- Crypto Saving Expert's Newsletter

- Posts

- Crypto Saving Expert Newsletter - Issue 171

Crypto Saving Expert Newsletter - Issue 171

GM! Bitcoin is walking a tightrope this week.

Price is still stuck in the same range, support is being tested again, and the next move looks like it could finally break the stalemate. One slip lower, or one clean push above, and things change fast. Sentiment’s steady, volatility’s low, and with CPI on Thursday, the market feels like it’s holding its breath.

Full story in today’s newsletter. 👇

Table of Contents

Sponsored by: BloFin

Why BloFin?

Fair Trading: No internal or sister company market makers; BloFin doesn’t trade against its users.

Independent Liquidity: BloFin’s order books and liquidity is not shared with any large exchanges.

Transparent Leadership: The founder is fully doxxed—check out their Twitter here.

Impressive Volumes & Liquidity: Considering BloFin’s launch in 2023, its performance outshines many competitors like BingX.

Extensive Trading Options: Access 397+ futures pairs and 130+ spot pairs.

Secure Custody: User assets are held with Fireblocks, eliminating risks like hot wallet breaches.

Verified Proof of Reserves: Independently verified on Nansen for maximum security.

Chainalysis Integration: Ensures BloFin doesn’t accept illicit funds.

Instant Trade Execution: One of only four exchanges globally to achieve in-memory trade execution.

User-Friendly Policies: No KYC required, worldwide access via a VPN, and a mobile app for trading on the go.

Outstanding Customer Support and exciting user campaigns to enhance your experience.

Start trading with confidence and take advantage of BloFin’s innovative platform. Sign up now through our exclusive link:

Bitcoin Walks A Fine Line

Bitcoin is teetering on a place of safety and security but also a region that could mark a significant break into bear territory.

Bitcoin

Bitcoin is still trading within the range that it has built between $85,000 and $93,500.

Bitcoin chops between these regions, while moving nowhere on the daily. Here, it is testing support.

If it breaks to the downside, the liquidity at $80,650 appears ripe for the taking, while the upside is also there should it finally get above $94,000.

Historical Returns

Coinglass

Bitcoin is testing two trends when it comes to monthly performance.

Since April, May, and June 2022, bitcoin has not recorded three red months in a row. It is now testing that trend, with October and November having been red.

This would be the first time in three and a half years that bitcoin has suffered three straight red months.

Also, since 2013, every time November has been red, December has followed suit. Currently, it is keeping to that trend.

Massive Trend

When you zoom out to the weekly, it is noticeable that bitcoin has a massively important diagonal region.

This is where it found resistance in 2021 and 2024, but then flipped it to support this year.

It is now in the midst of testing this area again, but as seen on the chart, a drop down towards $75,000 would not be the end of the world and would still keep to the trend.

Weekly Moving Averages

Bitcoin is also testing its 100-weekly moving average (light blue). It has remained above for weekly closes over the past month, and is providing a line of defence.

The 200WMA and 300WMA reside at $56,550 and $48,601, respectively. If bitcoin loses the 100WMA, the 200WMA becomes the next logical line to watch in terms of weekly moving averages.

Fear And Greed Index

The Fear and Greed Index has seen minimal change and stays within Extreme Greed. The score has seen an uptick from 11 to 16 this week, with 11 being one of the lowest scores we see in history.

Typically, drops into that region have made good buying opportunities historically.

Uber

Uber has been retracing sharply from the $102 high it set in September, and is currently down ~20% from there, and sitting at $81. Whilst the structure remains bearish, it has fallen to a high time frame S/R. The fundamentals read well, and whilst the company faces more competition, their revenue continues to grow. From a chart perspective, we have fallen below the 200 day SMA, which signals a bearish trend. Closing a daily above $87 would provide a more bullish outlook. With Tesla reaching an all time high on the back of the Robotaxi war, UBER feels well positioned to play a part of the platforming, given their scale and sheer amount of ride data.

Trade Uber and many other stocks over on PrimeXBT

Important Dates

Thursday 18 December, 13:30 UTC - US Consumer Price Index (CPI)

CPI measures inflation and is a vital economic measurement in all countries. The data is released by the Bureau of Labor Statistics and calculated using a shopping basket of goods and services.

