- Crypto Saving Expert's Newsletter

- Posts

- Crypto Saving Expert Newsletter - Issue 177

Crypto Saving Expert Newsletter - Issue 177

Gm! This is one of those weeks that defines cycles. Bitcoin has swept major lows, fear is extreme, and price is sitting at levels that previously marked the end of selling pressure. Either the market finds its footing here, or we get one last flush into what could be a golden opportunity.

All key levels, scenarios, and important dates are laid out in today’s newsletter. 👇

Table of Contents

Sponsored by: PrimeXBT

Markets are tense. Gold and silver are moving strongly while crypto remains range-bound.

This is why multi-asset trading matters. On PrimeXBT, you can trade gold, FX, indices, commodities, and crypto from a single account.

Exclusive community deal: 0 trading fees on the PXTrader platform - 20% trading bonus. No need to switch platforms

Sign up using the link to access this offer HERE

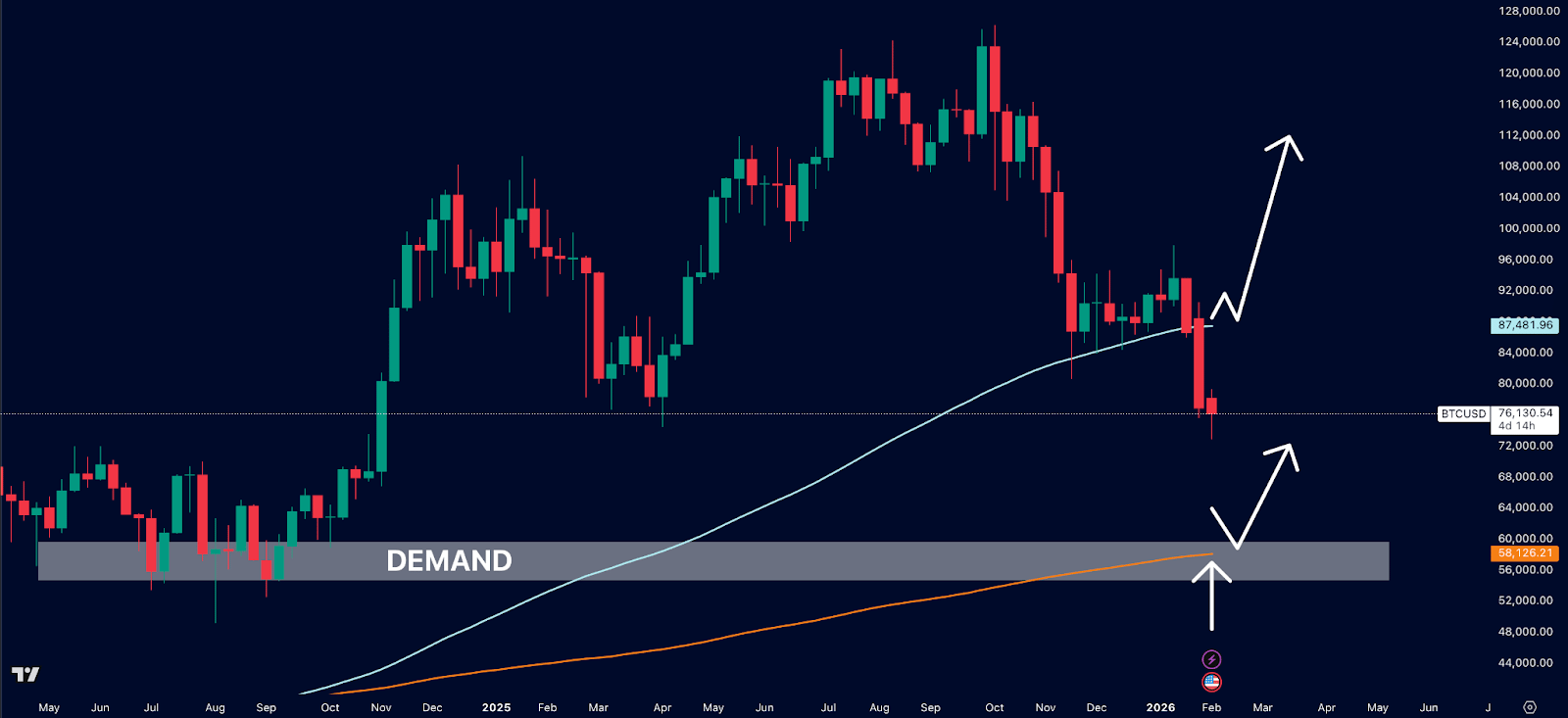

Bitcoin’s Do Or Die Moment

Bitcoin is on the cusp of either forming a bottom or seeing a final leg down into what could be a golden opportunity.

Bitcoin

Bitcoin has dropped over 42% from its all-time high in what has become its biggest pullback since the run began from $16,000.

This extended drop saw it sweep the 2025 low, but from there it has initially bounced.

During this time, Saylor’s entry has been met and dipped below, a major market event.

However, the price does remain in demand as this is where the selling stopped last year.

Weekly MAs

There are two vital moving averages we need to pay attention to on the weekly chart.

The 100WMA has been lost and now remains a point where, if reclaimed, bitcoin has a bullish outlook.

To the downside, the 200WMA may be waiting to be tested. Interestingly, this also lines perfectly with 2024 demand and again, a point where selling stopped and buying pressure took over.

We can't speak with certainty, but what we can say is anywhere in and around that downside point could offer a golden opportunity.

CME Gap

Bitcoin has a huge CME gap open and one of the largest in a long time.

This runs all the way up to $84,500 and offers a glimmer of hope for upside price action this week.

Still, this alone would not be enough to confirm a trend shift if it does get filled.

