- Crypto Saving Expert's Newsletter

- Posts

- Crypto Saving Expert Newsletter - Issue 176

Crypto Saving Expert Newsletter - Issue 176

Gm! The market remains in a waiting phase, with patience being the only real strategy right now. Price action across crypto and traditional markets suggests that nothing meaningful happens until bitcoin makes its next decisive move. Until then, volatility stays compressed and sentiment stays muted.

Full story in today’s newsletter. 👇

Table of Contents

Sponsored by: PrimeXBT

Markets are tense. Gold and silver are moving strongly while crypto remains range-bound.

This is why multi-asset trading matters. On PrimeXBT, you can trade gold, FX, indices, commodities, and crypto from a single account.

Exclusive community deal: 0 trading fees on the PXTrader platform - 20% trading bonus. No need to switch platforms

Sign up using the link to access this offer HERE

The Market In Waiting

The crypto market appears at a crossroads, waiting until something notable occurs allowing bitcoin to make its move, while the bull market is still on for metals.

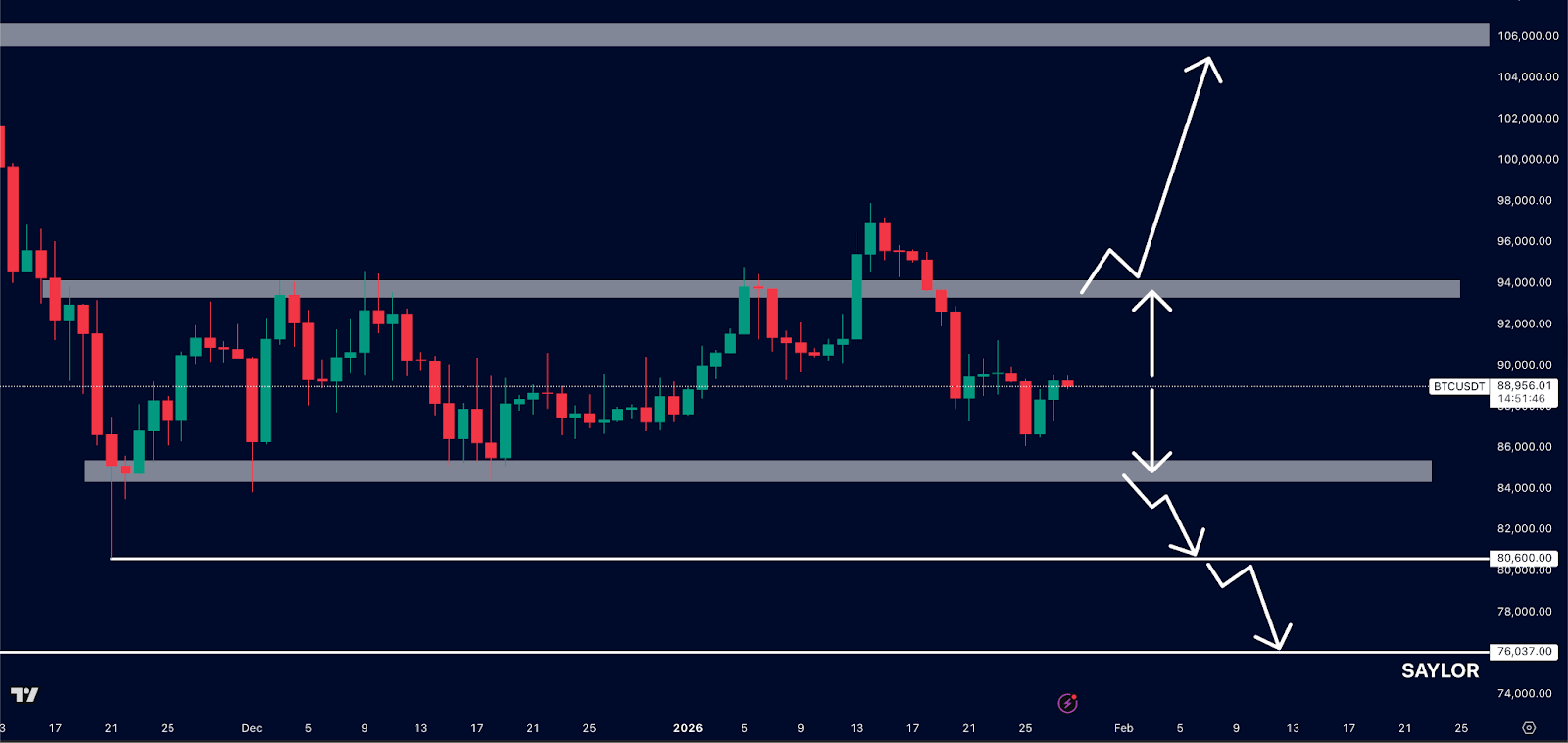

Bitcoin

Bitcoin is now spending more time within the range it has built since November.

This means it can freely trade between $85,000 and $94,000 without it meaning much at all aside from low time frame shifts in sentiment.

The real meaning behind bitcoin’s price action will begin once it breaks above or below the range. This will result in a push towards $100,000+ or a drop to $80,600 and then potentially Saylor’s entry at $76,000.

