- Crypto Saving Expert's Newsletter

- Posts

- Crypto Saving Expert Newsletter - Issue 174

Crypto Saving Expert Newsletter - Issue 174

Gm! Bitcoin starts the week leaning into strength, but still hasn’t made its intentions fully clear.

The price has continued to grind higher, pressing into resistance that’s capped momentum for weeks. Structure is improving, dips are being bought faster, and sentiment has quietly shifted out of fear mode. Risk appetite is rebuilding, but conviction remains selective as macro data and equity flows stay firmly in focus.

It feels like the market is positioning, not chasing.

This kind of environment rarely lasts long.

Full story in today’s newsletter. 👇

Table of Contents

Sponsored by: FOXIFY

$89,000 Trading Rewards Campaign: FUNDED by FOXIFY x Kodiak Finance

If you trade crypto, read this. FUNDED by FOXIFY has launched an $89,000 trading rewards campaign on Kodiak Finance (built on Berachain).Campaign Breakdown:

$20,000 FUNDED Double Cashout Bonus (First-Come, First-Served - FCFS)

$69,000 Trading Volume Competition (Runs until Jan 31, UTC)

What is FUNDED by FOXIFY?

FUNDED offers a new way to trade: you deposit a small amount and FOXIFY provides you with a bigger trading balance to trade with, without risking a huge personal balance.

Scale Up: Deposit $100/$500 to get $500/$2,500 instantly, & scale up to $10,000+ in trading capital.

Key Features: No KYC, no evaluation phase, no trading rules/restrictions, 80% profit share.

Trading Rules: 15% profit target at each level, up to 20% static drawdown limit.

Access: 100+ trading pairs with up to 100x leverage.

Reward #1: $20,000 Double Cashout Bonus (FCFS)

A shared $20,000 bonus pool doubles your payouts when you withdraw profits.

+100% bonus until the first $10,000 of the pool is used up.

+50% bonus until the next $10,000 is used up.

Note: This is only valid for users trading with a FUNDED account on Kodiak Finance.