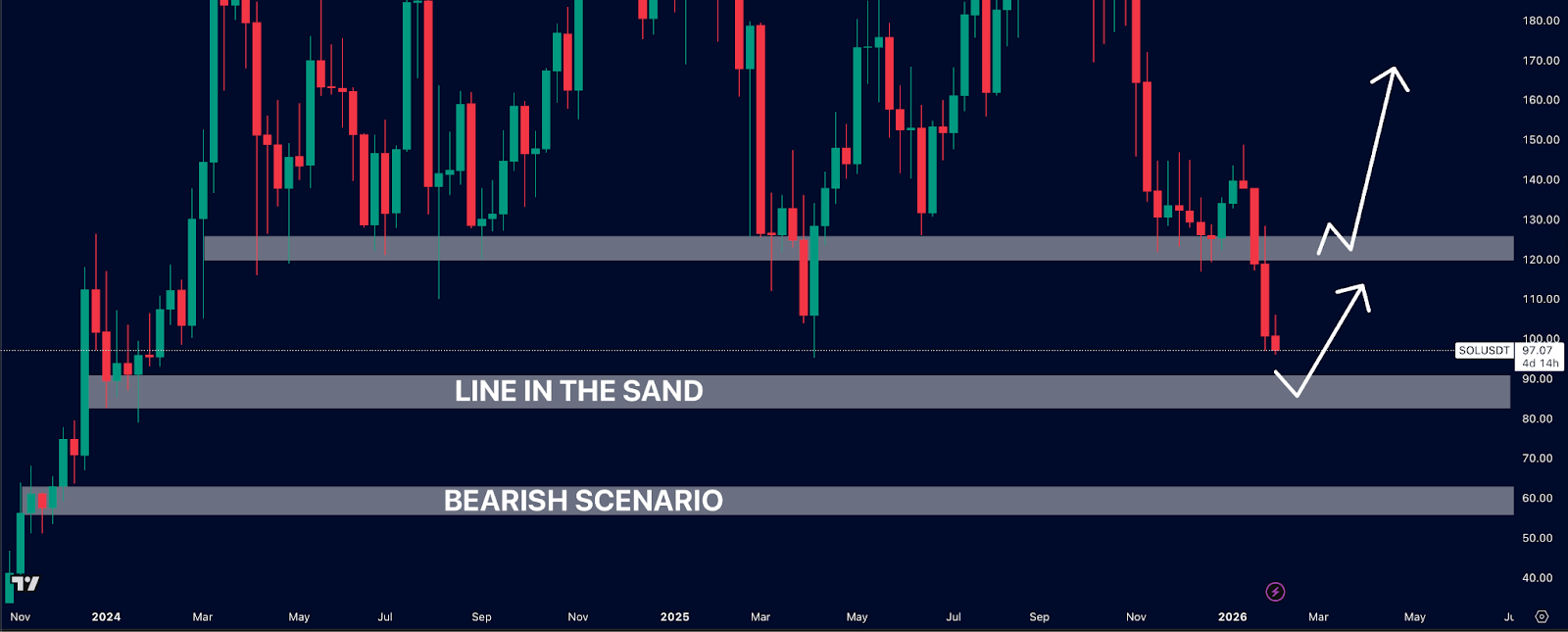

Solana

Solana, like many altcoins are staring down the barrel of either a huge opportunity or another drop.

SOL is very close to coming into weekly demand, around the $85 region. This would offer a reasonable place for the price to hold.

Still, the market very much depends on bitcoin and if it does indeed drop lower, the $60 region is a bearish scenario but also a huge opportunity.

Hyperliquid

In a week where prices have been in decline and chaos has prevailed in traditional finance, one crypto name has stood out above the rest. HYPE, the native token for L1 dex Hyperliquid has been an immense performer, soaring 87% from its lows. The long from $21.40 was glorious, and then a secondary scalp from $27.50 last week (for those in the Discord) was a great move. The token respected our levels and cooled off following the run.

I have some targets lined up for this, with zones at $31 and $28. I don’t think this narrative is dead and expect this to be a strong performer, and potentially one of the best majors to own.