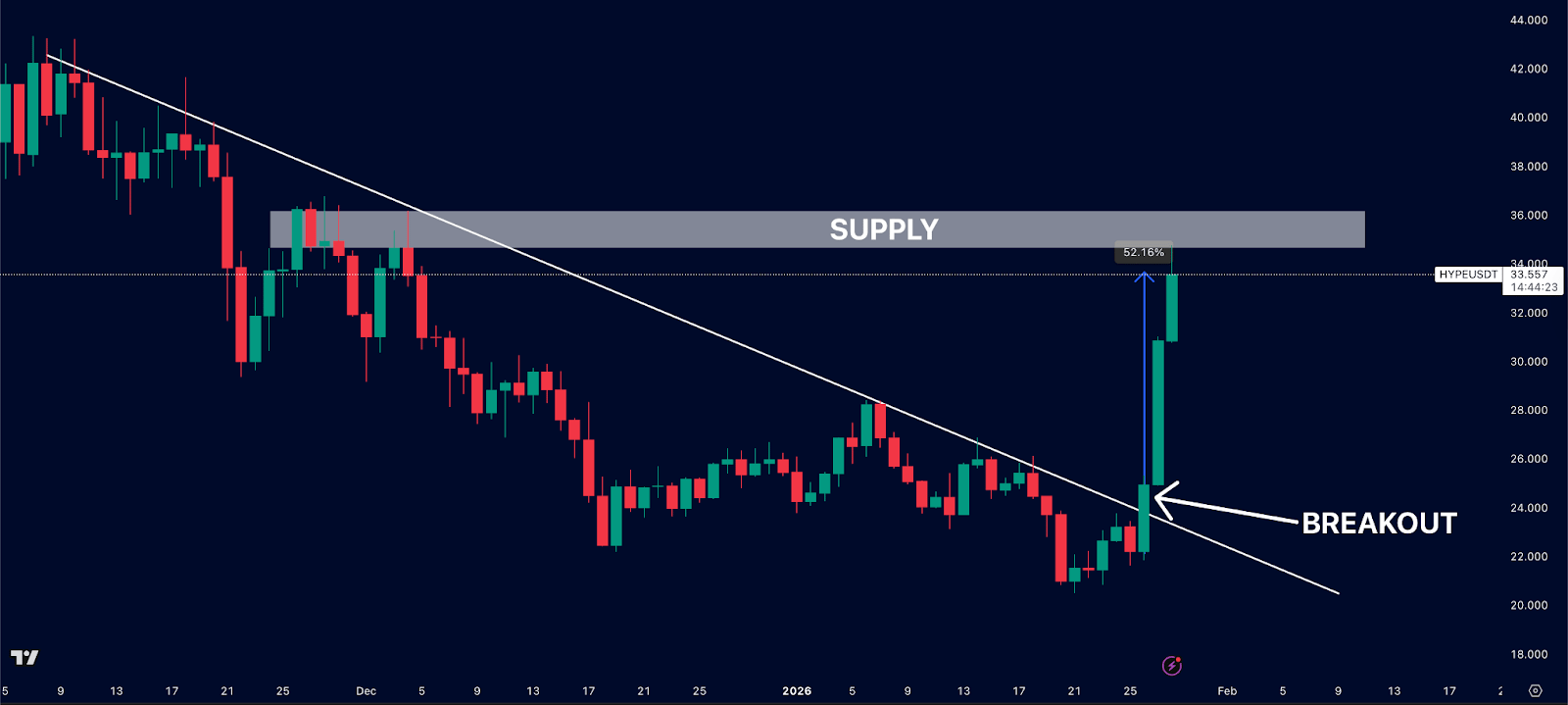

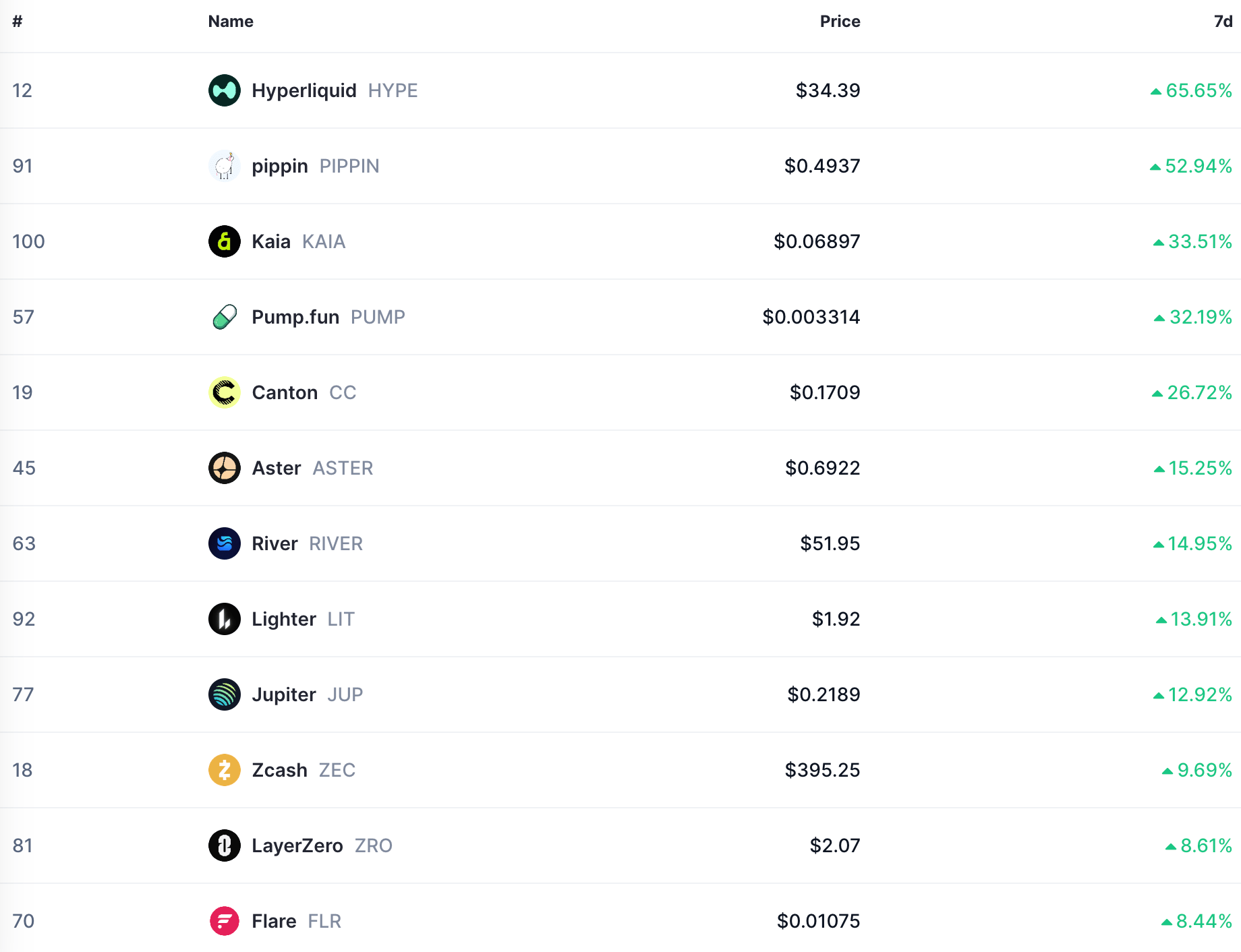

Hyperliquid

Hyperliquid has been the strongest performing large-cap this week by far as it broke the descending trendline and began an upside move.

HYPE is up 52% this week and did edge slightly higher as it rammed into supply. This region, in and around $35, will be a huge test for the price.

From here, we could see a drop off as profit taking commences, or if momentum continues, the door opens towards $40-$45.

