- Crypto Saving Expert's Newsletter

- Posts

- Crypto Saving Expert Newsletter - Issue 173

Crypto Saving Expert Newsletter - Issue 173

GM! Bitcoin enters the new year with intent, but not without hesitation.

The price is starting to lean higher, yet remains pinned beneath familiar resistance, keeping traders cautious. Momentum is improving, sentiment is recovering from December’s lows, and risk appetite is slowly creeping back in. Macro signals are mixed, geopolitics are simmering, and crypto is once again watching equities lead the way.

It feels like the calm before a bigger move.

Full story in today’s newsletter. 👇

Table of Contents

Sponsored by: BloFin

Why BloFin?

Fair Trading: No internal or sister company market makers; BloFin doesn’t trade against its users.

Independent Liquidity: BloFin’s order books and liquidity is not shared with any large exchanges.

Transparent Leadership: The founder is fully doxxed—check out their Twitter here.

Impressive Volumes & Liquidity: Considering BloFin’s launch in 2023, its performance outshines many competitors like BingX.

Extensive Trading Options: Access 397+ futures pairs and 130+ spot pairs.

Secure Custody: User assets are held with Fireblocks, eliminating risks like hot wallet breaches.

Verified Proof of Reserves: Independently verified on Nansen for maximum security.

Chainalysis Integration: Ensures BloFin doesn’t accept illicit funds.

Instant Trade Execution: One of only four exchanges globally to achieve in-memory trade execution.

User-Friendly Policies: No KYC required, worldwide access via a VPN, and a mobile app for trading on the go.

Outstanding Customer Support and exciting user campaigns to enhance your experience.

Start trading with confidence and take advantage of BloFin’s innovative platform. Sign up now through our exclusive link:

Bitcoin Starts With Intent

Bitcoin has kicked off the new year with a much-needed uptrend and is following a similar trend to previous years.

Bitcoin

Bitcoin is facing a fierce task to overcome the daily resistance at $94,000.

This has been troublesome for bitcoin while in this range, and a region it must overcome to allow for higher prices.

From there, the liquidity at $97,000 would be an attraction for the price, with it either resulting in a fall-off or the start of further expansion toward $106,000, which is the high time frame S/R.

Moving Averages

Bitcoin’s 100-week moving average (blue line) has held as support all the way through November’s drop and December’s consolidation.

This has created a springboard for bitcoin’s current rally.

However, the 50-week moving average (orange line) lies at $101,600 and is one of the most crucial points in this cycle.

This creates a potential S/R region between these two levels, with a reclaim of the 50WMA being bullish and a drop below the 100WMA bearish.

Previous Years

Bitcoin has started the year the same as it has in previous years. January is typically a bullish month, with five of the past six years closing green.

Thus far, bitcoin is up 4.5% and is keeping to the trend.

If bitcoin can see a 2020, 2021, or 2023 style of move this month, it would make for a string rally.

S&P 500

The S&P 500 made another all-time high on Monday.

While bitcoin and crypto has struggled, the stock market has continued to thrive, and the index broke out to new highs.

Looking at the daily chart, an ascending triangle is visible, with what could be the start of price expansion. If this is the case, it would give bitcoin plenty of room to catch up.

Fear And Greed Index

The Fear and Greed Index has witnessed a revival thus far this year and scores 42. Despite being within Fear, this is a huge increase from the depths of December, where it lay towards the lower echelons of the scale.

Without a doubt, a push towards $100,000 from here would significantly lift investor sentiment.

SMCI

The AI narrative appears to be back on track, with a renewed focus on shortages within the supply chain and the continued accelerated build out for data centres. SMCI provides critical infrastructure on the server side.

Having been beaten down on shrinking margins, the company is still aggressively growing revenue and has plans to grow their margins and entrench their moat, which focuses on liquid cooling and fast deployment.

As we see Nvidia’s blackwell chips begin to hit the market, the company is positioned to capitalise. Whilst still in a downtrend, there is a bull case for a push up, and should we clear the $32 resistance, we could see a squeeze up to the $40 mark, an area where analysts expect the stock to be in a year's time.

This can be traded over on PrimeXBT, so check it out before the end of winter.