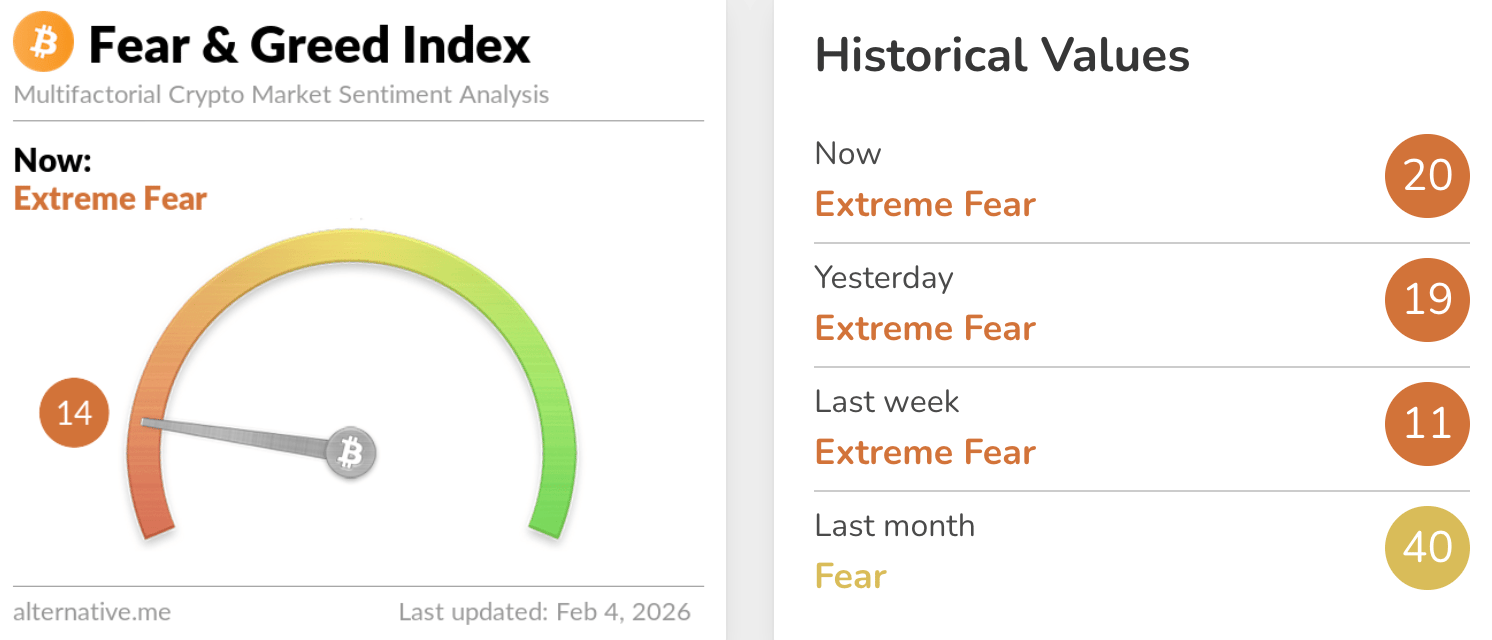

Fear And Greed Index

The Fear and Greed Index is deep within Extreme Fear as Bitcoin’s next move looks uncertain.

After hitting the lowest levels in over a year, market participants are scared and panicked, with the next move absolutely pivotal.

Important Dates

Wednesday 4 February, 13:15 UTC - ADP Employment Change

Automatic Data Processing Inc. (ADP) releases employment change for the US. A higher figure is bullish for the markets due to increased employment, which suggests economic strength.

The consensus is set at 48,000, with the previous data coming in at 41,000.

Wednesday 4 February, 15:00 UTC - ISM Services PMI

The Institute for Supply Management (ISM) releases this data, with it providing a measure of the US non-manufacturing sector. It is considered positive if the figure is above the 50 mark, with the forecast at 53.5.

Friday 6 February, 14:00 UTC - Michigan Consumer Sentiment Index

The University of Michigan releases the index, which is a survey depicting consumer confidence in the economy. The survey provides insight into consumers’ confidence to spend money within the US economy.

The Index’s score is set to come in at 55, with the previous data coming in at 56.4.