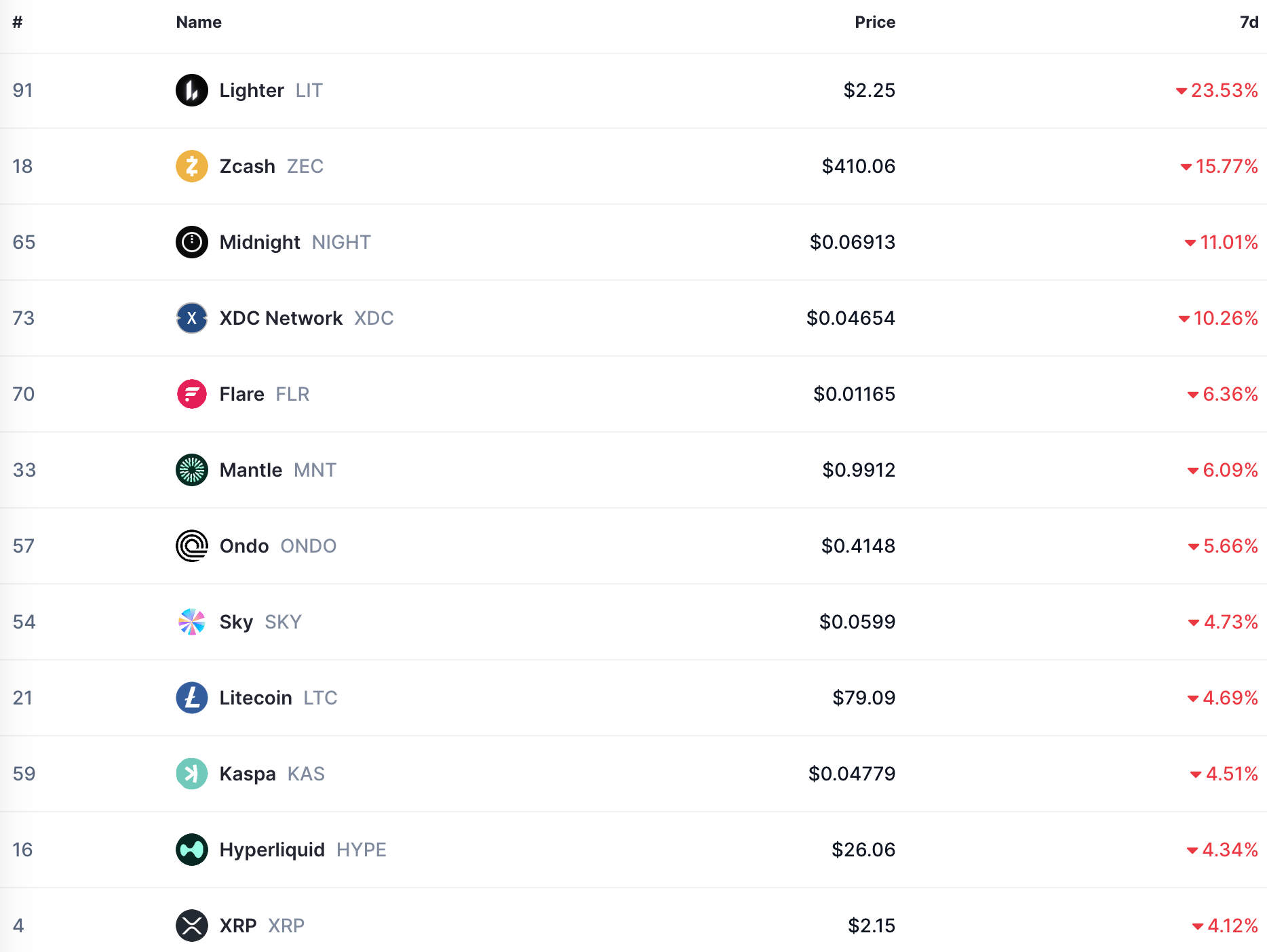

Reward #2: $69,000 Kodiak Trading Volume Competition

The competition runs from Jan 1 → Jan 31 (UTC). Traders with the highest trading volume rank highest on the leaderboard.

Top 10 Payouts:

With FOXIFY, you can trade with more size (up to 100x your deposited capital and additionally up to 100x leverage) to generate volume without needing massive personal capital. Multiple FUNDED accounts can be used with the same wallet.

How to Join (2 Steps):

Start Here: https://kodiak.foxify.trade/funded/start-journey

Choose Your Account Type:

FUNDED Entry: Deposit $100 → Get $500 instant FUNDED capital → Reach $10,000 in funding across 5 levels.

FUNDED Pro: Deposit $500 → Get $2,500 instant FUNDED capital → Reach $10,000 in funding across 3 levels.

Profit withdrawals are instant and can be claimed at the end of each level.

Need help? Check out the step-by-step tutorial: Tutorials: FUNDED on Kodiak Finance - YouTube

Live Walkthrough

I’m hosting a live stream with FOXIFY on my YouTube channel to break down the details:

How FUNDED works (for beginners)

Double cashout bonus payment (FCFS pool)

Using FUNDED on Kodiak for the $69K leaderboard

Q&A live

📅 Date: 15th January 2026

⏰ Time: 11am UTC

🔗 YouTube Live Link: HERE

Disclaimer: This promotion is subject to a limited shared reward pool. Once depleted, bonus payouts will no longer apply. Trading digital assets carries inherent risks. This message is for informational purposes only and should not be treated as financial advice. FUNDED/Foxify reserves the right to make changes at any time without prior notice.

The Market’s Green Light

The crypto market appears to be waiting for the green light from bitcoin that could lead to a fruitful rest of Q1.

Bitcoin

Bitcoin has officially broken out of its two-month range with a daily close above $94,000 on Monday.

As the chart shows, bitcoin has not closed above this region since the downtrend, which suggests it may be ready for upside expansion.

However, bitcoin must hold this region as support and not fall back into the range. If bitcoin can do this, then a gradual move up towards $107,000 is on.

Ethereum

Ethereum is also attempting to break the range, and give the signal it will follow bitcoin to the upside.

The move from $3,300 to $3,600 looks fairly easy should bitcoin continue to provide the right conditions.

However, the move to back above $4,000 is what most will be looking for and structurally, it aligns if bitcoin can begin its move to $100,000+.

