariff dividend”is politically explosive, economically stimulative, and legally uncertain.

Markets like it.

Analysts fear it.

Prediction markets doubt it survives court scrutiny.

Who Really Moves Bitcoin Now? ETF Flows, Shrinking Liquidity, and the Myth of the Whale

Bitcoin’s daily moves are no longer dictated by whale wallets. ETF flows, liquidity conditions, and macro factors now dominate price action. Here’s the shift explained.

TL;DR

Since 2024, spot ETF inflows/outflows are the #1 driver of Bitcoin’s green and red days.

Exchange balances sit at six-year lows, meaning every order cuts deeper into the order book.

Large holders now split trades or use OTC, muting wallet-based signals.

Funding rates, open interest, the dollar, and yields often dictate intraday direction more than any whale.

Whale moves still matter, but they no longer set the daily tone.

Bitcoin Has Outgrown the Whale Era

For years, Bitcoin watchers treated every whale alert like breaking news; a big wallet moves, the market must follow. But 2025 has changed the structure of the market. Spot ETFs, institutional allocation, and declining exchange balances mean Bitcoin now trades more like a global macro asset than a retail-driven experiment.

Whales still matter, but they’re no longer the core driver of intraday or daily direction. They’re now just one piece of a much larger liquidity ecosystem.

The New Power Centre: ETF Flows

The biggest shift is simple: spot ETF flow now outweighs almost any single on-chain entity.

BlackRock, Fidelity, Bitwise and others collectively hold over 1.6 million BTC, and these funds consistently move tens of thousands of coins per day. When they take in net inflows, Bitcoin tends to have green days. When they bleed capital, Bitcoin tends to fall.

It’s structural, measurable, and far more influential than a whale shifting 5,000 BTC between wallets.

Thin Liquidity Amplifies Every Move

Even more important: exchange balances keep shrinking.

There are now only around 2.8m BTC sitting on centralised exchanges, the lowest level in roughly six years.

With less tradable supply available, every order travels further through the book. A normal sell program hits twice as hard. A normal buy program lifts the price more quickly. It’s not whales moving the market; it’s weaker liquidity.

In short: When there are fewer coins to trade, it doesn’t take a whale to make a splash.

Why Whale Alerts Matter Less Than Ever

There are two reasons whale trackers are less useful:

1. Most large holders use OTC desks now.

The big trades never hit exchanges, so they don’t appear as the scary red candles people expect.

2. ETF flows dwarf whale moves.

A single bad ETF day can represent 20× the size of a typical whale transfer.

And importantly, large holders often sell into strength, not pump price higher. They tend to counter the crowd rather than lead it.

The Quiet Forces Behind Daily Price Direction

On most trading days, Bitcoin moves because of:

👉 ETF flows: the most reliable daily driver.

👉 Funding and open interest resets: derivatives wipeouts move spot faster than whales.

👉 Dollar strength and US yields: Bitcoin is still macro-sensitive.

👉 Low exchange liquidity: thinner books = bigger candles.

This is the real engine under the hood.

So… Do Whales Still Matter At All?

They matter, but in a much narrower way. During periods where liquidity disappears or derivatives are crowded, a large market order can still push the price abruptly. But it rarely defines the entire day.

If the ETFs are net sellers, macro is risk-off, and liquidity is thin, whales only add noise, not direction.

If ETFs are net buyers and macro is calm, whale selling simply gets absorbed.

The myth that whales “control Bitcoin” is outdated. The market is far more institutional, far more flow-driven, and far more macro-linked than it used to be.

We’re excited to offer you a massive 35% discount!

What You Unlock:

- Strategies from top crypto experts

- Exclusive access to market insights, guides, and top tips

- Tools to maximise your crypto savings and investments

- A supportive community of like-minded crypto enthusiasts

- Access to our community Discord

Use the code 35OFF at checkout to claim your discount and get full access to our community plan for just a fraction of the price.

Secure your spot in the Crypto Saving Expert Community today.

Sponsored by: Stonksy

Stonksy is a momentum identifier that aims to capture expansive market moves before they happen by highlighting the start of potential price shifts. It can be used across all markets, including crypto, stocks, indices, commodities, and currencies.

Stonksy is growing in users week-on-week, proving why it aims to become one of the most-used indicators in the industry.

You can get 25% off the annual Stonksy plan with code TMG25, taking the price down to just £749.25 for an entire year of full access. Sign up today.

Find examples of Stonksy indications posted to the X every day: @stonksyio and learn how to use Stonksy and how it can benefit your trading system on the YouTube channel, with daily livestreams at 12:00 UTC.

Where to Invest $100,000 According to Experts

Investors face a dilemma. Headlines everywhere say tariffs and AI hype are distorting public markets.

Now, the S&P is trading at over 30x earnings—a level historically linked to crashes.

And the Fed is lowering rates, potentially adding fuel to the fire.

Bloomberg asked where experts would personally invest $100,000 for their September edition. One surprising answer? Art.

It’s what billionaires like Bezos, Gates, and the Rockefellers have used to diversify for decades.

Why?

Contemporary art prices have appreciated 11.2% annually on average

…And with one of the lowest correlations to stocks of any major asset class (Masterworks data, 1995-2024).

Ultra-high net worth collectors (>$50M) allocated 25% of their portfolios to art on average. (UBS, 2024)

Thanks to the world’s premiere art investing platform, now anyone can access works by legends like Banksy, Basquiat, and Picasso—without needing millions. Want in? Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

This Newsletter is strictly for informational purposes only; the content is generic and has not been tailored in any way. Crypto Saving Expert UAB (“CSE”) is not providing, and should not be interpreted as providing, any form of offer of any currency, security, financial instrument or digital asset, or investment advice, recommendations or strategy. The content of this Newsletter is not intended to replace your own research with regard to any assets, products or services, and any action taken on the basis of this material is entirely at your own risk. CSE neither accepts nor assumes any liability or responsibility for any loss or damage arising out of, or in any way connected to, the Newsletter content. Cryptocurrencies and digital assets may be unregulated in your jurisdiction, any profits may be subject to tax and the value of any investment could fall.

If you click on a link within this Newsletter to go through to a provider, we may get paid. This usually only happens if you get a product/use a service from it. This is what helps fund CSE and keeps the majority of our content free to use. Two crucial things you should know about this, however: a) this never impacts our editorial recommendations, if something is included, it is because we independently rate it as the best; and b) you will always get as good a deal, or better, than if you went direct. For full details on how CSE is funded, please click here.

CSE collects, processes and stores certain data. Such data may be shared with CSE’s wholly owned subsidiary company, Crypto Saving Expert Limited. Please note that by submitting information about yourself to CSE you are consenting to such use. For full details on our collection, processing and storage of data, together with your rights in relation thereto, please consult our Privacy Statement here.