Gainers

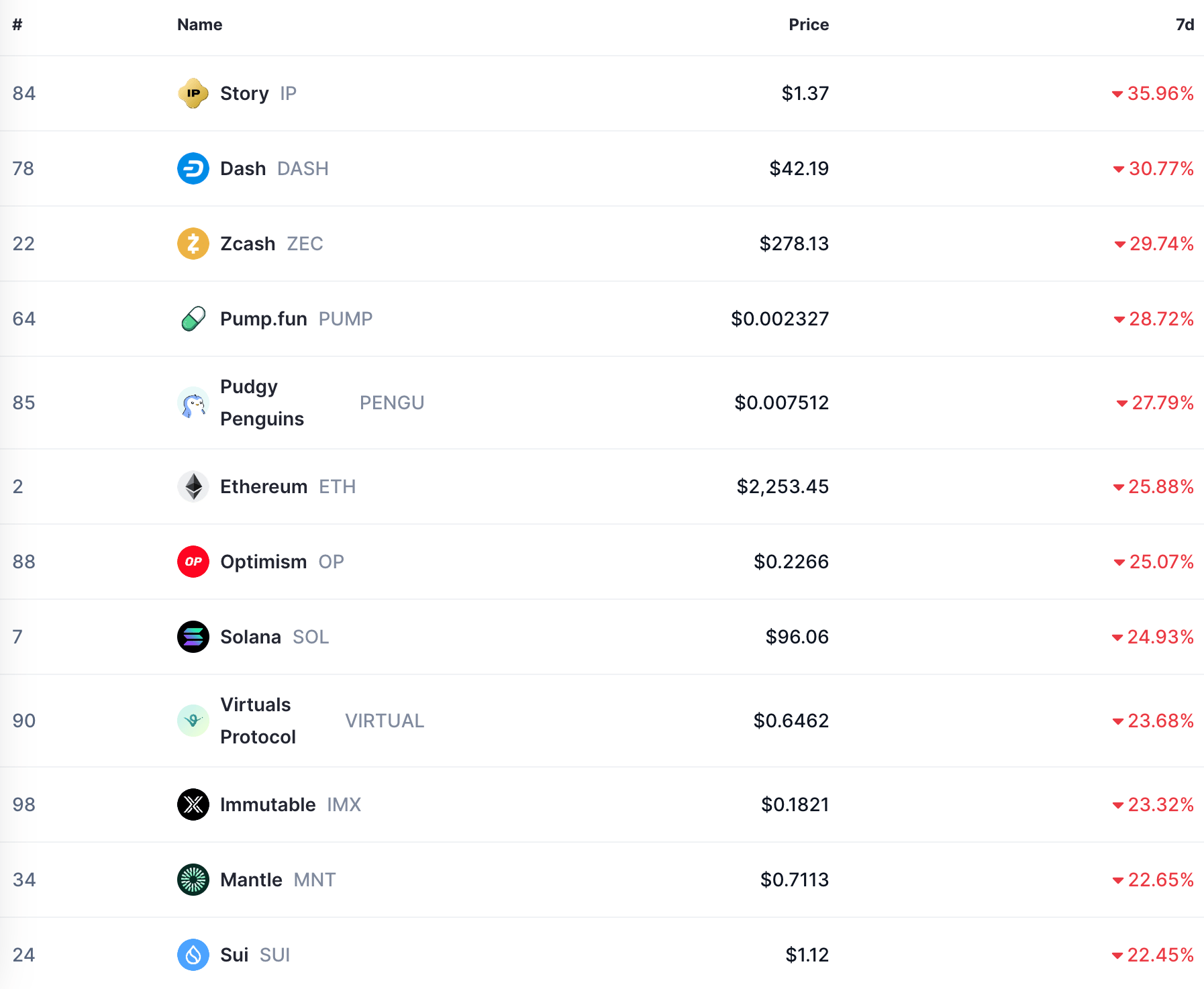

Losers

Spot Bitcoin ETF Assets Slip Below $100bn as Outflows Resume

Spot Bitcoin ETF assets fell below $100bn after fresh outflows, as Bitcoin slid under $74,000 and crypto markets sold off.

⚡ TL;DR

👉 Spot Bitcoin ETF assets dropped below $100bn for the first time since April 2025

👉 $272m in net outflows hit ETFs on Tuesday as Bitcoin fell under $74,000

👉 Total crypto market cap shed nearly $500bn in a week

👉 Altcoin ETFs quietly attracted small inflows

👉 Institutions may be preparing to move beyond ETFs and trade crypto directly

Assets held in spot Bitcoin ETFs slipped below the psychologically important $100bn mark on Tuesday, following $272m in net outflows, according to data from SoSoValue.

It’s the first time ETF assets under management have fallen below $100bn since April 2025, a sharp reversal from October’s peak near $168bn, when Bitcoin optimism was running hot.

The move comes as Bitcoin plunged below $74,000, dragging the broader crypto market lower in a sell-off that wiped roughly $470bn off total market capitalization in just one week, per CoinGecko.

🧊 Bitcoin ETFs bleed again after brief rebound

Tuesday’s outflows followed a short-lived bounce on Monday, when spot Bitcoin ETFs pulled in $562m in fresh capital a reminder of just how volatile flows have become.

That rebound didn’t last.

With Tuesday’s losses, year-to-date net outflows from spot Bitcoin ETFs now approach $1.3bn, underscoring how sensitive ETF demand has become to price action and macro stress.

Notably, Bitcoin is now trading well below the ETF creation cost basis of around $84,000, meaning new ETF shares are effectively being issued at a loss a dynamic that tends to discourage fresh inflows.