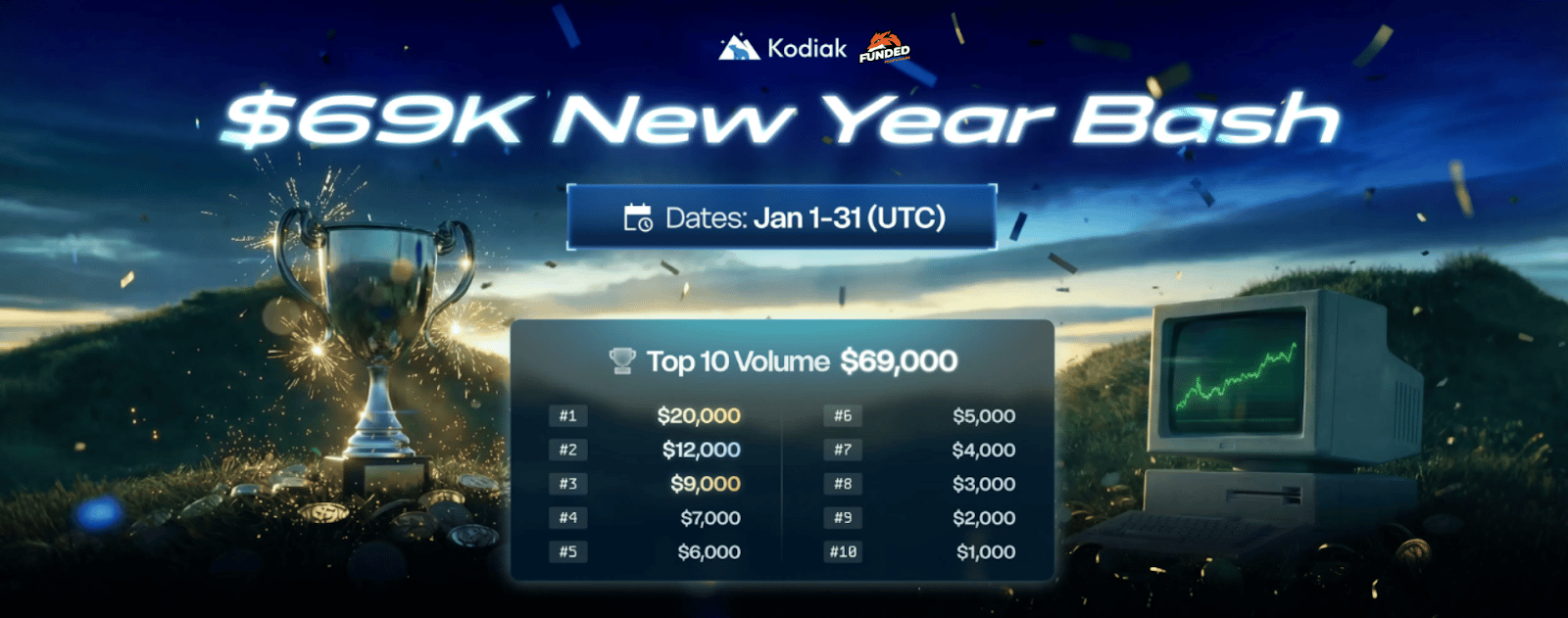

Solana

Looking at Solana, you can begin to draw a similar pattern across altcoins which is that they are pressing resistance and just awaiting the green light from bitcoin to begin expansion.

SOL looks very similar to ETH in that it is pressing resistance and has a logical upper target on the first leg of momentum.

Still, the $200 level looks to be the golden region and again it will depend on if bitcoin can provide the fuel.