TOTAL2

TOTAL2 has a consistent channel over the past two years.

It is now within the downside of the channel, where it finds support and demand. In theory, it should head towards the upside over the next six months as long as it doesn’t break to the downside.

If the channel holds, TOTAL2 could set a new all-time high this year, approaching $2 trillion.

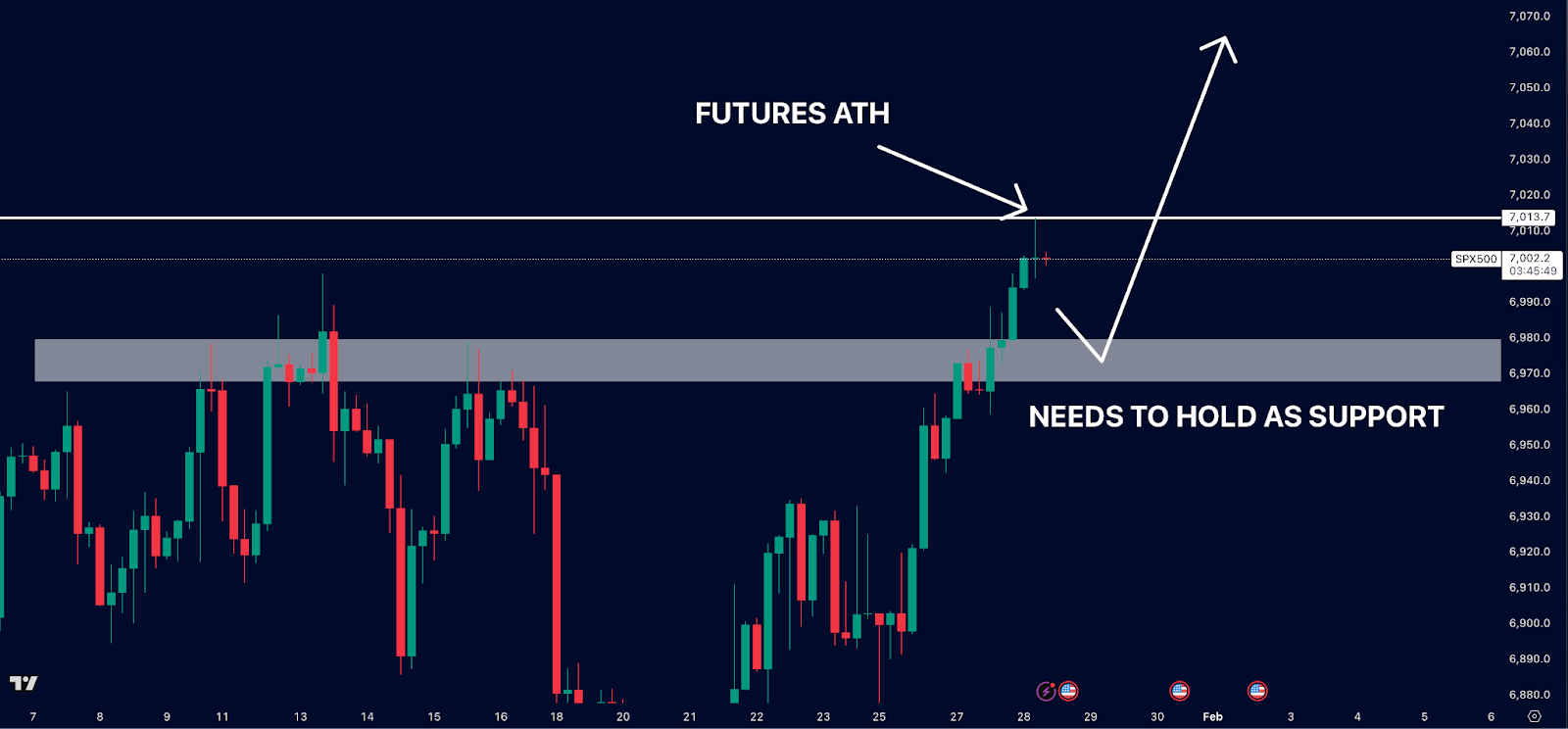

S&P 500

The S&P 500 reached an all-time high on Tuesday as it hit above $7,000 in futures hours.

