- Crypto Saving Expert's Newsletter

- Posts

- Crypto Saving Expert Newsletter - Issue 169

Crypto Saving Expert Newsletter - Issue 169

Gm! Another tough start to the week for Bitcoin

Bitcoin is still struggling into the year-end, with sellers keeping control and momentum looking shaky.

But the big question now is simple… can the market put in a higher low here and give us one last push before 2025 closes out?

Sentiment is still cold, charts still look uncertain, and a big week of data is on the way.

Everything else you need to know is inside today’s newsletter. 👇

Table of Contents

Sponsored by: BloFin

Why BloFin?

Fair Trading: No internal or sister company market makers; BloFin doesn’t trade against its users.

Independent Liquidity: BloFin’s order books and liquidity is not shared with any large exchanges.

Transparent Leadership: The founder is fully doxxed—check out their Twitter here.

Impressive Volumes & Liquidity: Considering BloFin’s launch in 2023, its performance outshines many competitors like BingX.

Extensive Trading Options: Access 397+ futures pairs and 130+ spot pairs.

Secure Custody: User assets are held with Fireblocks, eliminating risks like hot wallet breaches.

Verified Proof of Reserves: Independently verified on Nansen for maximum security.

Chainalysis Integration: Ensures BloFin doesn’t accept illicit funds.

Instant Trade Execution: One of only four exchanges globally to achieve in-memory trade execution.

User-Friendly Policies: No KYC required, worldwide access via a VPN, and a mobile app for trading on the go.

Outstanding Customer Support and exciting user campaigns to enhance your experience.

Start trading with confidence and take advantage of BloFin’s innovative platform. Sign up now through our exclusive link:

Bitcoin Struggles As The End Of Year Approaches

Bitcoin took another dive at the start of this week as sellers remain in control of the market and upside momentum still lacks.

Bitcoin

Bitcoin suffered a sharp drop-off on Monday as it fell below $83,000 momentarily.

However, it has given the chance to form a potential higher low in its market structure, which could then see bitcoin go for a higher high and test the $96,000-$97,000 region.

Still, the $93,000 zone remains a strong hurdle and bitcoin must not fall to new lows to maintain any bullish momentum.

Bitcoin Yearly

Despite going on a run of setting new all-time highs this year, bitcoin is in danger of closing the yearly candle red, with the long upper wick showcasing the selling pressure that has come in.

As it stands, bitcoin will close 2025 negative, the first red yearly candle since 2022.

Bitcoin had lodged gains of up to 35% this year, which were taken away in November. There is still time for bitcoin to put in a rally to close the candle green.

MSTR

MSTR has fallen a massive 71% from its macro high. The stock has suffered much more than bitcoin during the downtrend and started showing weakness in July, much earlier than bitcoin.

Strategy has reached its lowest level since mid-September 2024, demonstrating the downturn.

Still, it has re-entered a zone of demand and if bitcoin puts together a rally, it could go and re-test $300.

ZEC

The ZEC bubble appears to have burst as the selling accelerates.

There is reason to believe it could bounce from around where it currently is, and also from slightly lower towards $200.

In either instance, ZEC could put together a reversal back towards $600 and form a lower high or in market psychology terms, a complacency bounce.

Still, this could be eradicated by the coin going to new highs.

Fear And Greed Index

The Fear and Greed Index remains within Extreme Fear and scores 23.

There has been nothing to change investor sentiment, and it will likely only improve should bitcoin get back towards $100,000.

Important Dates

Wednesday 3 December, 13:15 UTC - ADP Employment Change

Automatic Data Processing Inc. (ADP) releases employment change for the US. A higher figure is bullish for the markets due to increased employment, which suggests economic strength.

The consensus is set at 10,000, with the previous data coming in at 42,000. Therefore, the ADP expects a slight rise in employment.

Wednesday 3 December, 15:00 UTC - ISM Services PMI

The Institute for Supply Management (ISM) releases this data, with it providing a measure of the US non-manufacturing sector. It is considered positive if the figure is above the 50 mark.