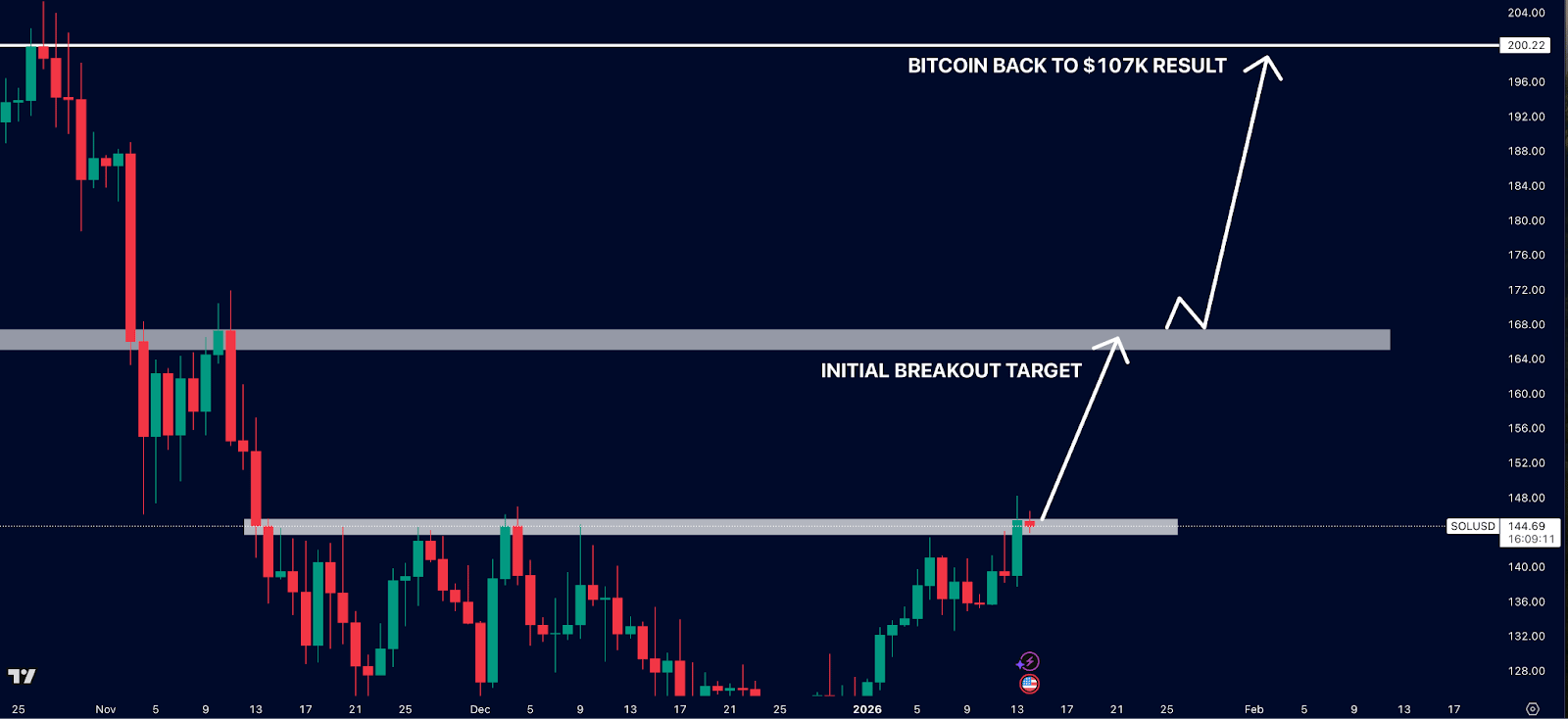

USDT Dominance

USDT dominance is one of the keys to unlock these moves.

It has reached the upside zone in which it has found exhaustion over the past two years. In every scenario since, it has dropped back towards 4%.

This means that USDT is flowing back into bitcoin and altcoins instead of investors selling assets into USDT.

This, alongside with how bitcoin and altcoins charts are looking, appears to be all the right ingredients for a rally for the rest of Q1.

Fear And Greed Index

The Fear and Greed Index scores 48 and has been flung into Neutral as a result of bitcoin’s Monday move.

With the price action aligning, sentiment could take a huge uplift in the following weeks, which could see the Index push back into Greed.

Two Down, One To Go

What a start to the year for assets. January saw green across the board, led by metals, equities and now crypto! This sets us up for quite an interesting year. There is a seasonal pattern from a book called Stock Traders Almanac (recommended reading) called the ‘Five Day Rule’, which says if the SP500 is green for the first 5 days, the chances of a positive year go up past 80%.

This gets more interesting when in the context of Hirshc’s January Trifecta, which if all three hit, sees the chance of a green year north of 90%!

The Three components are:

Santa Claus Rally (Yes)

First Five Days (Yes)

Positive January (Pending)

So what could be the key themes of the year?

Metals will continue to dominate as we see the continued build out for AI data centres and billions of dollars in capex. Key metals to watch for are Copper, Aluminium, Zinc and Rhodium.

All of these barring Rhodium are tradeable on PrimeXBT.

Charts for these can be found in our Discord

As mentioned in the prediction video (watch here if you haven’t already), energy looks to be the next bottleneck for the AI story, and with geopolitical tensions galore, we have seen Oil begin to rally upwards. This could be a theme throughout the year, and given the negative sentiment for oil and the bearishness in the space, this presents some great upside opportunities.

On my radar to cover today was a zone of interest in AMD, with $200 being a potential bounce zone. That was taken and a rally ensued, however I suspect it gets retested again at some point and may be worth marking on your chart.

AMD 8H Tradingview

Instead focus turns to Nvidia. January sees CES in Las Vegas (a big technology conference) where a lot was showcased. I was very impressed with the new Rubin platform which Jensen Huang introduced. TSM reports this week and following blockbuster earnings for the last few quarters, I expect this to continue. NVDA feels to be consolidating into a nice pattern, and with earnings at the end of February, the stock may see some volatility over the next month.