Important Dates

Wednesday 7 January, 13:15 UTC - ADP Employment Change

Automatic Data Processing Inc. (ADP) releases employment change for the US. A higher figure is bullish for the markets dueSolana’s increased employment, which suggests economic strength.

The consensus is set at 45,000, with the previous data coming in at -32,000. Therefore, the ADP expects a slight rise in employment.

Wednesday 7 January, 15:00 UTC - ISM Services PMI

The Institute for Supply Management (ISM) releases this data, with it providing a measure of the US non-manufacturing sector. It is considered positive if the figure is above the 50 mark, with the forecast at 52.3.

Friday 9 January, 13:30 UTC - Nonfarm Payrolls (NFP)

The US Bureau of Labour Statistics releases the NFP. This form of data represents the number of new jobs created in the previous month, which will be December and is another signal of economic health.

The consensus is set at 55,000, with the previous data at 64,000.

Gainers

Losers

NFT Paris and RWA Paris Cancel 2026 Events as Market Slump Bites

NFT Paris and RWA Paris have cancelled their 2026 conferences just weeks before they were set to kick off, citing the prolonged NFT market collapse and unsustainable economics.

⚡ TL;DR

🛑NFT Paris and RWA Paris are cancelled with just one month’s notice

📉 Organisers cite the ongoing crypto and NFT market collapse

💸 Sponsors say some fees won’t be refunded, but ticket holders will be

🧊 The decision underscores how hard NFTs struggled throughout 2025

❌ Paris Conferences Pulled at the Last Minute

The teams behind NFT Paris and RWA Paris have cancelled their flagship events, originally scheduled for February 2026, blaming harsh market conditions.

In a post shared on X, the organisers said they were forced to abandon the events after months of trying to keep them viable.

“The market collapse hit us hard. Despite drastic cost cuts and months of trying to make it work, we couldn't pull it off this year.”

The statement strongly suggested a full shutdown rather than a simple postponement, telling followers they were effectively“closing this chapter.”

🎟️ Refunds for Attendees, Not All Sponsors

According to the organisers:

🎫 All ticket holders will be refunded within 15 days

🤝 Some sponsors claim they won’t receive refunds, sparking frustration

📉 NFT Market Reality Check

The cancellation lands amid one of the worst years on record for NFTs.

Key numbers paint a bleak picture:

📉 Monthly NFT sales fell to ~$320m in November 2025

📊 Total NFT market cap sits near $2.7bn, down 68% year over year

Once-hyped conferences, sponsorships and brand activations have become harder to justify as trading volumes, user activity and prices continue to slide.

🔄 NFT Platforms Are Pivoting Too

The pressure isn’t limited to events.

Major NFT platforms have already begun reinventing themselves:

👉OpenSea announced a shift from “NFT marketplace” to “trade everything”

👉X2Y2 shut down entirely and pivoted to AI

👉Rarible rolled out a new token model after admitting prior designs weren’t sustainable

Together, these moves reflect a broader reset across the NFT sector, from speculative hype toward survival, utility and consolidation.

🧠 Bigger Signal for Crypto Events?

The abrupt cancellation of NFT Paris and RWA Paris is a reminder that bear markets don’t just hit prices, they hit infrastructure, communities and culture too.

For now, Paris will be quieter than expected this February, and the NFT world is being forced to ask a harder question in 2026:

Not when is the next boom, but what’s worth building until then?

Bitcoin Nears $93k as Trump’s Latin America Threats Stoke Geopolitical Uncertainty

Bitcoin pushed toward $93,000 as Trump floated tougher action against Colombia and Mexico, adding fresh geopolitical risk to global markets.

⚡ TL;DR

🌎 Trump hinted at possible US military action in Colombia and tougher measures in Mexico

📈 Bitcoin climbed above $92,000 as geopolitical uncertainty increased

🪖 Markets shrugged off the Venezuela shock as it was resolved quickly

❄️ Greenland tensions add another layer of global risk

📈 Bitcoin Rises on Fresh Geopolitical Jitters

Bitcoin climbed toward $93,000 on Monday, gaining over 3% in the past 24 hours, as comments from Donald Trump injected new geopolitical uncertainty into global markets.