Friday 5 December, 13:30 UTC - Core Personal Consumption Expenditures (PCE)

The US Bureau of Economic Analysis releases the core PCE data, which measures the average amount of money consumers spend monthly in the economy.

PCE is released in two formats: month-over-month and year-on-year. The data also removes volatile products, such as energy and food.

The year-on-year data is not forecasted.

Gainers

Losers

The Rising Sun Sets on Free Money

Japan's bond market is waking from its decades-long slumber, and the world is feeling the tremors.

KAZUO UEDA is not given to drama. So when Japan's central bank governor declared on December 1st that policymakers would "consider the pros and cons" of raising interest rates, markets understood the subtext: a rate hike was coming.

The response was swift. Within hours, two-year bond yields leapt to 1.02% - levels unseen since 2008. Thirty-year bonds hit 3.4%, their highest point on record. Japan's $8tn government bond market, long a byword for somnolence, had jolted awake. Foreign investors who once joked that trading Japanese Government Bonds was like watching paint dry discovered that the paint had suddenly caught fire.

Japan government bonds 10-year - TradingView

Markets are pricing a 76% probability that the Bank of Japan will raise rates at its December 18-19 meeting, lifting the policy rate from 0.5% to 0.75%. This would mark the first increase since January and another step in Japan's tortuous exit from monetary exceptionalism. The central bank formally abandoned its yield-curve-control policy in March 2024, ending years of artificially suppressing long-term rates. Quantitative tightening began in August: the BoJ is now reducing its ¥600tn balance sheet by roughly ¥400bn monthly, forcing markets to absorb bond supply that the central bank had previously hoovered up.