Crypto is heating up though and I am very much in altcoin search mode. All of my finds can be found in the CSE discord, for what promises to be a massive month!

NVDA 8H TradingView

Important Dates

Wednesday 14 January, 13:30 UTC - Producer Price Index (PPI)

The Bureau of Labour Statistics is also responsible for PPI, which measures the average change in commodity prices. Similar to core inflation, PPI removes volatile goods from its findings. The data is forecasted at 2.7%.

Wednesday 14 January, 13:30 UTC - US Retail Sales

The retail sales data is published by the Census Bureau and comprises two pieces of data: the month-over-month (MoM) and the control group.

The MoM figure measures the monthly changes in retail sales, demonstrating consumer confidence to spend money in the economy. This figure is forecast at 0.4%, with the previous figure at 0%.

The second figure is the control group, which measures the entire industry sales and estimates the personal consumption expenditures (PCE) for goods. The control group data isn’t forecasted.

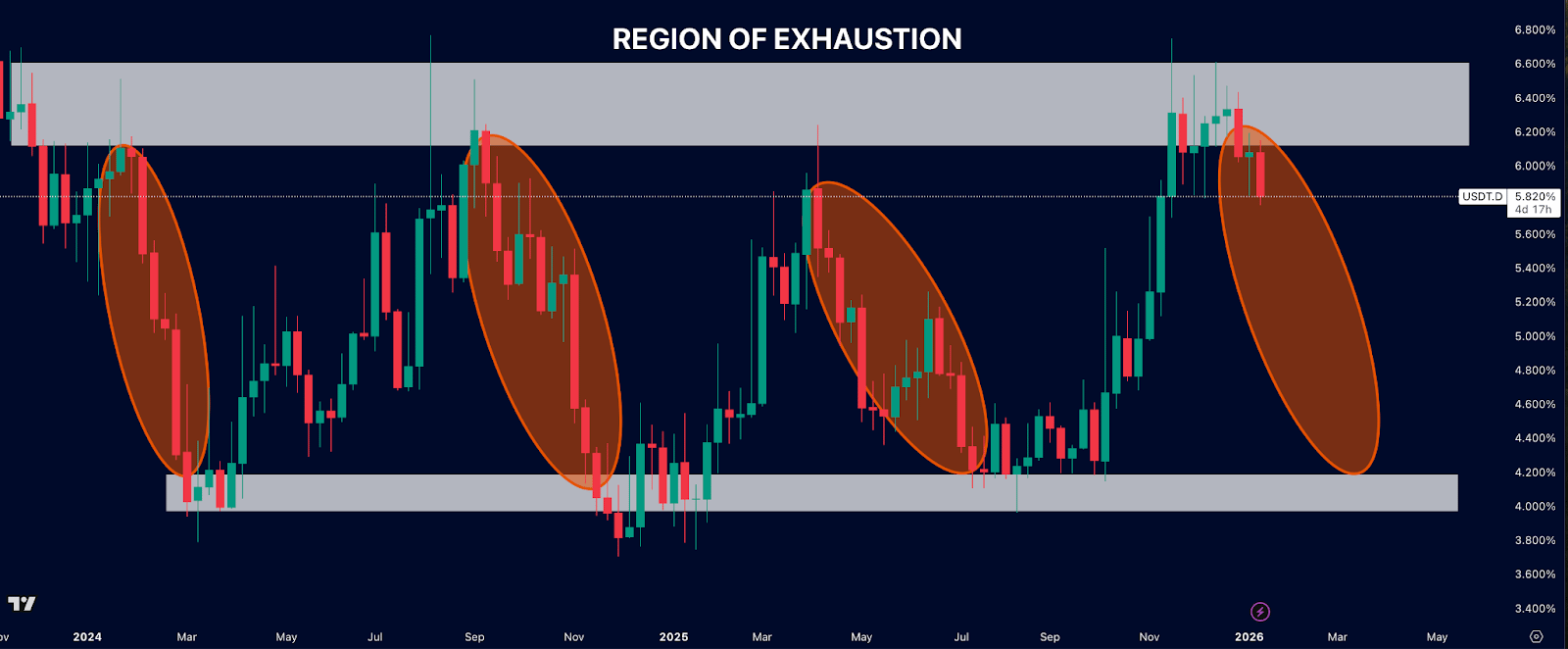

Gainers

Losers

Should Bitcoin Belong in 401(k)s? Volatility, Risk and the Retirement Debate

Is Bitcoin too volatile for retirement accounts? Bitwise CIO Matt Hougan says no, arguing crypto can be less volatile than major stocks, as US regulators and lawmakers clash over crypto in 401(k)s.