This is significant as the sub-$7,000 region has been a testing region for the index as it proceeded to be rejected at resistance.

Still, it now has the chance to perform an S/R flip should it drop back down to test it from the upside. After several months of consolidation, the stock market may be about to begin its next leg higher.

Coinbase

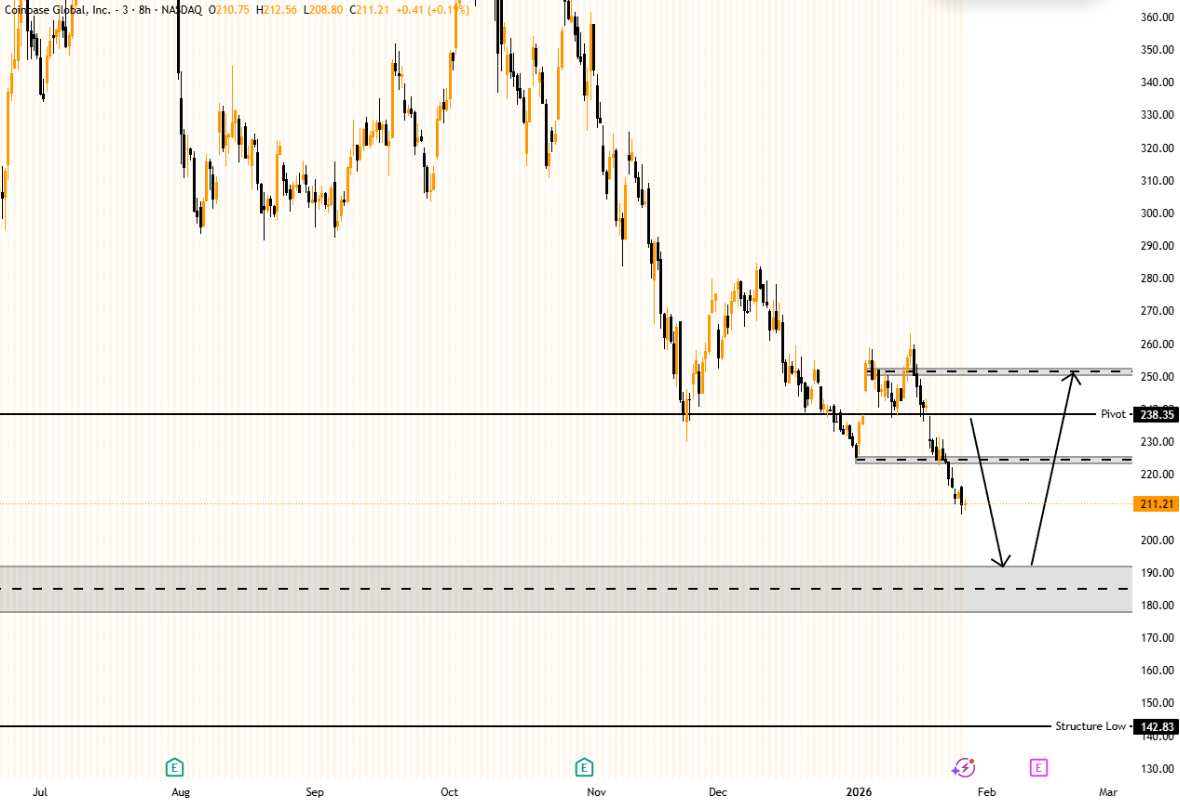

The stock very much on my radar is Coinbase ($COIN) which has retraced over 50% from the highs, sitting at ~$210 at time of writing. This presents a really interesting opportunity as we are now back at a level of support. However, I have my eye on a lower entry for a couple of reasons.

COINBASE $COIN 8hr - TradingView

The main being that there is a lot of liquidity sitting at the lower end of the OB, around $180. This presents a good opportunity for a rip and dip scenario. This is an asset that is correlated to the price of Bitcoin, and trades at a ~0.8 correlation to BTC, and has a 2-3x beta. This means that if the price of Bitcoin moves 10%, COIN will follow at around 20%-30%.

The trend for COIN is still down, and I’d want to see a reversal and some key level reclaims to be bullish. Given my thesis for BTC has more downside, my bias leans bearish, however the Risk Reward (RR) for the trade either way is not here for this entry, therefore I would target one of two set ups. Long from $180, or short the underside at $240.

You can trade COIN on PrimeXBT.