The data is forecast at 3.2%.

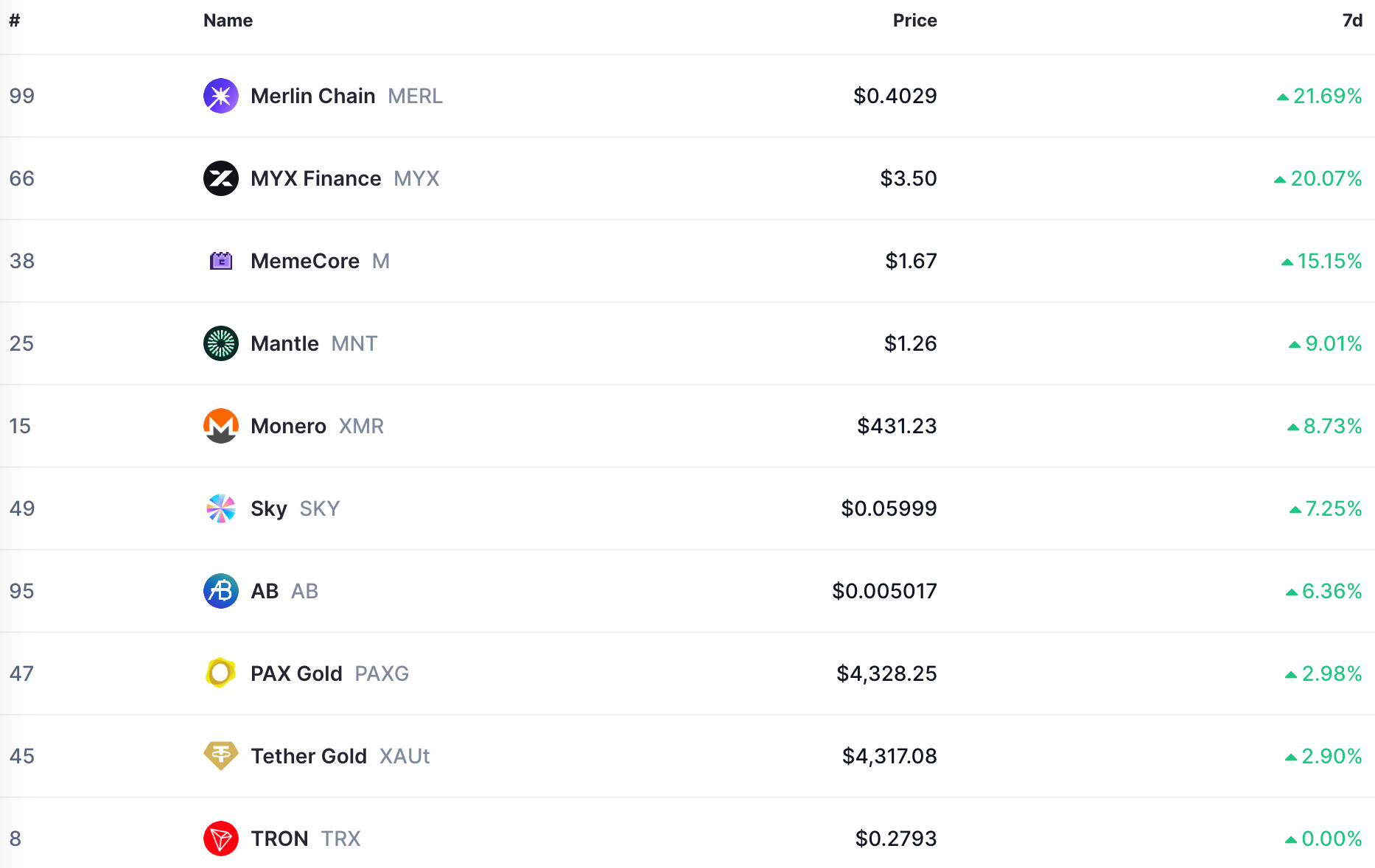

Gainers

Losers

UK to Regulate Crypto Like Traditional Finance by 2027 in Sweeping Legal Overhaul

The UK plans to bring cryptocurrencies under full financial regulation by 2027, placing crypto firms under FCA oversight in a bid to boost innovation, protect consumers and cement the UK as a global crypto hub.