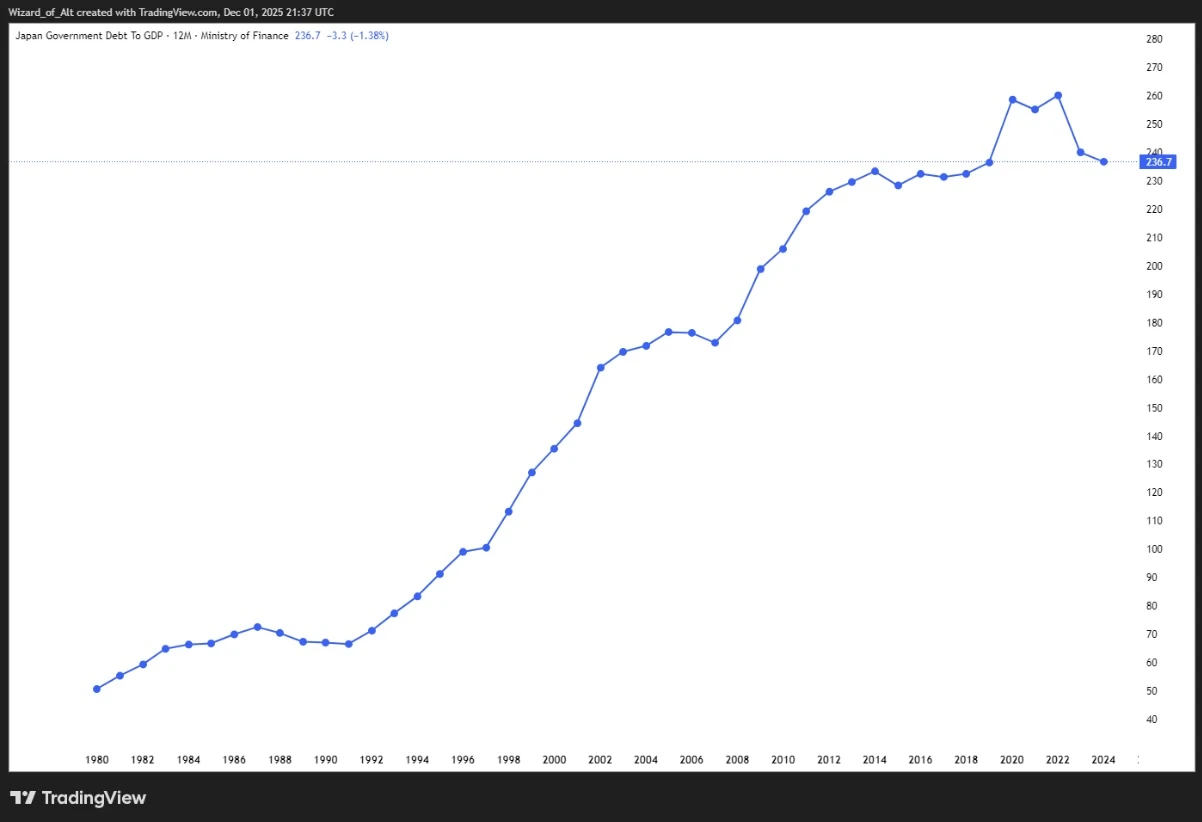

Yet even as the central bank tries to normalise policy, the government is pulling in the opposite direction. Prime Minister Sanae Takaichi has approved a ¥21.3tn ($140bn) stimulus package. The policy incoherence reflects political reality. Ms Takaichi faces Upper House elections next year and cannot afford to be seen as austere. Mr Ueda, by contrast, worries that if he waits much longer, inflation expectations could become unanchored. Neither can publicly acknowledge the contradiction, leaving Japan to tighten monetarily while loosening fiscally - a high-wire act in a country where gross government debt stands at 226% of GDP, the highest in the OECD.

Japan Government Debt to GDP - TradingView

The spread between five-year and thirty-year JGBs has widened by roughly 120 basis points in the fourth quarter alone. Ultra-long maturities have become the epicentre of volatility. "We've been preparing for this for two years," says one Tokyo-based portfolio manager, "but you can't really prepare for something that's never happened before." Pension funds and insurers, which hold vast quantities of these bonds, now face mounting losses. Should they begin selling to rebalance portfolios, liquidity could vanish.

Why Japan can sustain debt levels that would trigger market revolts elsewhere remains one of the puzzles of global finance. The answer lies in captive domestic savings, a persistent current account surplus, and the yen's status as a funding currency. But this exceptionalism depends on yields staying low. As rates rise, the arithmetic becomes less forgiving. Unlike Paul Volcker's shock therapy in 1979 or the Federal Reserve's taper tantrum in 2013, Japan's normalisation is glacial by design - but this also means any miscalculation has years to compound.

Carry on unwinding

The real danger lies in what Japan's policy shift means for global capital flows. For years, the yen carry trade has functioned as a multi-trillion-dollar subsidy for risk assets worldwide. Investors borrowed yen at near-zero rates and invested the proceeds in higher-yielding foreign bonds, equities, and other assets. Estimates suggest this trade has swelled to some $20tn, making it one of the largest cross-border capital flows in financial history. Rising Japanese rates threaten to throw this strategy into reverse.

The arithmetic is unforgiving. As Japanese rates rise, borrowing costs increase, eroding profitability. Meanwhile, as investors rush to repay yen-denominated loans, the currency strengthens, amplifying losses on foreign assets. Following Mr Ueda's speech, the yen firmed to 155.49 per dollar - still weak by historical standards, but moving in the wrong direction for carry traders. A sustained move toward 140-145 per dollar could trigger cascading deleveraging across global markets.

USD/JPY 1 hour - TradingView

The transmission runs through multiple channels. Japanese investors hold substantial foreign government bonds, including British gilts and American Treasuries, which could face selling pressure as domestic yields rise. Thirty-year gilt yields hit 5.68% in September, driven partly by domestic fiscal concerns but also by shifting Japanese capital. When the world's largest creditor nation experiences bond-market turmoil, global investors invariably reassess sovereign risk premiums across the board. American markets face similar pressures: Japanese investors may need to liquidate dollar-denominated assets to repay yen loans as the carry trade becomes unprofitable, creating simultaneous bond selling and dollar weakness.