🌱 Altcoin ETFs quietly attract inflows

While Bitcoin funds were bleeding, altcoin-linked ETFs showed modest resilience:

👉Ether ETFs: +$14m

👉XRP ETFs: +$19.6m

👉Solana ETFs: +$1.2m

The flows are small, but the contrast matters. It suggests that some allocators may be diversifying away from Bitcoin-only exposure, rather than exiting crypto altogether.

🏦 Are institutions moving beyond ETFs?

Despite the drawdown, several industry voices argue that ETF investors are unlikely to panic-sell.

ETF analyst Nate Geraci noted on X that the vast majority of spot Bitcoin ETF assets are likely to stay put, even amid volatility.

Institutional liquidity provider B2C2 CEO Thomas Restout echoed that view but added an important twist.

“The benefit of institutions coming in and buying ETFs is they're far more resilient. They will sit on their views and positions for longer.”

However, Restout suggested the next phase of institutional adoption may bypass ETFs entirely.

“We’re expecting the next wave of institutions to be the ones trading the underlying assets directly.”

In other words: ETFs may have been the on-ramp, not the endgame.

🧠 Big picture

The dip below $100bn isn’t a death knell for Bitcoin ETFs but it is a reminder that:

👉 ETF flows are still price-sensitive, not purely strategic

👉 Bitcoin’s volatility cuts both ways for institutional products

👉 Institutional crypto adoption may be evolving, not retreating

If the next wave really does shift toward onchain trading and direct exposure, ETF flows could become a lagging indicator not the main event.

For now, though, the message from the tape is simple: risk is being repriced, and Bitcoin ETFs aren’t immune.

If you want, next we can:

👉 Zoom out and compare this ETF drawdown to previous BTC cycle pullbacks

👉 Tie this into liquidity, rates, and the yen carry trade

👉 Or frame it as“ETFs were step one here’s what step two looks like”

Crypto’s $250bn Wipeout Isn’t a Crypto Problem It’s a US Liquidity Problem

Raoul Pal argues crypto’s $250bn crash isn’t a broken cycle, but a temporary US liquidity squeeze hitting all long-duration assets.

🧠 TL;DR

👉 Crypto didn’t break, liquidity did

👉 Bitcoin and SaaS stocks are falling together, pointing to a macro liquidity drain, not sector failure

👉 Gold soaked up marginal liquidity, starving risk assets

👉 US Treasury plumbing issues and government shutdowns worsened the squeeze

👉 Raoul Pal remains very bullish for 2026, expecting liquidity to return fast

A brutal weekend selloff wiped more than $250bn off the crypto market, reigniting the familiar chorus:“Bitcoin is broken. The cycle is over.”

Raoul Pal doesn’t buy it, and his argument cuts straight through the noise.

According to the Global Macro Investor founder, what we’re seeing isn’t a crypto-specific failure at all. It’s a classic liquidity event, and crypto just happens to be in the firing line.

🔗 Bitcoin and SaaS are moving together, and that matters

Pal points out something that narrative-driven markets tend to ignore: correlation.

Bitcoin and SaaS stocks have been selling off in lockstep. That’s not random.

Both are what macro investors call long-duration assets, whose value is heavily dependent on future growth, adoption and cash flows. When liquidity tightens, or rates stay higher for longer, these assets are hit first and hardest.

“People are saying crypto is dead, and AI is replacing software companies,”Pal said.“But if two completely different asset classes are collapsing together, the cause isn’t sector-specific. It’s macro.”

In other words:

👉 Same move, same timing, same driver

And that driver is liquidity.

🥇 Gold sucked the oxygen out of the room

One of Pal’s more interesting observations is the role gold has played. Gold’s explosive rally hasn’t just been a safe-haven trade; it’s been a liquidity vacuum.

“The rally in gold essentially sucked all marginal liquidity out of the system that would have flowed into BTC and SaaS,”Pal explained.

There simply wasn’t enough liquidity to support:

👉 Gold

👉 Bitcoin

👉 SaaS stocks

When liquidity is scarce, capital flows to perceived safety and risk assets pay the price.