TL;DR

🇬🇧The UK plans to fully regulate crypto under existing financial laws by October 2027.

🤔New legislation will place crypto firms under FCA oversight, similar to stocks and traditional finance.

💥The move goes far beyond current AML-only registration and adds consumer protection and conduct rules.

⚡️Officials say the goal is to attract investment, protect users, and block bad actors.

🦾The UK aims to compete globally and align more closely with US crypto regulation.

The UK is preparing to bring cryptocurrencies fully under its financial services rulebook, marking one of the most significant regulatory shifts for the digital asset sector in the country to date.

According to reports from The Guardian and Reuters, the government will introduce legislation to parliament on Monday that extends existing financial laws to crypto firms. If passed, the framework would place exchanges, brokers and other crypto service providers under the direct oversight of the Financial Conduct Authority (FCA) by October 2027.

Treasury chief Rachel Reeves said the move is designed to balance innovation with consumer protection.

“Bringing crypto into the regulatory perimeter is a crucial step in securing the UK’s position as a world-leading financial centre in the digital age,”Reeves said.

She added that clear rules would give firms the confidence to invest in the UK while“locking dodgy actors out of the market.”

From AML registration to full financial regulation

Until now, most UK crypto firms have only been required to register with the FCA under anti-money laundering rules. The regulator’s role has largely focused on financial crime rather than market conduct, investor protection or prudential standards.

The new legislation would change that entirely.

Under the plan, crypto activities would be regulated in a similar way to traditional financial products such as stocks and derivatives, subjecting firms to requirements around governance, disclosures, consumer safeguards and operational resilience.

The proposal builds on draft legislation published by the Treasury in April, which officials told Reuters has since undergone only minor revisions.

Aligning with the US and competing globally

UK officials have framed the move as both defensive and strategic.

The legislation would bring Britain closer to the United States, where lawmakers are working on bills that formally divide crypto oversight between market regulators. The two countries formed a joint crypto task force in September to explore short- and medium-term cooperation.

Economic Secretary Lucy Rigby said the UK intends to be proactive rather than reactive.

“Our intention is to lead the world in digital asset adoption,”she told the Financial Times.

Rigby emphasised that the rules would be“proportionate and fair,”arguing that growth, investment and consumer protection are not mutually exclusive.

A long runway, but a clear direction

While the changes won’t take effect until 2027, the signal is already clear: crypto in the UK is moving out of regulatory limbo.

The FCA last month published a roadmap for crypto regulation, with consultations planned on stablecoins, trading platforms and decentralised finance through 2026. Final rules are expected before the end of that year.

At the same time, the Bank of England has proposed its own stablecoin framework, one that has already drawn criticism from lawmakers who warned it could make the UK a “global outlier” by restricting wholesale stablecoin use and imposing tight holding limits.

What it means for crypto firms

For crypto companies, the shift brings both opportunity and pressure.

Clearer rules could make the UK more attractive for institutional players and long-term investment. But compliance costs will rise, and firms that have relied on lighter-touch oversight may struggle to adapt.

The government’s message, however, is unambiguous: crypto is no longer a regulatory experiment.

By 2027, digital assets in the UK will be treated less like an exception and much more like finance.

Kalshi Wins Temporary Shield From Connecticut Crackdown as Prediction Market Battles Spread Across the US

A federal judge has ordered Connecticut regulators to pause enforcement against Kalshi as the prediction market fights multiple states over alleged illegal gambling.

TL;DR

📨 Connecticut sent cease and desist orders to Kalshi, Robinhood and Crypto.com on Dec. 2 for alleged unlicensed online gambling.

🧑⚖️ Kalshi sued the next day, arguing it operates legally under federal CFTC authority, not state gambling laws.

🇺🇸 A federal judge has now ordered Connecticut regulators to pause all enforcement while the court reviews the case.

🤔 Kalshi faces similar battles in New York, Massachusetts, New Jersey, Nevada, Maryland, and Ohio.