UK Government bond yields 30yr - TradingView

During a brief market disruption in August 2024, Japanese investors hedged currency exposure rather than selling bonds outright. But sustained yen appreciation could eventually force direct sales of American fixed-income holdings. "The August wobble was a warning shot," notes a strategist at a large asset manager. "If we see another move like that, people won't just hedge. They'll sell."

The narrow path ahead

Economists expect a gradual march to 0.75% by March 2026 and a terminal rate around 1%. Such an outcome would represent a relatively benign scenario, allowing markets to adjust without major disruption. Some analysts argue that Japan's normalisation could proceed smoothly precisely because it is so gradual and well-telegraphed. Markets have had years to prepare, the argument goes, and Japanese policymakers have learned from others' mistakes. The BoJ has been meticulously transparent, publishing detailed plans for balance-sheet reduction and signalling rate moves well in advance. This is textbook central banking.

Yet risks abound. Some board members have warned against being "too late" on policy changes. If inflation expectations become unanchored or fiscal concerns intensify, the central bank may need to tighten more aggressively. Japanese financial institutions face uncomfortable asset-liability mismatches as rising rates reduce the value of their JGB holdings. Should pension funds and insurers liquidate holdings simultaneously, the BoJ might face an uncomfortable choice: persist with tightening despite financial stability concerns or backtrack on normalisation just when credibility matters most.

For global investors, the message is clear: the era of free Japanese money is drawing to a close. Portfolio managers must reduce duration risk in JGB holdings, hedge currency exposures, and brace for volatility spillovers. Some are already positioning for the shift. Vanguard and T. Rowe Price have implemented "flattener" trades - selling short-end JGBs while buying long-end bonds - betting that the curve will narrow as policy normalises.

If normalisation proceeds smoothly, Mr Ueda will have achieved what his predecessors thought impossible: escape from the zero-rate trap. But the margin for error is slim. Japan is attempting to exit emergency monetary policy while running emergency fiscal policy, even as global markets have grown dependent on cheap yen funding. Should any element misfire, unanchored inflation, fiscal panic, or disorderly yen appreciation, the consequences will not remain confined to Tokyo.

Watch the yen closely: a move below 150 per dollar would suggest the carry trade unwind is accelerating. Monitor Japanese pension fund flows: sustained selling would signal deeper distress. Pay attention to long-end JGB yields: a breach of 4% on the thirty-year would indicate markets are pricing in genuine fiscal concerns rather than mere normalisation. For now, the world's most indebted rich country is carefully feeling its way forward. Investors everywhere should hope it doesn't stumble.

MrBeast’s $10m Crypto Controversy and Secret “MrBeast Financial” Plans Reveal a Much Bigger Play

MrBeast’s Bitcoin fortune, NFT flips and alleged $10m pump-and-dump gains collide with a new trademark filing for “MrBeast Financial.”

TL;DR

💰 MrBeast holds at least $1.5m in Bitcoin, with some sources estimating closer to $2m.

🎁 He’s run multiple Bitcoin giveaways with Coinbase and experimented with crypto handouts to fans.

🤑 He made big profits flipping CryptoPunks during the NFT boom.

🤔 In late 2024, analysts accused him of making $10m+ from alleged low-cap token “pump-and-dump” schemes, claims his team has never addressed.

🧑💻 In 2025, his company filed a trademark for “MrBeast Financial” outlining their foray into crypto payments, banking, credit and digital asset trading.

👼 The filing is early-stage, unapproved and would face heavy regulatory scrutiny.

MrBeast’s Crypto Footprint Runs Deeper Than Fans Realise

MrBeast isn’t just the biggest YouTuber in the world; he’s also quietly become one of the most influential (and controversial) personalities in crypto.

During a 2021 interview, Jimmy Donaldson confirmed he held nearly $1.5m in Bitcoin. Other trackers suggest the real number could be closer to 21 BTC or around $2m, but he’s never publicly verified the speculation.

What is verified?

MrBeast likes giving Bitcoin away almost as much as he likes giving away cars and islands.

👉 In Sept. 2021, he partnered with Coinbase to give $100,000 in BTC to one winner.