Fear And Greed Index

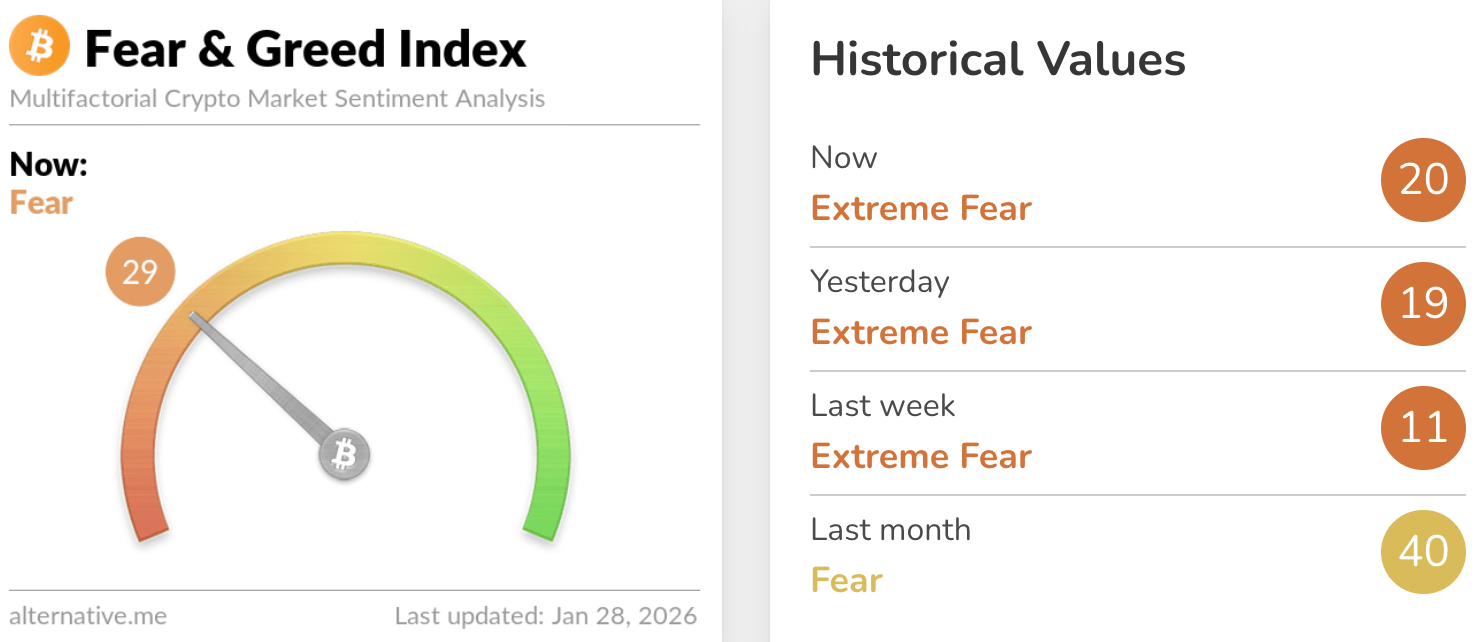

The Fear and Greed Index remains unchanged and within the Fear segment, scoring 29.

As covered above, nothing is likely to change until bitcoin makes a move out of this range, and sentiment is the same.

However, the breakout or breakdown is likely to cause a shockwave of panic or euphoria once it occurs.

Important Dates

Wednesday 28 January, 19:00 UTC - Fed Interest Rate Decision

The Federal Open Markets Committee meeting occurs eight times a year. The Fed meets to discuss recent economic data and the strength of the US economy and the expected decision is no change to rates.

The Federal Reserve is composed of a Board of Governors that assists its Chair, Jerome Powell, in making interest rate decisions and steering the US economy.

At 19:00 UTC, the Fed will announce its interest rate decision. Afterwards, a press conference will begin at 18:30, where Powell will conduct a 30-minute speech before taking questions from the press.

Friday 30 January, 13:30 UTC - Producer Price Index (PPI)

The Bureau of Labour Statistics is also responsible for PPI, which measures the average change in commodity prices. Similar to core inflation, PPI removes volatile goods from its findings. The forecast is set at 2.9%, with the previous data at 3%.