📈 The company recently hit $4.54bn in monthly volume and closed a $1bn funding round at an $11bn valuation.

Kalshi Gets Emergency Protection From Connecticut Regulator

Prediction markets platform Kalshi has won a temporary reprieve from a Connecticut crackdown after a federal judge ordered the state to stop all enforcement actions while the case proceeds.

The Connecticut Department of Consumer Protection (DCP) issued cease and desist letters on Dec. 2 to Kalshi, Robinhood and Crypto.com, accusing them of facilitating unlicensed gambling, specifically “online sports wagering.”

Kalshi immediately sued, claiming:

✔Its event contracts are legal under federal law

✔It is regulated exclusively by the Commodity Futures Trading Commission (CFTC)

✔Connecticut has no authority to apply state gambling laws to a federally regulated exchange

In an order filed Monday, Judge Vernon Oliver instructed the DCP to “refrain from taking enforcement action” against Kalshi until the court decides whether to grant a preliminary injunction.

The ruling acts as a legal pause button, protecting Kalshi from shutdown while the fight escalates.

Court Timeline: A Multi-Month Legal Showdown

The judge has set:

👉Jan. 9, Connecticut must respond

👉Jan. 30, Kalshi’s additional filings due

👉Mid-February, oral arguments

A full ruling on the injunction could determine whether prediction markets are treated as regulated financial products or state-governed gambling, a distinction with enormous implications for the industry.

Kalshi Is Now Fighting Half the Country

The Connecticut suit is only the latest front in Kalshi’s growing war against state regulators. So far in 2024–2025, Kalshi has been hit with cease and desist orders or legal threats in:

✅New York

✅Massachusetts

✅New Jersey

✅Nevada

✅Maryland

✅Ohio

In several cases, Kalshi has sued first, accusing states of regulatory overreach and asserting federal preemption via the CFTC.

The central question:

Are event contracts commodities or gambling?

States say gambling. Kalshi (and the CFTC) argue they’re federally regulated financial derivatives.

Kalshi’s Growth Has Made It a Target

Kalshi’s explosive rise is drawing national attention and regulatory heat.

Recent milestones:

💵 Record $4.54bn volume in November

💸 $1bn funding round, valuing the company at $11bn

💰 Massive inflows into contracts on elections, sports, and macroeconomic events

Kalshi is no longer a niche exchange; it’s shaping public market sentiment in real time. That scale has triggered a turf war between states and federal regulators.

Why This Matters for Crypto and Prediction Markets

Kalshi isn’t just fighting for itself; it’s fighting for the future classification of prediction markets in the US.

If Kalshi wins:

✅ Event contracts become federally regulated financial products

✅ CFTC authority is strengthened

✅ State gambling laws lose power over national prediction markets

If states win:

❌ Prediction markets could be fractured state-by-state

❌ Platforms may be forced to acquire gambling licenses

❌ A chilling effect could hit US innovation in political and economic forecasting

Crypto-based prediction markets like Polymarket and Augur are watching closely; a strong ruling for Kalshi could reshape how regulators treat on-chain prediction markets as well.

Conclusion

Kalshi’s temporary victory in Connecticut is significant, but it’s just the beginning. With lawsuits now unfolding across multiple states, the platform is at the centre of a regulatory showdown that could define the future of prediction markets in the United States.

The outcome will determine whether event trading is considered financial speculation or gambling, and whether platforms like Kalshi become Wall Street staples or remain regulatory minefields.

MetaMask Adds Native Bitcoin Support as Multichain Push Accelerates

MetaMask has added native Bitcoin support, allowing users to buy, send and swap BTC as the wallet expands beyond Ethereum and Solana.

TL;DR

✅ MetaMask has rolled out native Bitcoin support, following an earlier tease of the feature this year.

🦾 Users can now buy, send, receive and swap BTC directly in MetaMask.

⚡️ Bitcoin joins Ethereum, Solana, Sei and Monad as supported networks.

⛓️ MetaMask states that more blockchain integrations are planned for 2026.