👉 Earlier that year, he tested the waters by handing out $10,000 in Bitcoin instead of cash to fans on Twitter.

He was also active during the NFT mania, flipping eight CryptoPunks for large profits and parlaying those gains into other digital assets.

But that was just the beginning.

The $10m Question: Accusations MrBeast Has Never Addressed

In late 2024, on-chain analysts accused MrBeast of profiting over $10m through alleged “pump-and-dump” activity involving micro-cap tokens.

The claim:

Wallets allegedly tied to MrBeast or his team accumulated low-liquidity tokens shortly before he publicly engaged with trending projects, then sold into the resulting spikes.

None of these allegations have been proven, and MrBeast’s camp has never issued a statement addressing them. Still, the speculation added fuel to an already heated debate: Is the world’s biggest creator using his influence to shape crypto markets behind the scenes?

Enter: “MrBeast Financial”, His Most Ambitious Move Yet

While the crypto buzz around him grew, MrBeast was setting up something bigger.

In October 2025, Beast Holdings filed a US trademark for “MrBeast Financial,” hinting at a full-blown fintech and crypto platform branded under his empire.

What the trademark covers

The filing outlines an enormous potential product suite:

👉 Crypto payment processing

👉 Centralised and decentralised exchanges

👉 Online banking + mobile payments

👉 Investment advisory and wealth management

👉 Consumer lending and credit card services

If even half of this were launched, MrBeast would be positioning himself as a competitor to Revolut, Coinbase, PayPal and even neobanks.

Status

👉 The trademark is official.

👉 But it has not been assigned to a USPTO examiner.

👉 Meaning the idea is early, unapproved and far from guaranteed.

If MrBeast wants to run a crypto exchange, banking service or credit operation in the U.S., he’ll face some of the toughest licensing and compliance regimes in the world.

A Creator Empire Turning Into a Financial Empire?

The picture is becoming clearer:

👉 A multimillion-dollar Bitcoin position.

👉 Deep NFT trading activity.

👉 Accusations of unaddressed crypto market manipulation.

👉 And now, a trademark filing for a wide-reaching financial platform.

Whether “MrBeast Financial” becomes a real product or just a shelved idea, the move shows Jimmy Donaldson is thinking far beyond YouTube.

The world’s biggest creator might not just be giving away money soon, he might be holding it, moving it, exchanging it, lending it and managing it.

Vanguard Reverses Course, Opens Platform to Bitcoin, Ether, XRP and Solana ETFs

Vanguard will finally allow trading of crypto ETFs, reversing years of opposition and signalling a major shift in traditional asset management.

TL;DR

🖥️ Vanguard will allow clients to trade crypto ETFs and mutual funds starting Tuesday.

📊 Approved assets include Bitcoin, Ether, XRP and Solana ETFs, but no memecoins.

💥 The move reverses Vanguard’s long-held stance that crypto is too speculative for its investors.

📈 The decision follows intense retail and institutional demand.

🌊 Analysts say this could open the floodgates for fresh capital and accelerate crypto adoption.

Vanguard Finally Lets Clients Trade Crypto ETFs

In a dramatic reversal of its long-standing anti-crypto stance, Vanguard, the world’s second-largest asset manager, will start allowing its brokerage clients to trade third-party crypto ETFs and mutual funds beginning Tuesday.

A Vanguard spokesperson confirmed the shift, comparing the upcoming crypto access to how the platform currently treats gold ETFs, available but not core to the firm’s investment philosophy.

Only ETFs that meet regulatory standards will be permitted, including products tied to:

👉Bitcoin (BTC)

👉Ether (ETH)

👉XRP

👉Solana (SOL)

Vanguard emphasised it will not add memecoin exposures and has no plans to launch its own crypto ETFs or mutual funds.

A Major Shift From Vanguard’s Anti-Crypto Past

For years, Vanguard drew a hard line against digital assets.

Former CEO Tim Buckley said in 2024 that Bitcoin“doesn’t belong in a long-term portfolio,”calling it too speculative for retirement savers. Vanguard consistently refused to list spot Bitcoin ETFs even after BlackRock, Fidelity, and others won approval.