Gainers

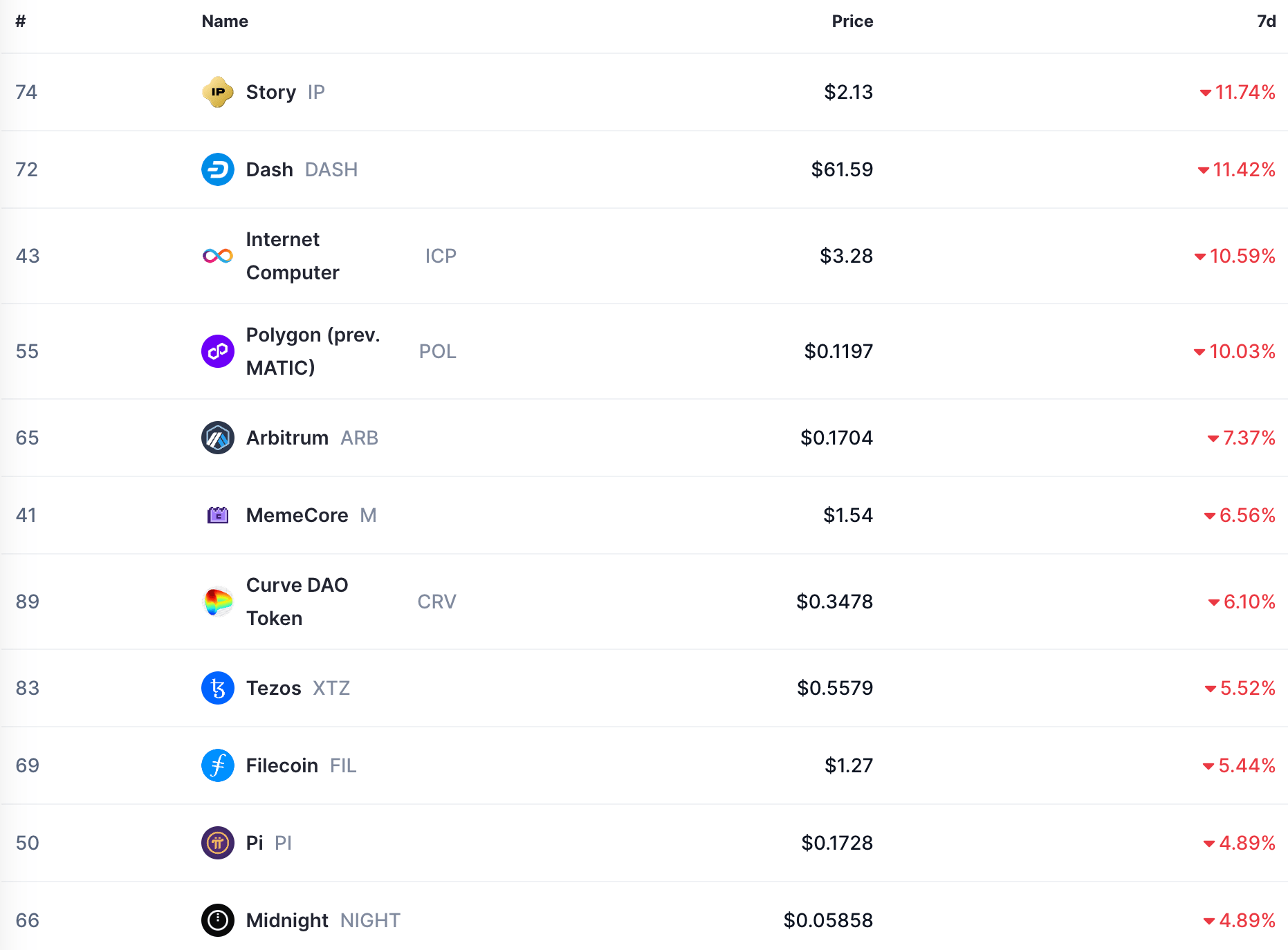

Losers

From NVDA to Bitcoin, Everything Is Secretly a Yen Trade

Japan’s yen carry trade may be the hidden force behind NVDA, Bitcoin and global risk assets, and as the BOJ tightens, a reverse carry trade could trigger a global margin call.

Markets love stories. They hate plumbing. Right now, that’s a problem.

While investors obsess over AI earnings calls, ETF flows, and Bitcoin narratives, the most important force shaping global risk may be coming from the most “boring” market on Earth: Japan 🇯🇵.

And if that force turns, it won’t just dent portfolios; it could trigger the long-awaited global margin call.

💤 The most important country nobody is watching

Japan hasn’t felt relevant to global investors in years. Low growth. Aging population. Yield-curve control. Zero rates forever. Or so the thinking went.

But that neglect is precisely the issue.

For decades, Japan’s ultra-low interest rates quietly turned the yen into the world’s funding currency, the cheapest leverage source on the planet. Investors borrowed in yen and recycled that capital into anything that moved: U.S. equities, credit, emerging markets… and eventually, crypto.

This wasn’t a headline trade. It was background radiation.

And like all background forces in markets, it conditioned behaviour. Risk felt safe. Leverage felt cheap. Drawdowns felt temporary.

🔌 How the yen became the global leverage engine

The mechanics are simple:

💴Borrow cheaply in yen

💵Convert to dollars

📈Buy higher-yielding or higher-beta assets

🔁Repeat

Do this at scale, across hedge funds, banks, prop desks and macro portfolios, and you get a world where risk assets fly, not because fundamentals are perfect, but because funding is.

This is the Japanese carry trade. And it didn’t just boost one market; it stitched together US equities, credit, and crypto into the same liquidity regime.

Which means they now share the same vulnerability.

🤖 NVDA: AI darling or carry-trade mascot?

Take NVIDIA.

Yes, the AI story is real. Yes, the earnings growth is staggering. But narratives alone don’t explain parabolic price action and extreme concentration.

As macro analyst Michael Gayed keeps hammering home, NVDA became the poster child of a carry-juiced market, a perfect vehicle for leveraged capital to pile into the same trade.

When funding is cheap, great stories become systemic risks.

That’s why Gayed warns that NVDA isn’t just a stock anymore. It’s a node. A crowded, levered, liquidity-dependent node. And when that node breaks, it doesn’t fall quietly.

It takes things with it.

₿ Bitcoin and the yen: the uncorrelated myth cracks

Bitcoin was supposed to be different.

Uncorrelated. Digital gold. Immune to central banks.

Yet recently, something uncomfortable has appeared: Bitcoin and the Japanese yen have started moving together.

That shouldn’t happen unless Bitcoin is now part of the same global liquidity plumbing.

The implication is brutal: If BTC dances to BOJ funding conditions, then it’s not insulated. It’s integrated.

From megacap tech to crypto, the carry regime stretches everywhere. And when the funding leg snaps back, everything pays.

From NVDA to Bitcoin, everything is secretly a yen trade.

🔄 The reverse carry: when leverage turns predator

Here’s the part markets don’t want to price.

The Bank of Japan is no longer asleep.