MetaMask Brings Bitcoin into its wallet

Crypto wallet provider MetaMask has officially added native support for Bitcoin, marking a major step in its shift from an Ethereum-first product to a fully multichain wallet.

The rollout was announced on Monday, nearly ten months after MetaMask first teased the feature in February. Bitcoin now joins Ethereum, Solana, Monad and Sei as supported networks within the wallet.

“Any Bitcoin transactions you make will appear in your asset list once confirmed,”MetaMask said, reminding users that Bitcoin transactions typically settle more slowly than those on EVM-based or Solana networks.

What Users can do with Bitcoin on MetaMask

With the update, MetaMask users can:

👉Buy Bitcoin

👉Send and receive BTC

👉Swap into BTC from other assets

The company is also incentivising adoption by offering MetaMask reward points for swaps into Bitcoin.

Previously, MetaMask users could only access Bitcoin exposure through wrapped BTC tokens on Ethereum-compatible networks.

From Ethereum-Only to Multichain Wallet

MetaMask was originally built to serve the Ethereum ecosystem and EVM-compatible chains. Over the course of 2025, the wallet has steadily expanded beyond that base.

The company added Solana support in May, followed by Sei in August and Monad in November. Bitcoin’s integration represents the most significant expansion yet, bringing the world’s largest cryptocurrency directly into MetaMask’s native feature set.

“Bitcoin support marks the latest step in our multichain expansion,”MetaMask said, adding that more networks are planned for rollout in 2026.

Bigger Picture

As wallets compete to become all-in-one crypto gateways, MetaMask’s move signals a broader industry shift toward chain-agnostic user experiences.

By integrating Bitcoin directly, MetaMask is positioning itself not just as an Ethereum wallet but as a central access point for users navigating an increasingly fragmented blockchain ecosystem.

We’re excited to offer you a massive 35% discount!

What You Unlock:

- Strategies from top crypto experts

- Exclusive access to market insights, guides, and top tips

- Tools to maximise your crypto savings and investments

- A supportive community of like-minded crypto enthusiasts

- Access to our community Discord

Use the code 35OFF at checkout to claim your discount and get full access to our community plan for just a fraction of the price.

Secure your spot in the Crypto Saving Expert Community today.

Sponsored by: Stonksy

Stonksy is a momentum identifier that aims to capture expansive market moves before they happen by highlighting the start of potential price shifts. It can be used across all markets, including crypto, stocks, indices, commodities, and currencies.

Stonksy is growing in users week-on-week, proving why it aims to become one of the most-used indicators in the industry.

You can get 25% off the annual Stonksy plan with code TMG25, taking the price down to just £749.25 for an entire year of full access. Sign up today.

Find examples of Stonksy indications posted to the X every day: @stonksyio and learn how to use Stonksy and how it can benefit your trading system on the YouTube channel, with daily livestreams at 12:00 UTC.

This Newsletter is strictly for informational purposes only; the content is generic and has not been tailored in any way. Crypto Saving Expert UAB (“CSE”) is not providing, and should not be interpreted as providing, any form of offer of any currency, security, financial instrument or digital asset, or investment advice, recommendations or strategy. The content of this Newsletter is not intended to replace your own research with regard to any assets, products or services, and any action taken on the basis of this material is entirely at your own risk. CSE neither accepts nor assumes any liability or responsibility for any loss or damage arising out of, or in any way connected to, the Newsletter content. Cryptocurrencies and digital assets may be unregulated in your jurisdiction, any profits may be subject to tax and the value of any investment could fall.

If you click on a link within this Newsletter to go through to a provider, we may get paid. This usually only happens if you get a product/use a service from it. This is what helps fund CSE and keeps the majority of our content free to use. Two crucial things you should know about this, however: a) this never impacts our editorial recommendations, if something is included, it is because we independently rate it as the best; and b) you will always get as good a deal, or better, than if you went direct. For full details on how CSE is funded, please click here.

CSE collects, processes and stores certain data. Such data may be shared with CSE’s wholly owned subsidiary company, Crypto Saving Expert Limited. Please note that by submitting information about yourself to CSE you are consenting to such use. For full details on our collection, processing and storage of data, together with your rights in relation thereto, please consult our Privacy Statement here.