Buckley stepped down at the end of 2024. His successor, Salim Ramji, formerly BlackRock’s global ETF chief, also dismissed crypto ETFs as recently as August.

Now, less than a year later, Vanguard is taking the opposite position.

With $11tn under management, the shift is one of the most significant endorsements digital assets have received from traditional finance.

Demand From Investors Forced the Pivot

Vanguard says the change was driven by pure market pressure.

“We serve millions of investors with diverse needs and risk profiles,”the spokesperson said.“We aim to provide the ability to invest in products they choose.”

Bloomberg ETF analyst Eric Balchunas called the decision“a huge deal,”noting it aligns Vanguard with nearly all other major US brokerages.

“The Floodgates Are Opening”, Crypto Industry Reacts

Investors and analysts erupted after the announcement, suggesting the move could unleash a wave of new capital into the crypto market.

Crypto analyst Nilesh Rohilla wrote that Bitcoin could jump 5% within 24 hours of the news.

X user BankXRP called the shift“another massive signal that traditional finance is fully stepping into digital assets.”

Vivek Sen, founder of Bitgrow Lab, was even more direct:“Trillions incoming.”

Conclusion

Vanguard’s decision to allow trading of Bitcoin, Ether, XRP and Solana ETFs marks one of the biggest policy reversals in traditional asset management. After years of resisting digital assets, the $11tn giant is responding to unrelenting investor demand, and in doing so, may accelerate the next wave of mainstream crypto adoption.

We’re excited to offer you a massive 35% discount!

What You Unlock:

- Strategies from top crypto experts

- Exclusive access to market insights, guides, and top tips

- Tools to maximise your crypto savings and investments

- A supportive community of like-minded crypto enthusiasts

- Access to our community Discord

Use the code 35OFF at checkout to claim your discount and get full access to our community plan for just a fraction of the price.

Secure your spot in the Crypto Saving Expert Community today.

Sponsored by: Stonksy

Stonksy is a momentum identifier that aims to capture expansive market moves before they happen by highlighting the start of potential price shifts. It can be used across all markets, including crypto, stocks, indices, commodities, and currencies.

Stonksy is growing in users week-on-week, proving why it aims to become one of the most-used indicators in the industry.

You can get 25% off the annual Stonksy plan with code TMG25, taking the price down to just £749.25 for an entire year of full access. Sign up today.

Find examples of Stonksy indications posted to the X every day: @stonksyio and learn how to use Stonksy and how it can benefit your trading system on the YouTube channel, with daily livestreams at 12:00 UTC.

This Newsletter is strictly for informational purposes only; the content is generic and has not been tailored in any way. Crypto Saving Expert UAB (“CSE”) is not providing, and should not be interpreted as providing, any form of offer of any currency, security, financial instrument or digital asset, or investment advice, recommendations or strategy. The content of this Newsletter is not intended to replace your own research with regard to any assets, products or services, and any action taken on the basis of this material is entirely at your own risk. CSE neither accepts nor assumes any liability or responsibility for any loss or damage arising out of, or in any way connected to, the Newsletter content. Cryptocurrencies and digital assets may be unregulated in your jurisdiction, any profits may be subject to tax and the value of any investment could fall.

If you click on a link within this Newsletter to go through to a provider, we may get paid. This usually only happens if you get a product/use a service from it. This is what helps fund CSE and keeps the majority of our content free to use. Two crucial things you should know about this, however: a) this never impacts our editorial recommendations, if something is included, it is because we independently rate it as the best; and b) you will always get as good a deal, or better, than if you went direct. For full details on how CSE is funded, please click here.

CSE collects, processes and stores certain data. Such data may be shared with CSE’s wholly owned subsidiary company, Crypto Saving Expert Limited. Please note that by submitting information about yourself to CSE you are consenting to such use. For full details on our collection, processing and storage of data, together with your rights in relation thereto, please consult our Privacy Statement here.