The move followed Trump’s remarks suggesting the United States could pursue tougher action against Colombia and Mexico, extending regional tensions after the weekend military operation in Venezuela.

Bitcoin rose from around $89,990 to near $93,000, according to CoinGecko, as traders repositioned amid rising macro and political risk.

🪖 Trump Floats Colombia, Mexico Action

Speaking on Sunday, Trump accused Colombia of fueling cocaine trafficking into the US and said a military-focused operation targeting the country “sounds good to me,” according to Reuters.

🗣️“Colombia is very sick, too… run by a sick man, who likes making cocaine and selling it to the United States,”Trump said.

When pressed on potential military action, Trump replied bluntly:“It sounds good to me.”

Trump also turned his attention to Mexico, warning that“something is going to have to be done”after Mexican President Claudia Sheinbaum rejected US assistance in combating cartel violence.

⚡ Venezuela Shock Absorbed Quickly

Despite fears of regional escalation, analysts noted that the Venezuela operation had a limited market impact.

Crypto analyst Crypto Rover said Bitcoin avoided a sharp volatility spike because the operation unfolded before uncertainty could fully spread, unlike past geopolitical shocks that triggered prolonged risk-off moves.

📊 Bitcoin has gained 3.35% since the Venezuela incident, suggesting traders viewed the situation as contained.

❄️ Greenland Still on Trump’s Radar

Adding to global uncertainty, Trump reiterated that Greenland remains strategically vital to US national security.

🇩🇰 Officials in Denmark and Norway have repeatedly pushed back, insisting the mineral-rich territory is not for sale and urging Trump to tone down rhetoric.

🔍 Why Bitcoin Reacted

Bitcoin’s move highlights its growing role as a macro-sensitive asset, often reacting to:

🌍 Geopolitical instability

📉 Risk-off sentiment

💵 Dollar and liquidity expectations

While equities remained muted, crypto traders appeared quicker to price in uncertainty, pushing BTC higher as headlines escalated.

For now, Bitcoin’s resilience suggests markets are watching geopolitics closely, but only reacting when uncertainty feels unresolved.