🏛️ US government shutdowns made things worse

The liquidity squeeze didn’t come from markets alone. It was amplified by US fiscal plumbing issues. Pal highlighted two key factors:

👉 Multiple government shutdowns, which disrupt normal Treasury operations

👉 The Reverse Repo Facility (RRP) is expected to be effectively drained by 2024

Previously, when the US Treasury rebuilt its cash balance (the TGA), liquidity was offset by money flowing out of the RRP. That buffer no longer exists.

Now, every TGA rebuild is a pure liquidity drain.

“There’s no offset available anymore,” Pal said. “That’s why this feels harsher than people expect.”

🪑 Is the next Fed chair to blame? Pal says no

Some market participants have blamed fears around a potentially hawkish Federal Reserve under Kevin Warsh. Pal dismissed that narrative entirely.

According to him, Warsh’s role isn’t to strangle liquidity, it’s to re-run the Greenspan playbook:

👉 Cut rates

👉 Let growth run hot

👉 Rely on productivity (especially AI) to suppress inflation

“Warsh will cut rates and do nothing else,”Pal said.“He’ll get out of the way while Trump and Bessent run liquidity through the banking system.”

🚀 Why Pal is still massively bullish for 2026

Despite the carnage, Pal ended on a strikingly optimistic note.

Yes, liquidity has been tight.

Yes, risk assets got punished.

But in his view, the worst of the drain is nearly over.

“We just can’t get every moving part right,”he said.“But we now understand the system better, and we remain HUGE bulls for 2026.”

His thesis is simple:

👉 Liquidity returns

👉 Long-duration assets recover first

👉 Bitcoin and high-growth tech benefit disproportionately

🧩 Bottom line

This wasn’t a crypto failure.

It wasn’t a broken cycle.

And it wasn’t the end of Bitcoin.

It was a liquidity event, and history shows those don’t last forever.

When liquidity turns, narratives tend to flip fast.

And if Raoul Pal is right, the people declaring crypto dead today may end up chasing it higher tomorrow.

ARK Invest’s Big Ideas 2026: The Technologies Set to Reshape the Global Economy

ARK Invest’s Big Ideas 2026 report outlines how AI, Bitcoin, robotics and biotech could drive the next decade of global growth.

⚡ TL;DR

👉 AI is the core engine accelerating every major innovation platform

👉 Bitcoin and public blockchains are positioned to reshape money, contracts and capital markets

👉 Multiomics + AI could collapse drug discovery costs and transform healthcare

👉 Reusable rockets and robotics unlock entirely new economic layers

👉 ARK believes these technologies could add ~4%+ to real global GDP growth this decade

🧠 The Great Acceleration Has Begun

According to ARK Invest, the global economy is entering what it calls “The Great Acceleration”, a phase where multiple exponential technologies mature at the same time and begin reinforcing each other.

This isn’t linear progress. It’s a step-function change.

Big Ideas 2026 marks ARK’s 10th annual flagship report, and the message is clear: AI is no longer just another sector; it’s the central nervous system of the future economy.

🤖 AI: The Central Dynamo of Everything

ARK argues that artificial intelligence is now the primary catalyst across five major innovation platforms:

- Artificial Intelligence

- Public Blockchains

- Robotics

- Energy Storage

- Multiomics (biological data)

As AI scales, it doesn’t just improve software; it unlocks entirely new capabilities in hardware, biology, energy systems and financial infrastructure. Think:

- AI agents running businesses

- Autonomous labs discovering drugs

- Robots integrating into human workplaces

- AI-powered wallets coordinating economic activity

This convergence is why ARK believes productivity growth could exceed consensus expectations by over 4% per year.

₿ Bitcoin, Public Blockchains & the Future of Finance

ARK doubles down on its long-held thesis that public blockchains will become the base layer of global finance.