TL;DR

🟠 Bitwise CIO Matt Hougan says banning Bitcoin in 401(k)s is “ridiculous”

📉 Bitcoin has been less volatile than Nvidia over the past year

🏛️ Senator Elizabeth Warren warns crypto could endanger retirement security

📜 Trump-era policy shifts have opened the door for crypto in retirement plans

⏳ Crypto in 401(k)s may not arrive in 2026, but normalisation looks inevitable

🧠 Is volatility a real argument or a convenient excuse?

The debate over whether Bitcoin should be included in retirement accounts has reignited, with volatility once again at the centre of the argument. Chief Investment Officer Matt Hougan has argued strongly against the notion that Bitcoin is uniquely risky, calling previous efforts to block its inclusion in 401(k)s “ridiculous.”

“This is just another asset,” Hougan said during an Investopedia Express Live interview. “Is there risk? Absolutely. But it’s actually been less volatile than Nvidia over the last year, and nobody is banning Nvidia from 401(k)s.”

📊 Bitcoin vs. Nvidia: A volatility reality check

Hougan’s argument cuts straight to a long-standing inconsistency in retirement investing rules.

Over the past year:

👉Nvidia shares swung roughly 120%, from about $94 to over $207

👉Bitcoin moved around 65%, from roughly $76,000 to $126,080

Despite Nvidia’s extreme price movement, it remains a staple option in retirement portfolios, while Bitcoin is often treated as an unacceptable outlier.

For Hougan, that double standard exposes a deeper issue: crypto isn’t being judged by risk alone, but by unfamiliarity.

🏛️ Why regulators and lawmakers are nervous

On the same day Hougan made his comments, US Senator Elizabeth Warren pressed the Securities and Exchange Commission for answers on how it plans to protect retirement savers if crypto is allowed into 401(k)s.

In an open letter, Warren warned that:

👉 Crypto’s volatility could harm long-term retirement outcomes

👉 Alternative assets often carry higher fees

👉 Workers’ retirement savings should not be treated as “a playground for financial risk”

She has asked SEC Chair Paul Atkins to clarify how crypto assets would be valued, how market manipulation would be addressed, and whether the SEC will publish educational materials for investors.

📜 Policy shifts are quietly changing the landscape

Despite the political tension, the regulatory ground has already shifted.

👉 In August, US President Donald Trump signed an executive order directing the Labor Department to reevaluate restrictions on alternative assets in retirement plans

👉 In May, the Department of Labor formally adopted a neutral stance on crypto in 401(k)s, rescinding a 2022 release that discouraged the practice

This doesn’t mandate crypto inclusion, but it removes a major psychological and legal barrier.

For crypto firms, 401(k)s represent something bigger than capital flows: legitimacy inside the traditional financial system.

⏳ Is crypto in 401(k)s inevitable?

Hougan doesn’t expect a sudden rush of crypto-heavy retirement plans in 2026. Retirement providers move slowly, and reputational risk still matters.

But he believes the direction is clear.

“These are very slow-moving institutions,” Hougan said. “But eventually, it’ll be normalised like other assets, which is how it should be.”

The debate, then, may not be about whether Bitcoin enters retirement portfolios, but when, and under what guardrails.

🧩 The bigger question

At its core, the controversy isn’t really about volatility.

It’s about whether Bitcoin is treated as a legitimate asset class, judged by the same standards as stocks, or as something fundamentally different that requires special restrictions.

As institutional acceptance grows and volatility comparisons become harder to ignore, that distinction is becoming increasingly difficult to defend.

Vitalik Says Ethereum Has Finally Solved Crypto’s Biggest Problem

Ethereum co-founder Vitalik Buterin says the blockchain trilemma is no longer a theory, arguing new upgrades have solved decentralisation, security and scalability in live code.

TL;DR

🧩 Vitalik Buterin says Ethereum has “solved” the blockchain trilemma

🚀 PeerDAS is already live on mainnet after the Fusaka upgrade

🔐 zkEVMs are production-ready on performance, with security upgrades ongoing

🕰️ Full rollout expected over the next four years

🔺 Ethereum Claims A Trilemma Breakthrough

Ethereum co-founder Vitalik Buterin says Ethereum has reached a milestone many blockchains never do: solving the blockchain trilemma.