Governor Kazuo Ueda has made it clear: if inflation and growth allow, rates will rise. Slowly, maybe but directionally, the era of free yen is ending.

That’s where the carry trade flips.

Higher Japanese rates mean:

💸More expensive funding

🦾Stronger yen

📉Forced deleveraging

And deleveraging doesn’t ask politely.

Positions get cut. Correlations spike. Liquidity vanishes. Assets that were “long-term convictions” become sources of cash.

That’s the reverse carry trade, and it’s how local policy becomes a global margin call.

🧠 Opinion: markets are pricing stories, not plumbing

Right now, markets are still worshipping narratives:

🤖AI will fix everything

🦔Bitcoin is a hedge

☠️Volatility is dead

💦Liquidity will always be there

But plumbing doesn’t care about stories.

Funding conditions determine survivability. And the global system is still leaning on a structure built for zero-rate Japan, a structure that no longer exists.

Risk management in 2026 isn’t about earnings beats or on-chain metrics alone. It’s about watching yen strength, BOJ signaling, and carry stress as closely as you watch CPI or ETF flows.

⚠️ What a Japan-driven margin call could look like

It won’t come with a press release. It’ll look something like this:

1️⃣ BOJ signals more tightening

2️⃣ Yen strengthens aggressively

3️⃣ Carry books unwind

4️⃣ Crowded trades gap lower

5️⃣ NVDA rolls over

6️⃣ Bitcoin sells off with equities

7️⃣ Credit spreads widen

The timing is unknowable. The structure is not.

That’s why Gayed’s tone is so stubborn, so fatalistic: plumbing always wins. Markets can ignore it for months, even years, but never forever.

🧯 Final thought

Japan doesn’t trend on X.

The yen doesn’t ring a bell.

And carry trades don’t announce themselves.

But when the funding engine flips into a risk engine, the shock won’t feel “Japanese” at all. It’ll feel global.

Did Q4 2025 Mark the End of the Crypto Bear Market?

Bitwise says Q4 2025 showed classic “bear market bottom” signals, with weak prices but surging fundamentals across Ethereum, DeFi and stablecoins.

⚡ TL;DR

🧠 Bitwise believes Q4 2025 may have marked the crypto bear market bottom

📊 Prices lagged, but fundamentals strengthened sharply

🔁 Similar setup to early 2023 after the FTX collapse

🧱 Ethereum, DeFi and stablecoins all hit record usage levels

🔮 2026 outlook is mixed, but structural tailwinds are building

The fourth quarter of 2025 may have quietly marked the end of the crypto bear market, according to a new report from asset manager Bitwise.

In a note shared this week, Bitwise Chief Investment Officer Matt Hougan said Q4 was defined by contradiction: weak price performance paired with strong and improving fundamentals. That divergence, he argues, is often what markets look like at major turning points.

🕰️ A Familiar Pattern From 2023

Hougan compared the current setup to early 2023, when crypto was emerging from the fallout of the FTX collapse.

At the time, Bitcoin was trading near $16,000, sentiment was deeply negative, and on-chain and business metrics sent mixed signals. Over the following two years, however, crypto prices surged dramatically, with Bitcoin peaking near $98,000 by early 2025.

“The data was topsy-turvy; some up, some down, some sideways,”Hougan said.“In the two years that followed, crypto prices soared.”

Hougan believes the same conditions are forming again, not at the top, but near the bottom.

📊 Prices Weak, Fundamentals Strong

According to Bitwise, Q4 2025 showed a rare and telling split between price action and network health.

Hougan highlighted four trends that stood out:

🔗 Ethereum and Layer-2 Activity Exploded

Transaction volumes on Ethereum and its layer-2 networks surged to all-time highs in Q4, driven by cheaper fees, improved infrastructure and growing real-world usage.

💼 Crypto-Native Revenues Keep Growing

Despite falling token prices, crypto companies continued to post strong revenue growth. Hougan argued the sector is now outperforming many traditional industries on growth metrics typically rewarded in equity markets.

💵 Stablecoins Enter a Supercycle

Stablecoin usage and assets under management increased sharply, with total market capitalisation surpassing $300 billion for the first time. Bitwise sees this as a sign that crypto is increasingly being used for payments, settlements and financial plumbing, not just speculation.

🧠 DeFi Adoption Remains Resilient

Decentralised finance also showed surprising strength. Hougan pointed out that Uniswap now consistently processes more transaction volume than Coinbase, a milestone that underscores how far on-chain markets have matured.

“That’s the kind of divergence you get at the bottom of bear markets when sentiment is down, but fundamentals are up,”Hougan said.

🔮 What Does 2026 Hold?

Not everyone agrees on what comes next.

📉Fundstrat’s Tom Lee expects crypto markets to struggle for much of 2026 before potentially rallying late in the year, citing tariffs and geopolitical uncertainty.

📈VanEck, on the other hand, expects a more immediate “risk-on” rebound in early 2026 as fiscal clarity improves and macro conditions stabilise.

Hougan leans cautiously bullish, pointing to several potential catalysts ahead:

🏛️ Progress on the CLARITY Act

💲 Continued expansion of stablecoins

🪑 A new US Federal Reserve chair

🏦 Major wirehouses opening access to crypto ETFs

🧩 Bottom-Line Takeaway

Bitwise isn’t calling for a straight-line rally, but it is suggesting something more important: The worst may already be behind us.

If history rhymes, Q4 2025 may be remembered not for weak prices, but as the moment when crypto quietly laid the groundwork for its next cycle just as it did in early 2023.