Key ideas:

👉 Money and contracts migrate on-chain

👉 Smart contracts reduce execution costs and friction

👉 Stablecoins bridge TradFi and DeFi

👉 Digital wallets evolve into AI-powered purchasing agents

In this world, Bitcoin remains the monetary anchor of digital scarcity in an increasingly programmable economy. ARK sees blockchains not as a niche asset class, but as financial infrastructure.

🧬 Multiomics: AI Meets Biology

Multiomics may be one of the least understood and most powerful ideas in the report. As the cost of sequencing DNA, RNA and proteins collapses:

👉 AI models trained on biological data accelerate discovery

👉 Drug development timelines shrink dramatically

👉 Precision therapies target rare and chronic diseases

👉 Blood tests could detect cancer earlier than ever

ARK believes autonomous AI labs could transform a stagnant pharmaceutical industry into one of the most productive sectors in the global economy.

🤖 Robotics, Energy & Reusable Rockets

The physical world isn’t being left behind.

ARK highlights how:

👉 Humanoid and specialised robots will work alongside humans

👉 Advanced batteries collapse transport and logistics costs

👉 Reusable rockets become critical infrastructure for AI cloud expansion

Reusable rockets aren’t just about space, they’re about moving compute, data and intelligence anywhere on Earth.

Yes, the biggest robots ever built might end up powering AI.

📈 Why This Matters

ARK’s Big Ideas framework isn’t about short-term price targets. It’s about identifying where exponential curves are crossing critical thresholds.

Their conclusion?

The future doesn’t arrive all at once, but those who recognise it early have the chance to own what’s next.

We’re excited to offer you a massive 35% discount!

What You Unlock:

- Strategies from top crypto experts

- Exclusive access to market insights, guides, and top tips

- Tools to maximise your crypto savings and investments

- A supportive community of like-minded crypto enthusiasts

- Access to our community Discord

Use the code 35OFF at checkout to claim your discount and get full access to our community plan for just a fraction of the price.

Secure your spot in the Crypto Saving Expert Community today.

Sponsored by: Stonksy

Stonksy is a momentum identifier that aims to capture expansive market moves before they happen by highlighting the start of potential price shifts. It can be used across all markets, including crypto, stocks, indices, commodities, and currencies.

Stonksy is growing in users week-on-week, proving why it aims to become one of the most-used indicators in the industry.

You can get 25% off the annual Stonksy plan with code TMG25, taking the price down to just £749.25 for an entire year of full access. Sign up here.

Find examples of Stonksy indications posted to the X every day: @stonksyio and learn how to use Stonksy and how it can benefit your trading system on the YouTube channel, with daily livestreams at 12:00 UTC.

This Newsletter is strictly for informational purposes only; the content is generic and has not been tailored in any way. Crypto Saving Expert UAB (“CSE”) is not providing, and should not be interpreted as providing, any form of offer of any currency, security, financial instrument or digital asset, or investment advice, recommendations or strategy. The content of this Newsletter is not intended to replace your own research with regard to any assets, products or services, and any action taken on the basis of this material is entirely at your own risk. CSE neither accepts nor assumes any liability or responsibility for any loss or damage arising out of, or in any way connected to, the Newsletter content. Cryptocurrencies and digital assets may be unregulated in your jurisdiction, any profits may be subject to tax and the value of any investment could fall.

If you click on a link within this Newsletter to go through to a provider, we may get paid. This usually only happens if you get a product/use a service from it. This is what helps fund CSE and keeps the majority of our content free to use. Two crucial things you should know about this, however: a) this never impacts our editorial recommendations, if something is included, it is because we independently rate it as the best; and b) you will always get as good a deal, or better, than if you went direct. For full details on how CSE is funded, please click here.

CSE collects, processes and stores certain data. Such data may be shared with CSE’s wholly owned subsidiary company, Crypto Saving Expert Limited. Please note that by submitting information about yourself to CSE you are consenting to such use. For full details on our collection, processing and storage of data, together with your rights in relation thereto, please consult our Privacy Statement here.