In a post on X over the weekend, Buterin argued that Ethereum’s recent and upcoming upgrades mean the network can now achieve decentralisation, security and scalability at the same time, in live code, not theory.

“The trilemma has been solved, not on paper, but with live running code,” Buterin said.

🧱 What Changed: PeerDAS And zkEVMs

The claim hinges on two major technical advances:

🔹 PeerDAS (Peer Data Availability Sampling)

Introduced with Ethereum’s Fusaka upgrade in December, PeerDAS allows the network to handle far more data without requiring every node to store everything. This significantly improves scalability while preserving decentralisation.

🔹 zkEVMs (Zero-Knowledge Ethereum Virtual Machines)

zkEVMs allow Ethereum blocks and transactions to be verified using zero-knowledge proofs, reducing computation while maintaining security. According to Buterin, zkEVMs are alreadyperformance-readybut still need further security hardening.

Together, Buterin says, these upgrades turn Ethereum into “a fundamentally new and more powerful kind of decentralised network.”

🧪 Still Early, But No Longer Theoretical

Buterin was clear that Ethereum is not “finished” yet.

🛠️ zkEVMs are still considered alpha from a security standpoint

📆 Small parts of the network are expected to begin using zkEVMs in 2026

🔒 Additional safety work remains before full adoption

However, he stressed that both halves of the solution now exist and function:

✅ PeerDAS is already live on mainnet

✅ zkEVMs are production-quality in performance

🗺️ Ethereum’s Roadmap From Here

Buterin outlined a multi-year rollout plan:

🟢2026: Larger gas limit increases and early zkEVM node operation

🟡2026–2028: Gas repricing, state structure changes, execution payloads moved into blobs

🔵2027–2030: zkEVMs become the primary method for validating Ethereum blocks

By the end of that process, zkEVMs are expected to sit at the core of Ethereum’s execution and validation model.

⏳ A Decade In The Making

Buterin said Ethereum’s trilemma breakthrough is the result of 10 years of sustained development, tracing the journey back to his first work on data availability in 2017.

“This was a 10-year journey… but it’s finally here,”he said.

The blockchain trilemma, balancing decentralisation, security and scalability, has long forced networks to compromise. Buterin pointed to Bitcoin as an example of a system that prioritises decentralisation and security but sacrifices throughput.

Ethereum, he argues, now sits in a different category.

🔮 Why It Matters

If Buterin’s assessment holds, Ethereum could be the first major blockchain to demonstrate that the trilemma is not a permanent constraint, but a technical challenge that can be engineered away.

For developers, institutions and long-term investors, that would mark a structural shift in how decentralised networks are evaluated, and what’s possible at a global scale.

Bitcoin Mining Is Getting Greener, And It Could Supercharge Clean Energy

Bitcoin mining is now 56.7% powered by sustainable energy, and experts say it could accelerate renewable deployment, cut methane emissions, and replace fossil-fuel heating worldwide.

TL;DR

♻️ 56.7% of Bitcoin mining now runs on sustainable energy, up from 34% in 2021

⚡ Mining acts as a buyer of last resort for renewables, speeding up new projects

🔥 Waste heat from mining replaces fossil-fuel heating in homes and industry

🌍 Bitcoin mining expands energy access in developing regions

💨 Mining helps eliminate methane emissions from flaring and landfills

🌍 Bitcoin Is Quietly Becoming a Green Energy Engine

Bitcoin mining is undergoing a rapid transformation.According totech investor and ESG analyst Daniel Batten, more than 56% of the Bitcoin network is now powered by sustainable energy, a figure that continues to rise.

“Bitcoin mining could be the century’s most important sustainable innovation,” Batten said, pointing to data compiled with analysts including Willy Woo and the Digital Assets Research Institute.

Just four years ago, the network was only 34% green. Today, it’s approaching levels that rival or beat many traditional industries, and Batten argues this is only the beginning.

⚡ Unlocking Renewable Energy Bottlenecks

One of the biggest challenges facing renewable energy isn’t generation, it’s grid access. Many solar and wind projects sit in 10–15 year interconnection queues before they can sell electricity.

Bitcoin mining changes that.

🟢 Miners act as instant buyers for stranded renewable projects

🟢 Payback periods drop from 8 years to ~3.5 years

🟢 Flexible demand helps stabilise grids with variable solar and wind

By monetising energy before grid connection, mining makes clean projects financially viable much sooner, encouraging more investment and faster rollout.

🔥 Replacing Fossil-Fuel Heating With Clean Heat

Around 50% of global energy consumption goes into heating, and most of it still relies on fossil fuels. Bitcoin mining produces large amounts of reusable waste heat, offering a cleaner alternative.