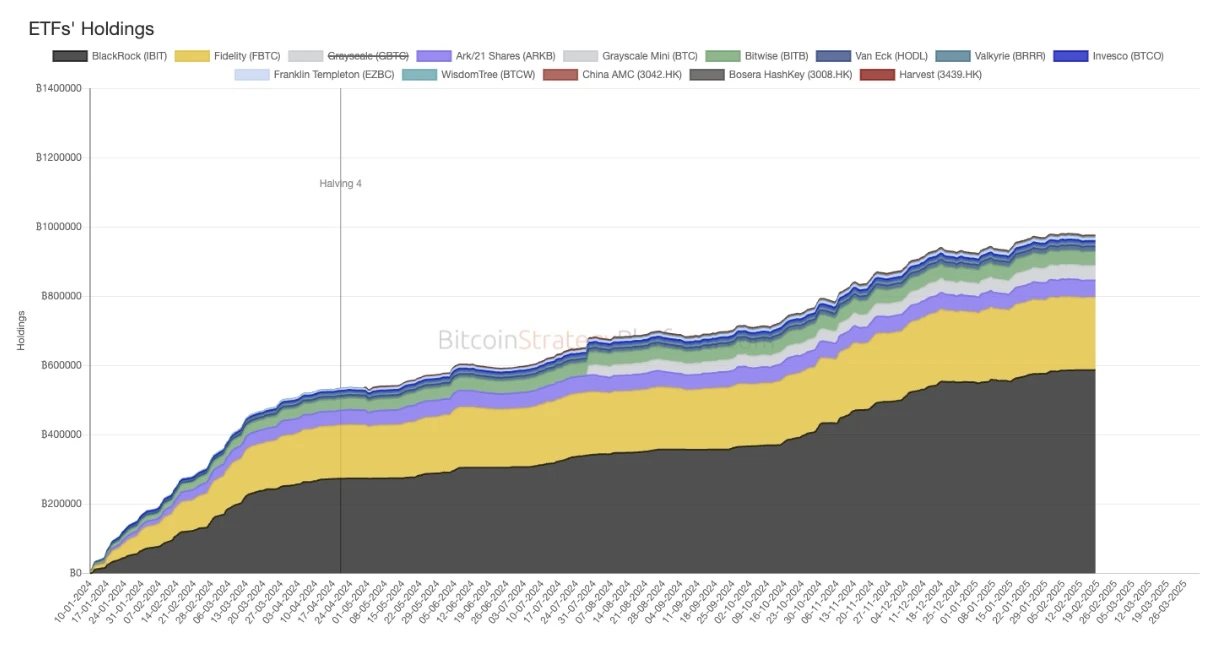

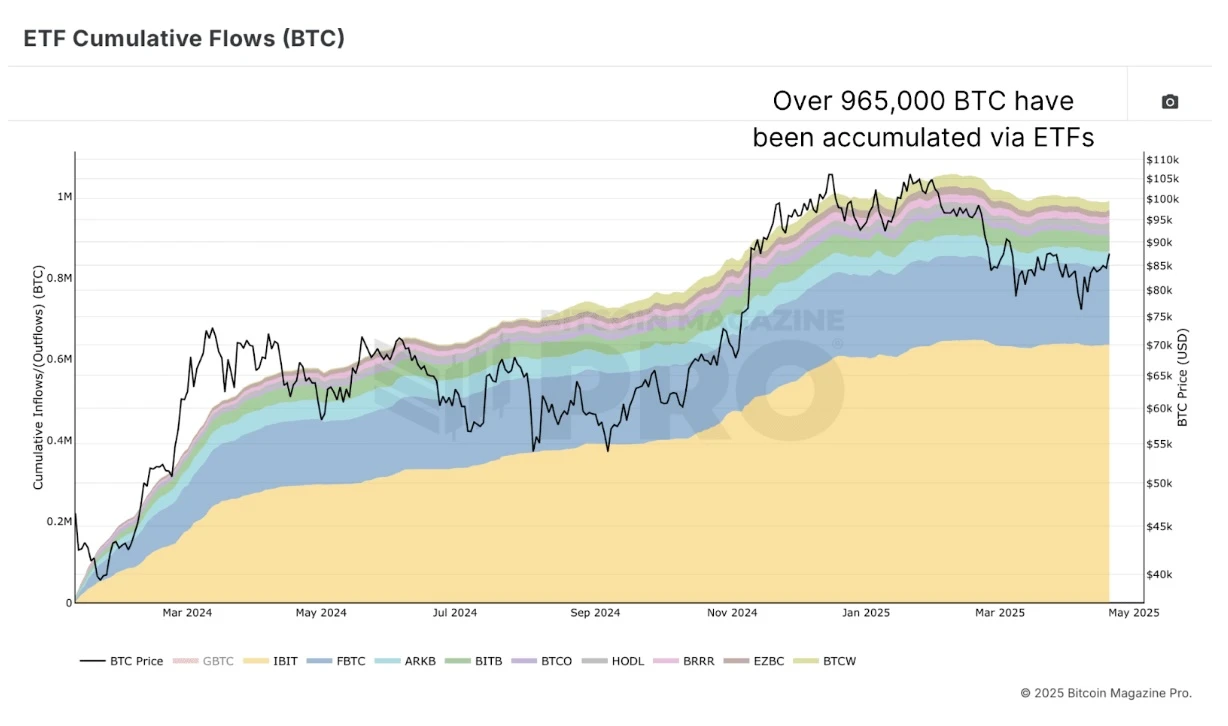

Institutions Are Buying Bitcoin Faster Than Miners Can Produce It

Institutional Bitcoin demand has flipped positive in 2026, with institutions buying 76% more BTC than miners produce, a signal that has historically preceded major price rallies.

⚡ TL;DR

🏦 Institutions have been net buyers of Bitcoin for 8 straight days

⛏️ Demand is running 76% higher than the new BTC supply from miners

📈 Past signals like this delivered ~110% average upside since 2020

🔄 After three red months, BTC could be due for a relief rally above $100k

🏦 Institutions Turn Net Buyers Again

Institutional appetite for Bitcoin has returned strongly in early 2026, with demand now outpacing new supply from miners.