Gold Smashes $5,000 as Bitcoin Slides: Safe-Haven Narrative Takes Over

Gold has surged past $5,000 amid trade tensions and shutdown fears, while Bitcoin slips toward $86k, highlighting a sharp divergence in global risk appetite.

TL;DR 🧠

🥇Gold breaks $5,000as investors pile into traditional safe havens ₿ Bitcoin drops toward $86k, wiping out 2026 gains ⚠️ Geopolitical risk, tariff threats and shutdown fears are driving the split 🔄 Investors are choosing gold over Treasuries and over crypto

Gold goes full panic hedge 🏆

Gold prices surged to a fresh all-time high above $5,080 on Monday, extending a powerful rally that’s now up 17% year-to-date and more than 80% year-on-year. The move reflects a sharp rise in macro anxiety. Markets are increasingly pricing in: 👉 A potential US government shutdown 👉 Escalating global trade tensions 👉 Renewed tariff threats from Donald Trump, including talk of a 100% tariff on Canada As the Kobeissi Letter put it bluntly, a shutdown risk “added fuel to the fire for precious metals.” Gold isn’t just acting like a hedge; it’s acting as the only hedge investors trust right now. Silver has followed suit, ripping past $107 per ounce for the first time and gaining nearly 50% in 2026.

Bitcoin slips as the divergence widens ₿⬇️

Bitcoin, meanwhile, is doing the opposite. BTC slid below $86,000 late Sunday, erasing all of its gains for the year and leaving the asset roughly 30% below its October peak near $126,000. The long-touted “Bitcoin = digital gold” narrative is under real pressure. Over the past year: 🥇Gold is up ~83% ₿ Bitcoin is down ~17% That gap keeps widening, and markets are noticing.

Even ETH lost the $5K race 😬

The shift in sentiment was underscored by a symbolic moment: gold beat Ethereum to $5,000. A long-running bet on Polymarket settled in gold’s favour after ETH crashed below $2,800 over the weekend. Ether is now more than 40% down from its all-time high, reinforcing the idea that speculative assets are being de-risked across the board.

Why gold, not Treasuries, is winning 🏦❌

Normally, periods like this would funnel capital into US Treasuries. But this time is different. According to Jeff Mei, COO of BTSE, investors are wary of government dysfunction itself: “Because of the potential government shutdown and recent tariff threats, global investors are less inclined toward Treasuries and more toward gold.” Add in expectations that the Federal Reserve will hold rates higher for longer, and you get a setup where: Bonds don’t feel safe Risk assets don’t feel safe Gold does Bitcoin, for now, is still trading like a liquidity-sensitive risk asset, not a crisis hedge.

The bigger picture 🔍

This isn’t just about price action. It’s about what investors trust when stress rises. Right now, markets are voting clearly: 🟡 Gold = protection 📉 Crypto = volatility ❓ Treasuries = political risk Whether Bitcoin eventually reclaims its safe-haven narrative remains an open question. But in this moment with tariffs, shutdown fears and geopolitical uncertainty piling up, old-school fear is beating new-school scarcity.

We’re excited to offer you a massive 35% discount!

What You Unlock:

- Strategies from top crypto experts

- Exclusive access to market insights, guides, and top tips

- Tools to maximise your crypto savings and investments

- A supportive community of like-minded crypto enthusiasts

- Access to our community Discord

Use the code 35OFF at checkout to claim your discount and get full access to our community plan for just a fraction of the price.

Secure your spot in the Crypto Saving Expert Community today.

Sponsored by: Stonksy

Stonksy is a momentum identifier that aims to capture expansive market moves before they happen by highlighting the start of potential price shifts. It can be used across all markets, including crypto, stocks, indices, commodities, and currencies.

Stonksy is growing in users week-on-week, proving why it aims to become one of the most-used indicators in the industry.

You can get 25% off the annual Stonksy plan with code TMG25, taking the price down to just £749.25 for an entire year of full access. Sign up here.

Find examples of Stonksy indications posted to the X every day: @stonksyio and learn how to use Stonksy and how it can benefit your trading system on the YouTube channel, with daily livestreams at 12:00 UTC.

This Newsletter is strictly for informational purposes only; the content is generic and has not been tailored in any way. Crypto Saving Expert UAB (“CSE”) is not providing, and should not be interpreted as providing, any form of offer of any currency, security, financial instrument or digital asset, or investment advice, recommendations or strategy. The content of this Newsletter is not intended to replace your own research with regard to any assets, products or services, and any action taken on the basis of this material is entirely at your own risk. CSE neither accepts nor assumes any liability or responsibility for any loss or damage arising out of, or in any way connected to, the Newsletter content. Cryptocurrencies and digital assets may be unregulated in your jurisdiction, any profits may be subject to tax and the value of any investment could fall.

If you click on a link within this Newsletter to go through to a provider, we may get paid. This usually only happens if you get a product/use a service from it. This is what helps fund CSE and keeps the majority of our content free to use. Two crucial things you should know about this, however: a) this never impacts our editorial recommendations, if something is included, it is because we independently rate it as the best; and b) you will always get as good a deal, or better, than if you went direct. For full details on how CSE is funded, please click here.

CSE collects, processes and stores certain data. Such data may be shared with CSE’s wholly owned subsidiary company, Crypto Saving Expert Limited. Please note that by submitting information about yourself to CSE you are consenting to such use. For full details on our collection, processing and storage of data, together with your rights in relation thereto, please consult our Privacy Statement here.