Real-world examples include:

🏘️ District heating in Finland, where mining heat warms 80,000 residents

🌱 Greenhouse heating in the Netherlands, powered by solar-linked mining

🏠 Bitcoin-powered home heaters, now commercially available

Instead of venting heat into the air, miners are increasingly feeding it back into homes, cities, and industrial processes.

🔬 Reviving Forgotten Renewable Technologies

Bitcoin mining isn’t just scaling existing renewables; it’s reviving abandoned ones.

Batten highlighted Ocean Thermal Energy Conversion (OTEC), a clean technology shelved in the 1980s due to poor economics. Mining can make OTEC viable by:

🌊 Providing revenue without grid connections

⚙️ Absorbing constant baseload energy

💡 Funding renewable R&D that markets once ignored

Mining is also powering off-grid microgrids in Africa, bringing electricity to 8,000 previously unconnected homes across Kenya, Malawi, and Zambia via projects like Gridless Compute.

💨 Slashing Methane And Carbon Emissions

Bitcoin mining is increasingly being deployed where emissions are worst:

🔥 Oil field gas flaring

🗑️ Landfill methane leaks

⚡ Gas peaker plants

Instead of venting or burning methane, a highly potent greenhouse gas, miners use it to generate electricity on-site.

📉 This converts wasted emissions into productive energy

📉 Reduces net greenhouse impact

📉 Already offsets an estimated 7% of Bitcoin’s total emissions

🌱 Bigger Than Bitcoin

Batten’s conclusion is clear: Bitcoin mining is no longer just about securing a network.

It now helps:

✅ Accelerate renewable energy deployment

✅ Replace fossil-fuel heating

✅ Expand electricity access

✅ Cut methane emissions at scale

As Batten put it:

“Bitcoin mining has emerged as a linchpin for addressing four systemic barriers to climate progress.”

Far from being an environmental liability, Bitcoin mining may be evolving into one of the most powerful climate-aligned energy tools of the modern era.

We’re excited to offer you a massive 35% discount!

What You Unlock:

- Strategies from top crypto experts

- Exclusive access to market insights, guides, and top tips

- Tools to maximise your crypto savings and investments

- A supportive community of like-minded crypto enthusiasts

- Access to our community Discord

Use the code 35OFF at checkout to claim your discount and get full access to our community plan for just a fraction of the price.

Secure your spot in the Crypto Saving Expert Community today.

Sponsored by: Stonksy

Stonksy is a momentum identifier that aims to capture expansive market moves before they happen by highlighting the start of potential price shifts. It can be used across all markets, including crypto, stocks, indices, commodities, and currencies.

Stonksy is growing in users week-on-week, proving why it aims to become one of the most-used indicators in the industry.

You can get 25% off the annual Stonksy plan with code TMG25, taking the price down to just £749.25 for an entire year of full access. Sign up today.

Find examples of Stonksy indications posted to the X every day: @stonksyio and learn how to use Stonksy and how it can benefit your trading system on the YouTube channel, with daily livestreams at 12:00 UTC.

This Newsletter is strictly for informational purposes only; the content is generic and has not been tailored in any way. Crypto Saving Expert UAB (“CSE”) is not providing, and should not be interpreted as providing, any form of offer of any currency, security, financial instrument or digital asset, or investment advice, recommendations or strategy. The content of this Newsletter is not intended to replace your own research with regard to any assets, products or services, and any action taken on the basis of this material is entirely at your own risk. CSE neither accepts nor assumes any liability or responsibility for any loss or damage arising out of, or in any way connected to, the Newsletter content. Cryptocurrencies and digital assets may be unregulated in your jurisdiction, any profits may be subject to tax and the value of any investment could fall.

If you click on a link within this Newsletter to go through to a provider, we may get paid. This usually only happens if you get a product/use a service from it. This is what helps fund CSE and keeps the majority of our content free to use. Two crucial things you should know about this, however: a) this never impacts our editorial recommendations, if something is included, it is because we independently rate it as the best; and b) you will always get as good a deal, or better, than if you went direct. For full details on how CSE is funded, please click here.

CSE collects, processes and stores certain data. Such data may be shared with CSE’s wholly owned subsidiary company, Crypto Saving Expert Limited. Please note that by submitting information about yourself to CSE you are consenting to such use. For full details on our collection, processing and storage of data, together with your rights in relation thereto, please consult our Privacy Statement here.