Data from Capriole Investments shows institutions have absorbed 76% more BTC than miners produced, marking a clear shift in market dynamics.

Capriole’s Net Institutional Buying metric, which tracks corporate treasury purchases alongside US spot Bitcoin ETFs, has printed eight consecutive “green” days, meaning daily institutional demand exceeded newly mined BTC each day.

🗣️ “Institutions are once again net buyers of Bitcoin,” said Capriole founder Charles Edwards in a post on X.

📊 Why This Signal Matters

This demand flip isn’t just symbolic; it has a strong historical track record.

📈 Since 2020:

👉 Institutional demand overtaking miner supply has led to ~109% average BTC gains

👉 The most recent prior signal still delivered 41% upside

The logic is simple: when large, long-term buyers consistently absorb more BTC than the network creates, supply tightens, and price pressure builds.

🔁 Bitcoin Due for a Relief Rally?

Adding to the bullish case, network economist Timothy Peterson highlighted that Bitcoin is emerging from a rare drawdown pattern.

📉 BTC has posted three consecutive monthly declines, something that has occurred only nine times since 2015.

Historically:

👉 BTC was higher 67% of the time one month later

👉 Average gain: ~15%

👉 The bearish exceptions all occurred during the 2018 bear market

Peterson summed it up plainly:

“History favours a return above $100,000 for Bitcoin this month.”

📈 Price Action Confirms Early Strength

Bitcoin reclaimed $94,000 following Monday’s Wall Street open, reaching its highest levels since mid-November and reinforcing the idea that institutional flows may already be influencing price.

With miner supply constrained, institutions accumulating aggressively, and historical probabilities leaning bullish, Bitcoin’s early-2026 setup is starting to look familiar, in a good way.

We’re excited to offer you a massive 35% discount!

What You Unlock:

- Strategies from top crypto experts

- Exclusive access to market insights, guides, and top tips

- Tools to maximise your crypto savings and investments

- A supportive community of like-minded crypto enthusiasts

- Access to our community Discord

Use the code 35OFF at checkout to claim your discount and get full access to our community plan for just a fraction of the price.

Secure your spot in the Crypto Saving Expert Community today.

Sponsored by: Stonksy

Stonksy is a momentum identifier that aims to capture expansive market moves before they happen by highlighting the start of potential price shifts. It can be used across all markets, including crypto, stocks, indices, commodities, and currencies.

Stonksy is growing in users week-on-week, proving why it aims to become one of the most-used indicators in the industry.

You can get 25% off the annual Stonksy plan with code TMG25, taking the price down to just £749.25 for an entire year of full access. Sign up today.

Find examples of Stonksy indications posted to the X every day: @stonksyio and learn how to use Stonksy and how it can benefit your trading system on the YouTube channel, with daily livestreams at 12:00 UTC.

This Newsletter is strictly for informational purposes only; the content is generic and has not been tailored in any way. Crypto Saving Expert UAB (“CSE”) is not providing, and should not be interpreted as providing, any form of offer of any currency, security, financial instrument or digital asset, or investment advice, recommendations or strategy. The content of this Newsletter is not intended to replace your own research with regard to any assets, products or services, and any action taken on the basis of this material is entirely at your own risk. CSE neither accepts nor assumes any liability or responsibility for any loss or damage arising out of, or in any way connected to, the Newsletter content. Cryptocurrencies and digital assets may be unregulated in your jurisdiction, any profits may be subject to tax and the value of any investment could fall.

If you click on a link within this Newsletter to go through to a provider, we may get paid. This usually only happens if you get a product/use a service from it. This is what helps fund CSE and keeps the majority of our content free to use. Two crucial things you should know about this, however: a) this never impacts our editorial recommendations, if something is included, it is because we independently rate it as the best; and b) you will always get as good a deal, or better, than if you went direct. For full details on how CSE is funded, please click here.

CSE collects, processes and stores certain data. Such data may be shared with CSE’s wholly owned subsidiary company, Crypto Saving Expert Limited. Please note that by submitting information about yourself to CSE you are consenting to such use. For full details on our collection, processing and storage of data, together with your rights in relation thereto, please consult our Privacy Statement here.